Stock of the Week: Evolution AB

Weekly spotlight: news, opportunities and insights at a glance!

Welcome to this new format! Every week, we will analyze a stock, sharing its key metrics, recent news, my view on the company, technical analysis, and the opportunities it presents.

For the first week, we are starting with Evolution. The company is well-known, and despite strong financial performance, its stock has fallen by 30% in 2024. Let's dive in!

Let me know what you think of Evolution in the comments!

One-pager

The stock at a glance!

Recent news

Legal issues:

The UK Gambling Commission has launched an investigation into gambling in the UK by operators (Evolution’s customers) without licenses.

In early 2024, Evolution faced two class action lawsuits in the US, filed by Federman & Sherwood and Pomerantz. Both allege that between Feb 2019 and Oct 2023, Evolution issued misleading statements about regulatory compliance, customer practices, and growth projections, raising concerns over potential securities fraud and deceptive business practices.

A strike in Georgia, one of the company's key countries for gambling table operations, has reduced its operational capabilities, limiting growth and revenue. The company has already cut 1,000 jobs in the country.

As of recent reports, approximately 60% of Evolution's revenues are generated from unregulated markets, notably in Asia. This exposure has raised concerns due to the potential risks associated with operating in regions lacking stringent regulatory oversight. Please note that operations in unregulated markets is different than the UK issue where operators without license were operating in the UK

In July, the company announced the acquisition of Galaxy Gaming, a leading independent developer and distributor of casino table games and technology. In November, it acquired another (smaller) company, Arcadia Gaming.

A share buyback program has been launched due to the stock's weakness. The number of shares has decreased from 212 million in 2013 to 206 million in 2024 (-3%).

Last earnings report

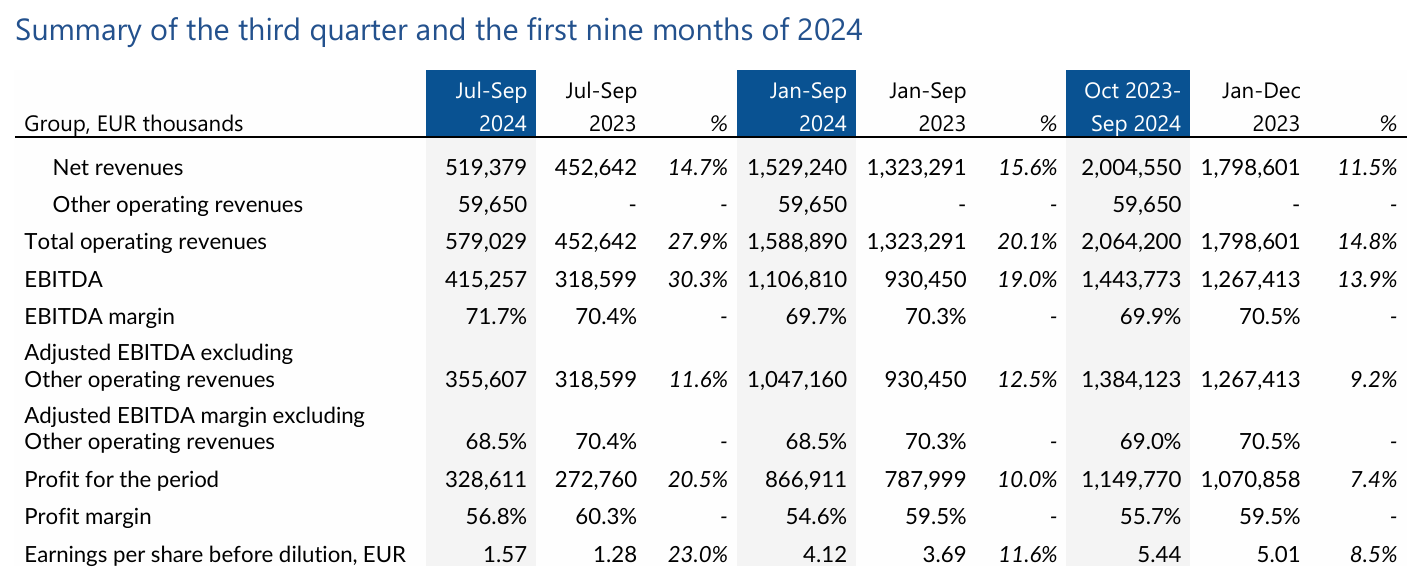

Despite negative market sentiment and a challenging news flow, the company continues to grow at a solid rate of around 15%. The market had anticipated €516M in revenue and €1.28 EPS, but Evolution delivered a double beat.

The reduction in profit margin is primarily attributed to tax changes in Sweden.

Analysts’ recommendations

Oct, 25. DNB. Buy. 1,550SEK —> 1,570SEK

Oct, 25. Berenberg. Hold. 1,140SEK —> 1,120SEK

Oct, 25. Redeye. Buy. 1,600SEK —> 1,500SEK

Nov, 18. Citigroup. Buy. 1,500SEK —> 1,570SEK

Dec, 03. Kepler Cheuvreux. Buy. 1,400SEK

Dec, 19. Pareto. Buy. 1,450SEK

Jan, 08. Morgan Stanley. Hold. 1,170SEK —> 1,070SEK

Jan, 09. Deutsche Bank. Buy. 1,000SEK —> 900SEK

My analysis

Market sentiment around the stock remains negative, and the share price has been stagnant for years.

Despite this, the company continues to deliver strong results and presents an attractive valuation.

While the unregulated market issues may create short-term volatility, they represent a long-term opportunity, as larger players often benefit from increased regulation.

The US market should be a significant growth driver for the company in the coming years.

Management is likely to continue its share buyback program, capitalizing on the stock's undervaluation.

Chart

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for Evolution.

Buying zone 1. 815SEK/825SEK

Buying zone 2. 708SEK

Buying zone 3. 650SEK

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Suggest the next stock to analyze in “Stock of the Week”

Used source: Marketscreener.com. Affiliate link just here

I like the one-pager. I share the same sentiment on the stock. It may remain undervalued for longer than we prefer but it has strong fundamental growth. The CFO transition presents another opportunity to buy cheaper. I don't expect much upside from multiple expansion until the class action lawsuits are resolved.

I want to congratulate you on this new format. It takes a lot of thinking about to get it right. Unlike some other writers you avoided the pre amble, amble and lastly the post amble.

For me I am adverse to gambling and gambling stocks.

As to other sin stocks like tobacco is there business an easy target for governments?