Investment Knowledge: Why Time in the Market is Better than Timing the Market

And why paying attention to the chart is a smart move!

In the words of Kenneth Fisher, “Time in the market beats timing the market.” However, it is easy to say and even easier to forget. In this article, part of our Investment Knowledge section of this newsletter, we will present why time in the market is better than timing the market. But we will also present why this is not a reason no to pay attention to the chart!

If you like this kind of article, you might like this one

Don’t miss out on the market’s best days

Missing the market's best days each year means missing out on the bulk of its overall performance. Markets don’t move in a straight line, they often surge strongly before taking a breather.

While some argue that timing the market could help you avoid the worst days, history shows it is extremely difficult (if not impossible and at least takes a considerable amount of time) to predict the best and worst days in advance. Staying invested lets you capture long-term growth.

You pay less transaction fees

Frequent buying and selling in an attempt to time the market significantly increases transaction fees, which can significantly erode your potential profits. Each trade comes with a cost, and the more you try to time market fluctuations, the more you pay in fees and commissions.

It increases your holding period

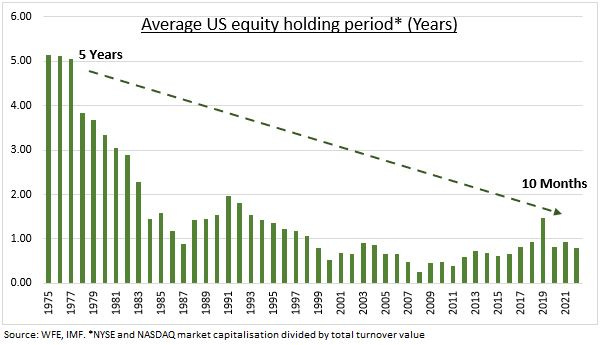

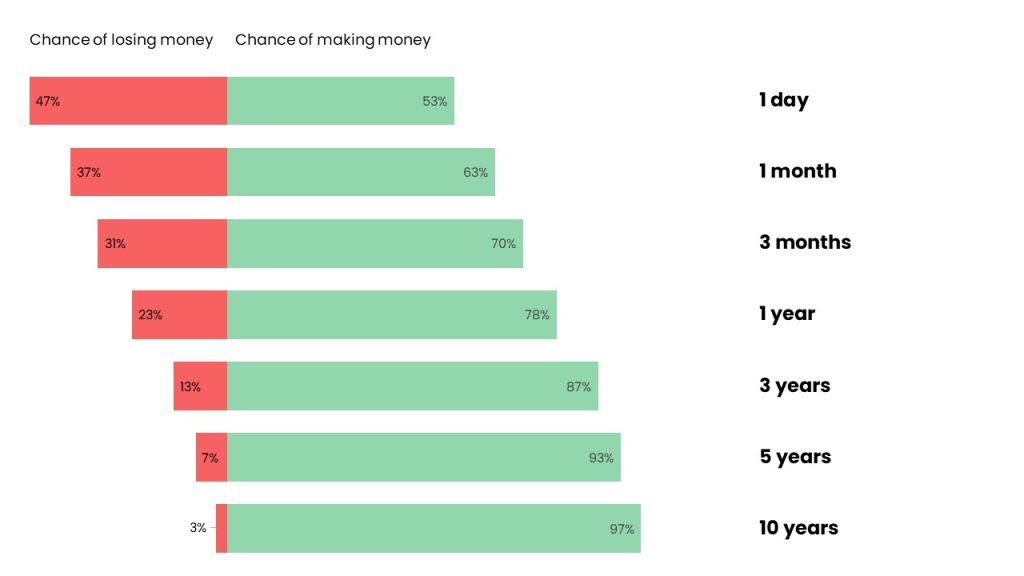

The average equity holding period collapsed with lower transaction fees and easier ways to buy and sell stocks. However the longer you hold a stock, the higher your chance of winning.

Timing the market is hard

Consistently predicting short-term market movements is extraordinarily difficult, even for experienced professionals. It involves recognizing patterns, calculating the probabilities of each, and managing your funds accordingly. More importantly, it demands a high level of psychological discipline.

It is extremely difficult and most people who attempt it end up losing money.

There are always good reasons to sell

You can always find good reasons to sell. For this one, your investment horizon and cash inflow are 2 important factors. If you have a short-term horizon and no cash inflow, the stock market is riskier and you can have very difficult periods. But if your horizon is long enough, you should more focus on quality and less on timing.

It reduces your stress

Time in the market requires minimal monitoring and fewer decisions, allowing you to take a more hands-off approach to investing. By reducing the need for constant analysis and quick reactions, it significantly lowers stress levels. This strategy also frees up valuable time, enabling you to focus on other aspects of your life without worrying about short-term market fluctuations.

The limits of time in the market

As you get to know me, you will realize that I avoid speaking in absolutes. I prefer adopting a more nuanced approach and considering different perspectives.

As I mentioned earlier, in the case of extreme events and a short-term investment horizon, time in the market may not be as effective (by definition, there simply is not enough time for it to work). Moreover, this strategy relies heavily on global economic growth. In the absence of such growth, following this approach becomes increasingly difficult. For example, if we experience a decline in the global population or face long-term energy shortages, the entire system could be affected - I admit, this is an extreme and unprecedented scenario.

However, aside from these extreme scenarios, it is crucial to pay attention to the charts to help identify interesting entry points. Sure, you can always buy without much thought, but purchasing in key zones improves your risk/reward ratio. It also helps you avoid buying during periods of market expansion, which are often fueled by FOMO (fear of missing out).

Conclusion

In conclusion, time in the market has proven to be a more reliable strategy for long-term growth. Paying attention to key entry points and understanding market cycles can enhance your risk/reward ratio. Ultimately, a balanced approach (staying invested while being mindful of market conditions) can help you navigate both stable and volatile periods, maximizing your potential for success. This article about market cycle can help you better understand the different periods you may experience while investing in the stock market.

Tell me what you think of that in the comments!

If you liked this article and enjoy Quality Stocks, spread the word!

While this newsletter provides valuable content for free subscribers, becoming a paid subscriber unlocks even greater benefits to help you gain an edge in the market.

Here is why upgrading to a paid subscription is worth it:

Access exclusive content. Dive deeper with detailed analyses, advanced insights, and premium research not available to free subscribers

Follow my portfolio. Gain exclusive access to my portfolio, including monthly updates, tracking my moves, and watchlists

Discover more stock ideas. Explore in-depth stock ideas, technical analyses, and strategies tailored to uncover hidden opportunities

Support this newsletter. Your subscription directly supports the creation of high-quality, valuable content to help you achieve your investment goals

Upgrade today and take your investing knowledge and performance to the next level!

I generally follow this philosophy in my investing. But I wonder if timing the market becomes a more viable approach when you’re dealing with individual stocks (as opposed to ETFs/Index funds)

Thanks!