Gigacloud Technology: One of the Cheapest Stocks in the Market

PE around 6x, 50% of market cap in cash

Gigacloud Technology might just be the cheapest stock in the entire technology sector. With a PE of just 6x and nearly 50% of its market cap sitting in cash, the company boasts an astonishing FCF yield of over 40%. In tech, this level of FCF yield is almost unheard of, unless the business is in serious decline. But that is not the case here. Gigacloud is growing rapidly, and that growth is expected to continue.

So, what exactly does Gigacloud do?

What is a fair value for the stock?

And why is the market pricing it so cheaply?

Let’s dive in and find out.

The business model

Gigacloud Technology is an online B2B platform that connects buyers and sellers of large-parcel merchandise, cutting out the middlemen like resellers and retailers. At its core, Gigacloud operates a global B2B marketplace.

The company started in the furniture sector but has since expanded into other categories.

The concept is simple. Imagine you are a furniture seller in the US looking to source products from suppliers, most of whom are based in Asia. Finding the right suppliers, comparing prices, managing lead times, and handling logistics can quickly become complicated and expensive. On top of that, you may be forced to rely on resellers or third parties, which eats into your margins.

Gigacloud’s platform solves this by letting you purchase directly from suppliers and connect with your end customers. In some cases, you don’t even need to handle logistics yourself, Gigacloud takes care of it for you.

The business model is built around 3main revenue streams:

Product revenue. From the sale of inventory listed on the platform

Service revenue. Earned by facilitating transactions between buyers and sellers

Logistics revenue. From providing shipping and logistics support to buyers who need it

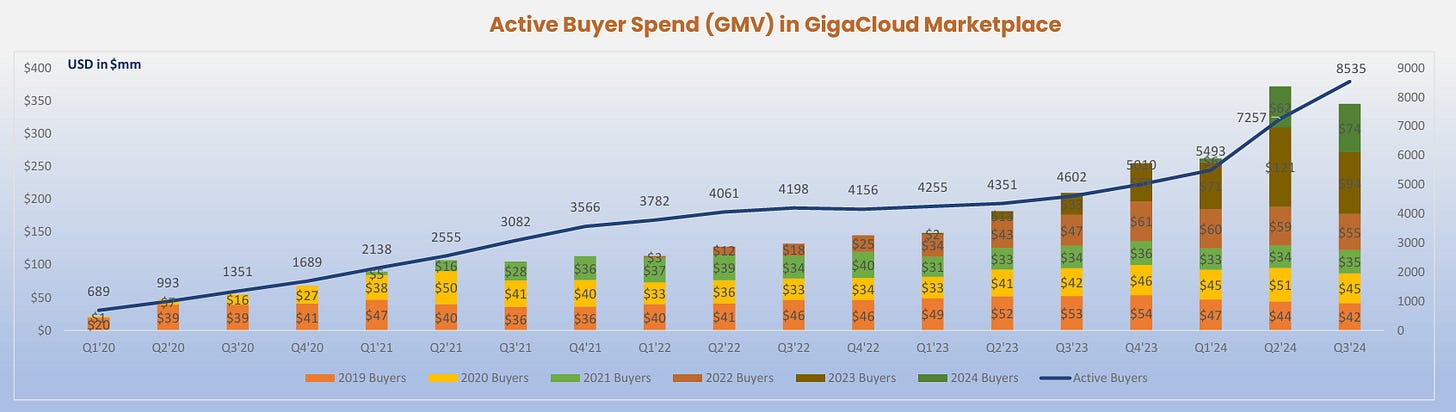

The value proposition is simple but highly effective. In Q4 2024, the number of active buyers on the platform surged 85% YoY, reaching 9,300 buyers. Sellers followed a similar trend, growing 36% YoY to around 1,100 sellers.

The majority of sellers are based in Asia (roughly 50% in China and 50% across Southeast Asia) providing buyers with direct access to a wide range of manufacturers and suppliers.

The growth strategy

Gigacloud is firmly focused on driving growth, and to sustain its momentum, the company is executing several key strategies.

Core business optimization. Enhancing its technology, improving the customer experience, and boosting operational efficiency to strengthen the foundation of the platform

Expanding market reach. Growing the customer base through new client acquisition and diversifying the product offering to attract a broader range of buyers and sellers

Increasing revenue per customer. Introducing additional services, leveraging commercial synergies across different divisions, and maximizing the value of existing customer relationships

Strategic acquisitions. As seen in December 2023 with the $85M acquisition of Noble House and Wondersign, aimed at unlocking both commercial and operational synergies while expanding the customer base

To boost EPS growth, the company initiated a $25M share buyback program (4% of the market cap) - easily sustainable given the $110M expected FCF in 2025 and the $300M+ cash reserve

After impressive growth of 44% in 2023 and 65% in 2024, the company's growth is expected to normalize, even with the impact of new tariffs (2% in 2025 and 6% in 2026). Naturally, these tariffs introduce a fair amount of uncertainty.

The rest of this article (including risks, opportunities, fair value analysis, buying zones, and key metrics) is available exclusively to paid subscribers.

By joining as a paid subscriber, you will unlock my most valuable insights, gain full access to my portfolios and real-time moves, and use custom stock screeners to discover new ideas. It is a great way to learn, sharpen your investing mindset, and find high-quality stocks to become a better investor.

Sign up today and enjoy 30% off your yearly subscription!

The risks

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.