After reviewing my small-cap portfolio, which was very interesting as we identified the potential of the stocks, reanalyzed the investment theses, and created an action plan, it is now time to focus on my large-cap portfolio.

This process ensures that every stock has a justified place in my portfolio. I will also identify the weakest stocks to potentially make room for more promising opportunities.

For each stock (16 stocks currently in my small-cap portfolio), I will:

Present my average purchase price + the current price

Present the major metrics

Explain my current view on the company

Estimate the yearly total shareholder return. This is calculated with 6 pillars

Estimated organic growth

Estimated growth from acquisitions

Dividends

Share buybacks

Margin increase or decrease

Valuation ratio increase or decrease

Describe my buying zones

Present my strategy with the stock

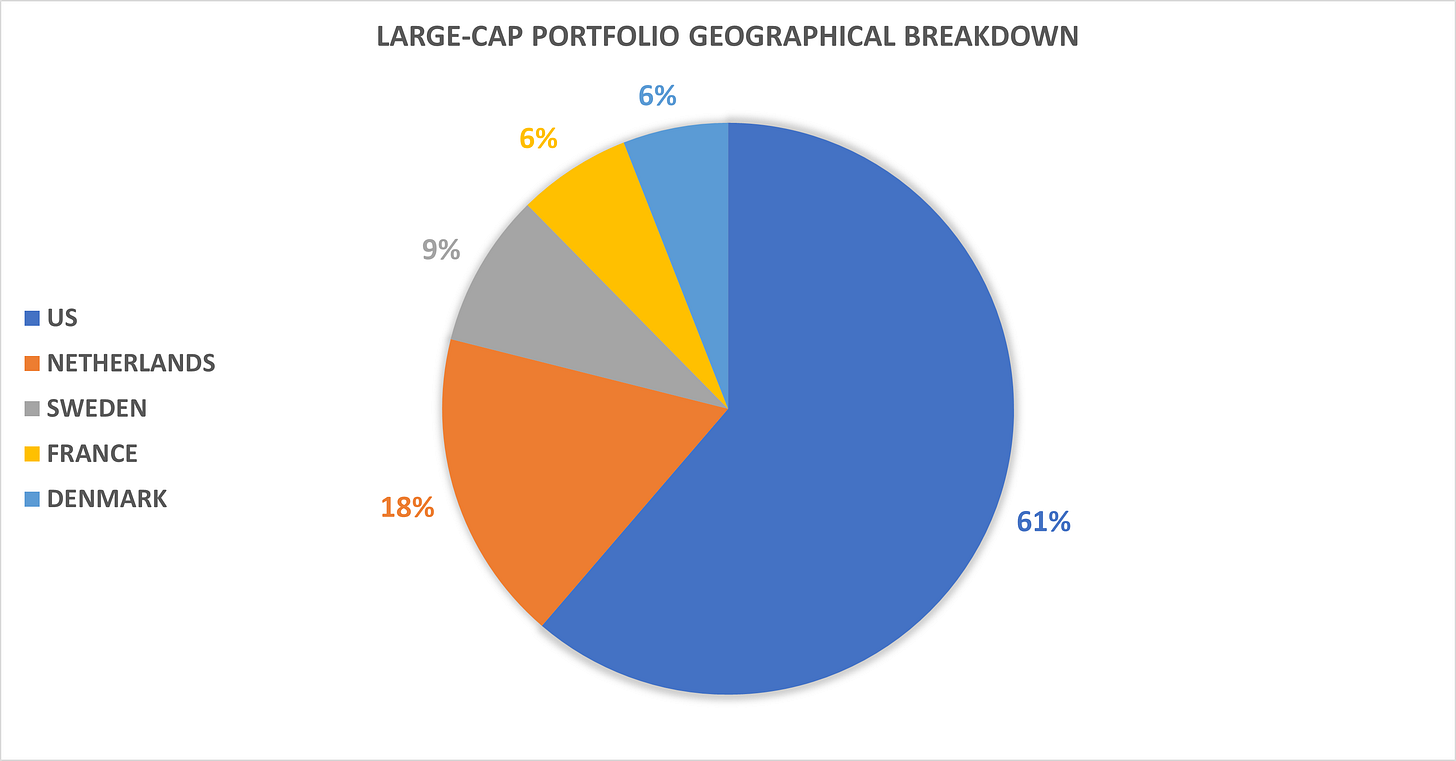

Please note that this is my real portfolio, as I believe it is important to have skin in the game. And just below, you can find the geographical breakdown of my current large-cap portfolio.

How did I find these stocks? You can find my investment framework in this article. I share my trades, including the stocks I buy and the timing of my purchases, exclusively with my paid subscribers. While this newsletter provides valuable content for free subscribers, becoming a paid subscriber unlocks even greater benefits to help you gain an edge in the market.

Here is why upgrading to a paid subscription is worth it:

Access exclusive content. Dive deeper with detailed analyses, advanced insights, and premium research not available to free subscribers

Follow my portfolio. Gain exclusive access to my portfolio, including monthly updates, tracking my moves, and watchlists

Discover more stock ideas. Explore in-depth stock ideas, technical analyses, and strategies tailored to uncover hidden opportunities

Support this newsletter. Your subscription directly supports the creation of high-quality, valuable content to help you achieve your investment goals

Upgrade today and take your investing knowledge and performance to the next level!

1. Adobe

Metrics

2025 growth 9.4% / 2026 growth 10.2% / 2027 growth 9.2%

2025 PE 28.1x

2025 dividend yield: -%

Estimated TSR (Total Shareholder Return) 11.0% / year

Trade

My position: 5 shares

Current price: $449

