Here is the 9th edition of Stock of the Week. You can find all the previous analyses and my articles on my main page (for an easier search, use a computer, mobile version is harder to navigate).

Here are the links to the 3 previous “Stocks of the Week” as well

This week, “Stock of the Week” focuses on Betsson. Insiders are buying and earnings report was great, it is time to take a look at this Swedish company specialized in online gambling.

Let me know what you think of Betsson in the comments!

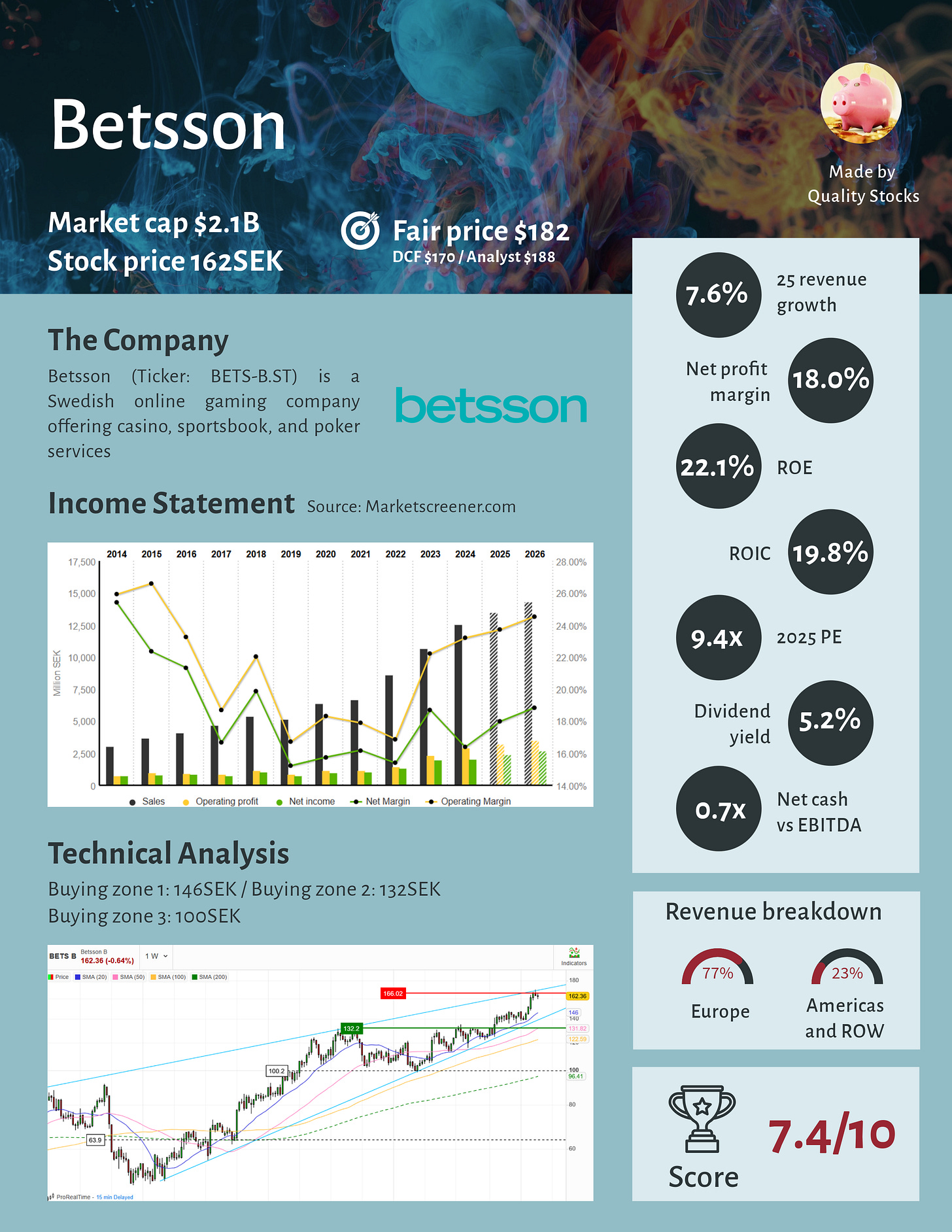

One Pager

The stock at a glance!

Recent news

Gaming license in Brazil. Betsson secured a local gaming license in Brazil, marking its entry into the newly regulated Brazilian market for online casino and sports betting. This aligns with the company’s strategy to expand geographically, particularly in Latin America

Insider buying. Eva de Falck, board member, has on February 25 bought 600 shares in the company. The shares were bought at a price of SEK 164.40 per share. Eva de Falck now owns 1,925 shares in Betsson

Last earnings report

Betsson reported great financial results for Q4 2024, with group revenue reaching 307M€, a 22% increaseYoY, and EBIT rising 23%. This propelled the company past the 1B€ revenue milestone for the full year 2024. The growth was driven by strong performance in casino and sports betting, particularly in LATAM.

Analysts’ recommendations

Feb, 18. Carnegie. Hold. 135SEK —> 150SEK

Feb, 10. DNB. Buy. 180SEK —> 195SEK

Feb, 07. Pareto. Buy. 160SEK —> 180SEK

Feb, 07. ABG Sundal Colliber. Buy —> Hold. 165SEK

My analysis

Betsson operates in a sector that is currently out of favor with the market. Concerns over increasing competition, stricter regulations, risks in unregulated markets, and ESG pressures have contributed to a low PE ratio despite solid growth prospects: 7.6% revenue growth and 18% EPS growth are expected in 2025

The company has a strong financial position, accumulating cash and maintaining flexibility for acquisitions. Additionally, the LATAM market presents significant growth opportunities

Insider buying signals confidence in the company’s future, suggesting positive internal developments

However, the recent stock surge may have been too rapid, and waiting for a consolidation could be a prudent approach

If you like this sector you might like the following articles

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for Betsson.

Buying zone 1. 146SEK

Buying zone 2. 132SEK

Buying zone 3. 100SEK

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Used source: Marketscreener.com. Affiliate link just here