Stock of the Week: The Trade Desk

What is the potential after a -50% YTD performance?

Here is the 12th edition of Stock of the Week. You can find all the previous analyses and my articles on my main page (for an easier search, use a computer, mobile version is harder to navigate).

Here are the links to the 3 previous “Stocks of the Week” as well

This week, we are focusing on The Trade Desk. After falling more than 50% YTD, the stocks has reached new interesting support levels. Let's analyze whether it is a compelling investment opportunity!

Would you consider investing in The Trade Desk? Share your thoughts in the comments

While free subscribers already benefit from a wealth of valuable content, upgrading to a paid subscription unlocks exclusive research, in-depth insights, real-time portfolio tracking, advanced stock screeners, and more giving you an edge to stay ahead of the market. Don’t miss out: subscribe now and supercharge your investing journey!

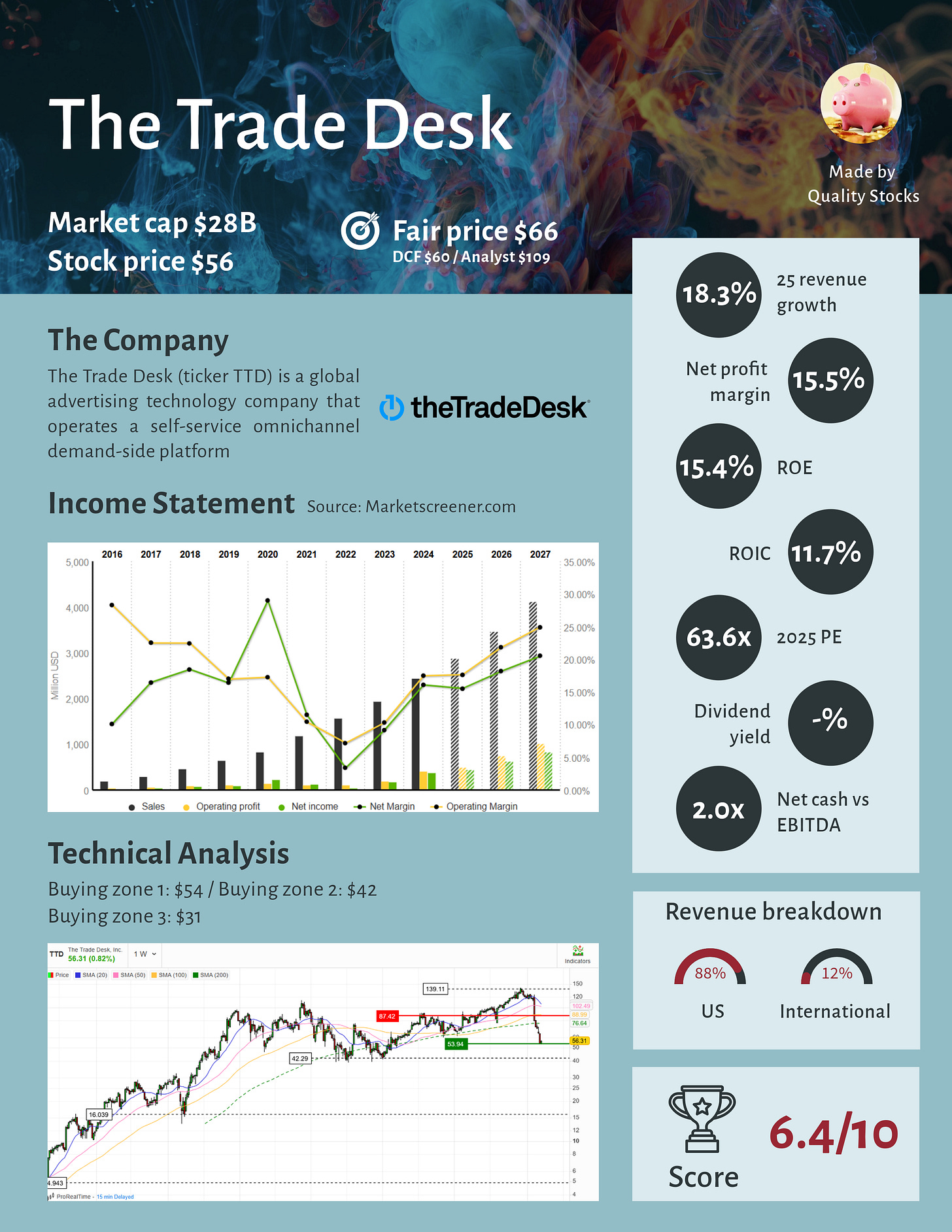

One Pager

The stock at a glance!

Recent news

The company is facing a securities fraud class action lawsuit. Investors allege that, The Trade Desk misrepresented challenges in rolling out its AI-driven advertising tool, Kokai

Despite lower than expected revenue, the company reported a record-breaking $12B in platform spend for Q4 2024, reflecting strong advertiser demand

In January, the company announced the acquisition of Sincera, a digital advertising data company. This acquisition aims to bolster its programmatic advertising capabilities with improved data insights

The Trade Desk recently announced a significant leadership change, appointing Vivek Kundra as Chief Operating Officer. It, is expected to enhance global operations and increase growth, particularly in the digital advertising sector

Last earnings report

For the first time in 33 quarters as a public company, The Trade Desk missed its revenue targets in Q4 24. However, growth was above 20% and profitability has reached all-time high.

In Q4 2024, revenue growth stood at 22%, trailing the full-year average of 26% and sparking investor concerns about a broader deceleration. Despite this slowdown, customer retention remained robust at above 95%.

However, the company’s guidance also fell short of expectations.

Revenue. The company anticipates revenue of at least $575M for Q1 2025. Analysts expected $582M

Adjusted EBITDA. The Trade Desk forecasts Adjusted EBITDA to be approximately $145M, which was also below analyst expectations of roughly $193M

Analysts’ recommendations

Mar, 17. RBC. Buy. $120 —> $100

Feb, 13. Wedbush. Buy. $145 —> $120

Feb, 13. Bank of America. Buy. $155 —> $130

Feb, 13. Oppenheimer. Buy. $135 —> $115

Feb, 13. Evercore ISI. Buy —> Hold. $135

My analysis

In the short term, The Trade Desk’s primary concern lies in its lower-than-expected profitability. Although revenue growth is slowing, it remains robust and is not the chief factor unsettling investors. Over the medium to long-term, profitability should improve as net profit margins continue to climb, and larger scale typically supports higher margins

Like many major US tech firms, The Trade Desk uses significant stock-based compensation (SBC), which reduces free cash flow and dampens shareholder returns. The positive note here is that SBC levels have been flat since 2022

Another challenge is intensifying competition within the advertising sector, not only from smaller players but also from established giants like Alphabet and Amazon; pressure that could impact both growth and margins

Nevertheless, The Trade Desk has several promising avenues for expansion

The company holds substantial net cash for acquisitions

The retention rates are high and consistent

The company could benefit from increased international penetration, especially since most of its revenue is currently concentrated in the US, while the majority of the global ad market lies overseas

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for The Trade Desk.

Buying zone 1. $54 (roughly the current price)

Buying zone 2. $42

Buying zone 3. $31

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Used source: Marketscreener.com. Affiliate link just here