Average cost: 320€ (in euros as I am based in Europe)

Current P&L: 29.8%

My opinion about the stock

Despite a challenging 2024, as I have an attractive buying price for Adobe, my performance remains positive. Investors are concerned that AI could disrupt the business model, which explains the contracting PE (almost half of its historical average!). Adobe is unlikely to return to its previous valuation ratios, but it still benefits from high recurring revenue, strong margins, and decent visibility. There is no reason to sell here as fundmantals continue to improve, but the current price presents a poor risk/reward ratio. Therefore, I would only consider reinforcing my position around $360 and not before.

You can find my article about the company just here.

2. Adyen

Metrics

2025 growth 24.6% / 2026 growth 25.4%

2025 PE 48.6x

2025 dividend yield: -%

Estimated TSR (Total Shareholder Return) 19.5% / year

Trade

My position: 7 shares

Current price: 1,593€

Average cost: 1,224€

Current P&L: 30.1%

My opinion about the stock

As I explain in this article, Adyen is a strong conviction. Growth should re-accelerate from already high levels. Its great technological platform, clever management, strong metrics and increasing partnership number make it a strong investment. 2 short-term catalyst: new strategy to be presented (especially for capital allocation) and potential accelerating growth.

It is a strong position so I won’t reinforce unless the price goes down. A wide zone around 1,430€ will be very interesting for me.

3. Alphabet

Metrics

2025 growth 11.4% / 2026 growth 11.1%

2025 PE 19.4x

2025 dividend yield: 0.4%

Estimated TSR (Total Shareholder Return) 14.0% / year

Trade

My position: 43 shares

Current price: $174

Average cost: 135€

Current P&L: 18.3% + dividends

My opinion about the stock

A strong conviction for me. Well-positioned for Cloud, AI, autonomous vehicles, quantum computing. Google Search still represents 57% of the revenues (down from 60% in 2021) but this share sould decrease faster with the new diversification segments. In the meantime, it offers an almost infinite source of free cash flow.

For now, I have a full position, so for this stock, I will also wait for a potential consolidation. $165/$170 could be a first buying zone, then $150. My article about Alphabet is available just here.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.