Stock of the Week: ASML

Weekly spotlight: news, opportunities and insights at a glance!

It is already the 4th edition of “Stock of the Week”. After Evolution, Pepsico and Alibaba, it is now the turn of ASML! With the Deep Seek frenzy and the strong quaterly reports, there is a ton of newsflow on the company.

This is Stock of the Week, where I analyze a stock each week, covering its key metrics, recent news, my perspective on the company, technical analysis, and the opportunities it offers. Let’s dive in!

Let me know what you think of ASML in the comment? Strong opportunity or already too pricey?

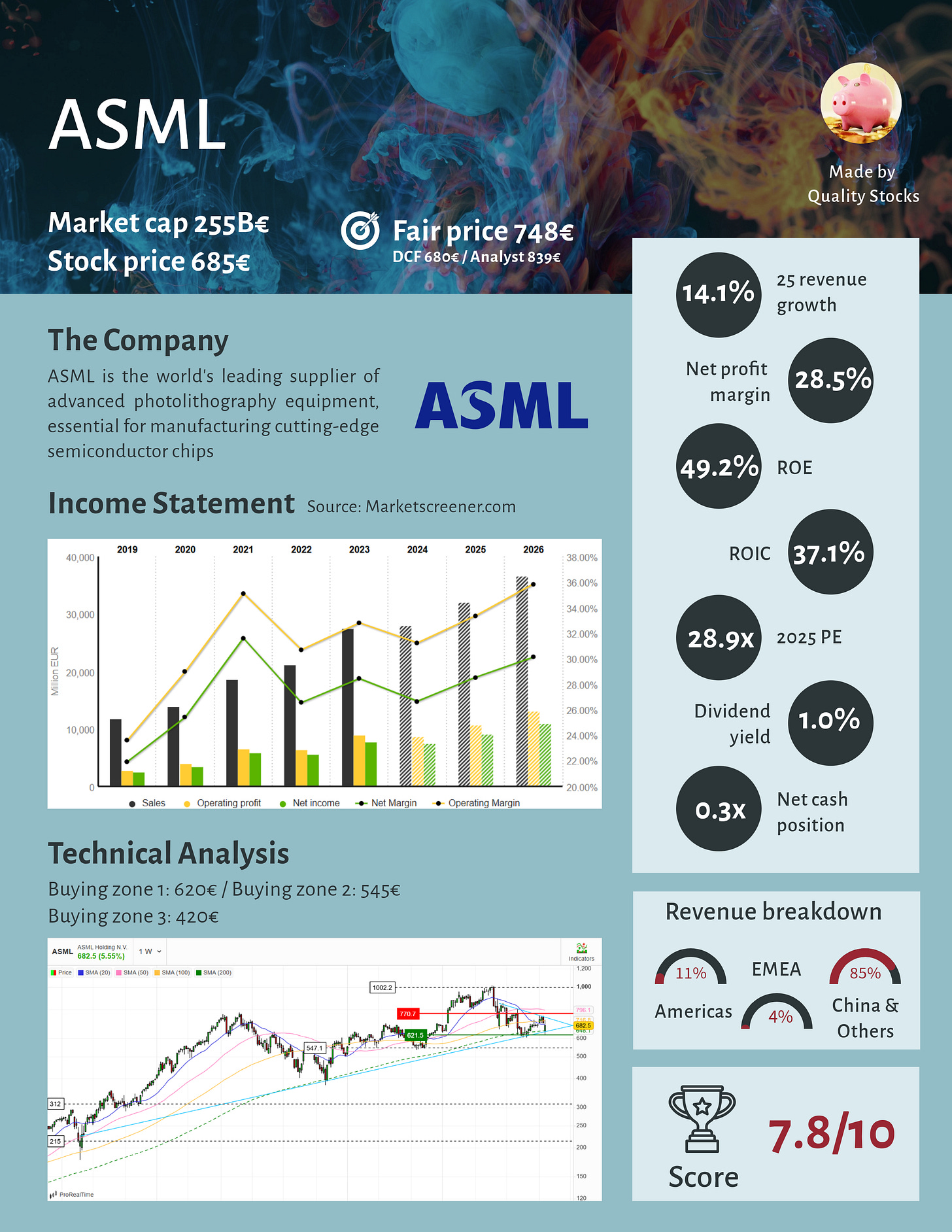

One-Pager

The stock at a glance!

Recent news

The growth in artificial intelligence has been highlighted as a key driver for the semiconductor industry, directly benefiting ASML's business. ASML is the key player of lithography, a step in chip manufacturing, with 80% market share

Current investor fears are about the shrinking order backlog. This could lead to lower growth and therefore might reduce growth

Trade tensions and export restrictions on manufacturing equipment to China pose a significant risk to the company. However, the company anticipates that any impact will be short-term, with no substantial long-term challenges

When DeepSeek, a Chinese AI startup, released its R1 model, which promised high performance at a fraction of the cost compared to leading AI models, it led to a significant sell-off in tech stocks, including ASML. The concern was that if AI models could be trained and run with less computing power, this might reduce the demand for the high-end chips that ASML's equipment is used to manufacture

Last earnings report

The company reported good results with +28% revenue growth +31% EPS growth. Net bookings were 7.1B€, above the 3.5B€ consensus. Intalled base management services (recurring revenue) are up +39% YoY.

These results reassured investors about the order backlog, and the guidance for 2025 was confirmed.

Analysts’ recommendations

0ct, 29. DZ Bank. Hold —> Buy

Oct, 29. Bernstein. Buy. 850€

Oct, 29. UBS. Hold. 710€

Oct, 29. JP Morgan. Buy. 1,057€

Oct, 29. Goldman Sachs. Buy. 1,010€

Oct, 29. Jefferies. Buy. 880€

My analysis

ASML is a key player in manufacturing equipment systems for semiconductors, holding a dominant position with more than 80% market share in advanced lithography

Management provides a long-term outlook through 2030, with AI and the digitalization of the world serving as the two main growth drivers

However, the company is cyclical. The semiconductor market, including manufacturers like TSMC, follows a cyclical pattern. As a result, equipment suppliers upstream in the value chain experience even greater variability

A positive aspect is the rapidly growing service revenue, including recurring revenue from maintenance, spare parts, and other services. This may mark the beginning of a shift in the company’s business model

Additionally, ASML’s strong net cash position creates opportunities for potential strategic acquisitions

An investor could expect between 10% and 15% total shareholder return in the next years

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for ASML.

Buying zone 1. 620€

Buying zone 2. 545€

Buying zone 3. 420€

As we are close to a buying zone, the current zone could be interesting for investors wanting to invest in the company.

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Suggest the next stock to analyze in “Stock of the Week”

Used source: Marketscreener.com. Affiliate link just here

Not a good entry point 753 average. Sold of my position and keeping a smaller position to add to

I already have it