Monthly Portfolio Update - April 2025

Great performance of my small-cap portfolio despite the tempest

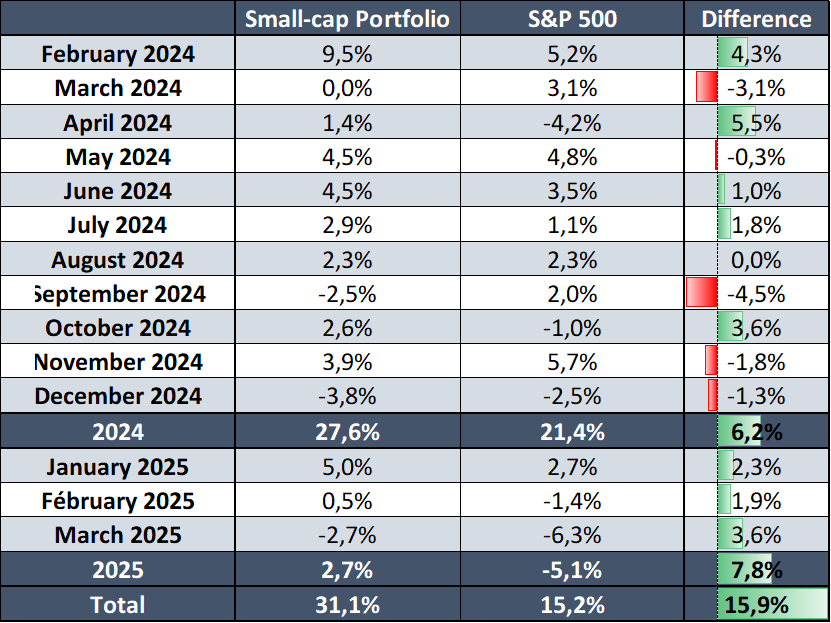

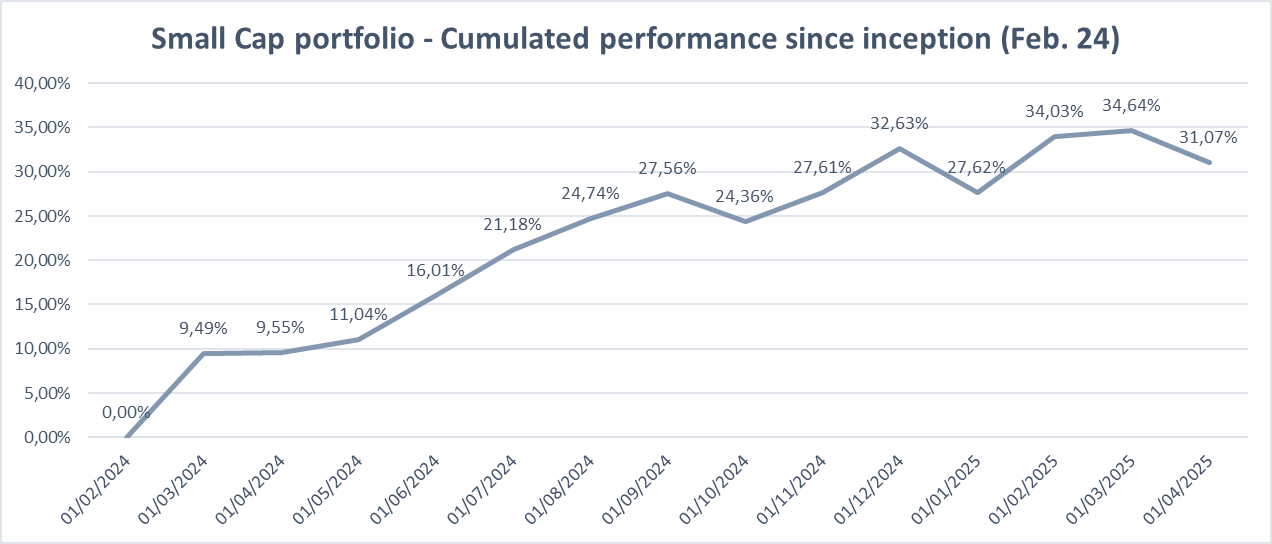

March has been a particularly challenging month, especially for the U.S. market, with the S&P 500 down over 6%. Despite the broader decline, my small-cap portfolio held steady, ending the month 2.7% down. This resilience brings its outperformance to 7.8% YTD for 2025 and 15.9% since inception in February 2024.

If you are curious or missed out, you can find my method here and how to react in case anything bad happens here.

In this section, I present a transparent monthly update of my portfolio. It adheres to my investment strategy. This presentation is divided into several parts:

Global view of the portfolio’s valuation and metrics

For dividend enthusiasts, a presentation of the Projected Annual Dividend Income (PADI) and a monthly calendar

Sector and geographical breakdown

My positions, fair price, price targets and moves

Overall performance

Large-cap portfolio

Since the beginning of the year, performance has slightly lagged behind the S&P 500 for two main reasons. First, a few key holdings have underperformed, though I remain confident in their long-term potential. Second, currency fluctuations, particularly the USD/EUR exchange rate, have impacted results as I report in euros. On a constant currency basis, the portfolio would have outperformed the S&P 500 by more than 2%.

That said, my small-cap portfolio continues to deliver strong results, with several companies announcing positive developments. This reinforces both the strategy I am following and the quality of the current stock selections.

Valuation and metrics

My portfolio’s key metrics continued to evolve this month (weighted average)

Past growth: 20.3% —> 20.0% / Estimated future growth: 13.5% —> 13.5%

Estimated EPS growth: 15.7% —> 15.9%

Net profit margin: 29.3% —> 29.0%

ROE: 40.9% —> 39.5% / ROIC: 25.4% —> 25.3%

Debt leverage: -0.81x —> -0.66x EBITDA (so increased average net cash position)

PE: 29.8x —> 28.3x / PE Y+2: 21.6x —> 20.4x

FCF yield: 3.79% —> 4.17% / FCF yield Y+2: 5.78% —> 6.20%

Dividend yield: 1.18% —> 1.30%

Dividend growth: 8.8% —> 8.8%

Buybacks: 0.69% —> 0.78%

Expected TSR: 13.8% —> 14.0%

Published articles in March

I have revamped the newsletter at the beginning of the year for a clearer, more structured format. You can now explore new categories right on my homepage.

Here are the different articles I have published:

Stock market news

Research and analysis

Investment knowledge

Stock spotlights

New stock ideas

Portfolio

The next sections (Portfolios, Stocks, News, and Moves) are exclusive to paid subscribers. While this newsletter provides valuable content for free subscribers, becoming a paid subscriber unlocks even greater benefits to help you gain an edge in the market.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.