This Market Consolidation Created Opportunities: Here Are the Stocks I Bought

A deep dive into my latest portfolio moves and investment strategy

So far, I have to say I was right about the 2025 investment themes, just as I predicted in this article at the end of 2024.

In this article, I outlined several key investment themes, including the “Trump effect”, rising volatility, persistent geopolitical tensions, the reality that inflation isn’t dead, and a renewed focus on overlooked areas like Europe and small caps. I also highlighted the risks of US market consolidation due to rich valuations.

Additionally, I discussed potential black swan events, such as an escalated trade war that could (let’s say) trigger a recession. Time will tell if we get there, but so far, my forecasts have been on point.

For long-term investors, volatility creates attractive buying opportunities. Of course, you can’t buy everything and you still need to keep some cash in case the market dips further (it is impossible to identify the exact bottom, but you can identify interesting buying zones and follow your plan). But when the right setups appear, you have to take action, and that is exactly what I have done.

If you are wondering how to navigate market consolidation or potential bear markets (though we are still far from one), I covered it in detail in the article below.

And without further ado, let’s dive in!

Performance

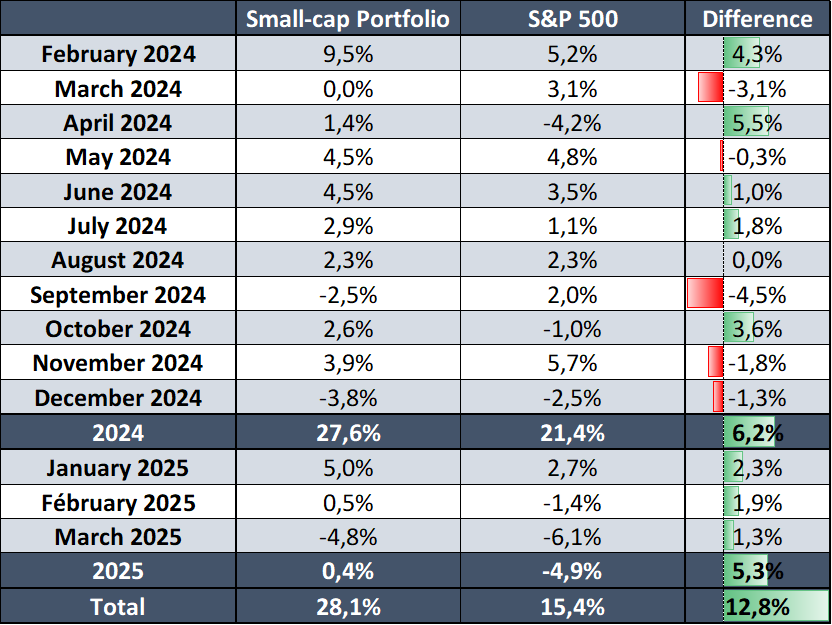

So far, I have maintained strong performance in my small-cap portfolio, my most dynamic portfolio. Meanwhile, my large-cap portfolio, built around blue-chip stocks, has delivered a steadier but still solid positive return.

This outperformance was achieved by sticking to my strategy: selecting carefully chosen small-cap stocks with untapped market potential, focusing on key metrics like margin growth, and targeting stocks with compelling valuations. I don't buy into trends, follow the crowd, or mimic superinvestors.

Instead, I rely on my own understanding of the markets and business models to identify what I believe are truly great companies with strong market potential. This approach enables me to offer you unique, overlooked opportunities that you won’t find elsewhere, primarily across the US, European, and Australian markets.

A new addition, but a familiar name

The first stock I added? None other than Paypal. It might be surprising, considering I sold it just a month ago with a solid 23% gain.

So why did I sell? The previous earnings were disappointing, and EPS growth relied heavily on share buybacks. However, after a 15% pullback in just a month, the stock has entered a compelling technical zone and now offers a more attractive margin of safety. It remains an interesting companies with potential risks priced in and interesting potential opportunities.

This is more of a tactical buy than a long-term conviction, however, as long as it is performing, I see no reason to sell. However, in case the current zone is not holding, I won’t hesitate to sell.

My position: 70 shares

Main metrics

Market cap $70B

Revenue 25 $33B

Revenue future growth 4.0% in 2025 / 6.7% in 2026 / 7.0% in 2027

Net profit margin 14.4%

ROE 20.0% / ROIC 12.9%

PE 2025 14.5x / PE 2026 12.9x

Dividend -% / Payout ratio -%

Debt: $3.2B or 0.4x EBITDA

Why invest in this company

Potential rerating

New opportunities

EPS growth fueled by share buybacks

Compelling technical setup

As I explained, this is a tactical bet and not a long-term investment, so I will remain cautious and won’t hesitate to sell in case things go bad.

I have also added 2 new US stocks to my portfolio and strengthened my position in 4 others that hit attractive buying zones!

Curious to know which ones? Get exclusive insights, in-depth analysis, powerful screeners, my portfolios, my moves and a market edge: subscribe now!

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.