Stock of the Week: Novo Nordisk

Weekly spotlight: news, opportunities and insights at a glance!

Welcome to this 6th edition of “Stock of the Week”. You can find all the previous stocks of the week and 250 other articles on my main page.

Here are the links to the 5 previous “Stocks of the Week” as well

This week, “Stock of the Week” focuses on Novo Nordisk. After a 40% drawdown from its ATH, the stock is currently at a reasonable price, and earnings have been strong. Is it time for a bounce back?

Let me know what you think of Novo Nordisk in the comments!

One-Pager

The stock at a glance!

Recent news

Novo Nordisk has made headlines with its ongoing clinical trials, including promising early results for its new weight-loss drug, amycretin, which demonstrated significant weight loss in participants. However, challenges remain, particularly with its next-generation obesity drug, CagriSema, where unclear trial results have left investors searching for more clarity

The FDA has approved Novo Nordisk's Ozempic to reduce the risk of kidney failure and slow disease progression in diabetes patients with chronic kidney disease (CKD), broadening its use beyond the current treatments

Novo Nordisk recently acquired a manufacturing facility from Catalent to help meet the surging demand for its GLP-1 drug

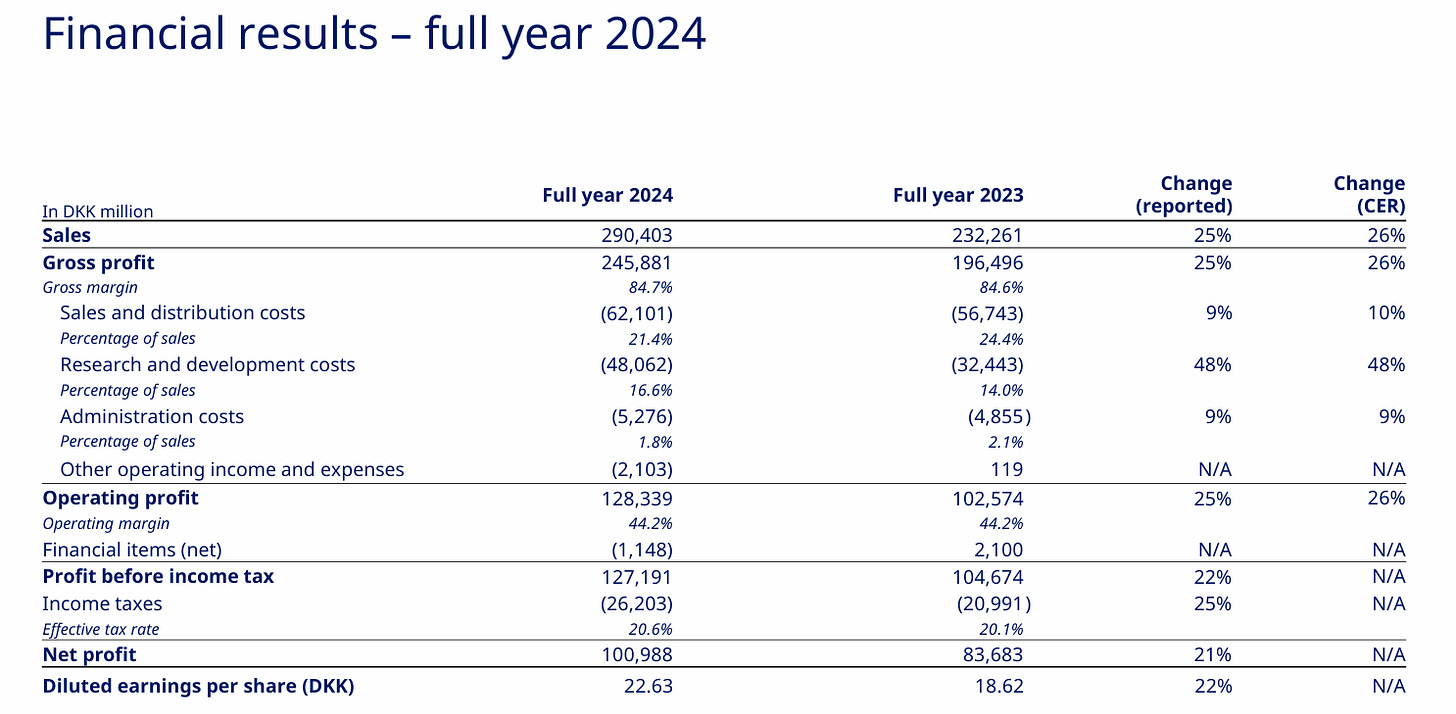

Last earnings report

Sales of Novo Nordisk's obesity drugs increased 57% in the fourth quarter, helping to ease investor concerns about competition from rival Eli Lilly. However, despite this strong performance, the company has projected slower growth for the coming year, reflecting a cautious outlook amid an increasingly competitive obesity treatment market.

Analysts’ recommendations

Jan, 30. Carnegie. Buy. 1,090DKK —> 1,024DKK

Feb, 06. JP Morgan. Buy. 1,050DKK —> 1,000DKK

Feb, 06. Jyske Bank. Buy. 850DKK —> 925DKK

Feb, 07. DZ Bank. Hold. 637DKK —> 630DKK

Feb, 10. Goldman Sachs. Buy. 875DKK —> 890DKK

My analysis

The stock is currently consolidating after a bullish excess in 2024. Down 40% from its ATH, its valuation now appears more reasonable, with a 2025 PE of around 22x, a 2026 PE of 18x, and a 2027 PE of 16.5x.

Given the company’s growth potential, the current valuation seems fair. However, risks remain: loss of exclusivity will eventually pose a challenge, and competition continues to intensify

Despite these risks, the current price appears attractive relative to the company’s long-term potential

Since mid-December 2025, the market has remained flat. Could the stock go lower? Possibly. However, fundamentals and valuation now seem more reasonable after years of being overpriced

A key factor to watch in the coming years will be diversification efforts to establish new growth streams beyond the GLP-1 boom

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for Novo Nordisk.

Buying zone 1. 550DKK

Buying zone 2. 470DKK

Buying zone 3. 380DKK

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Used source: Marketscreener.com. Affiliate link just here

Thanks for this one. Helpful. Just restacked.

Thanks for the update.