Monthly Portfolio Update - August 2024 + Key Movements

The performance this month was notably influenced by the consolidation of several large-cap stocks. Very good performance of my small-cap portfolio

Hello fellow investor,

In this section, I present a transparent monthly update of my portfolio. It adheres to my investment strategy, which you can find here. Additionally, I have detailed my approach to Total Shareholder Return (TSR) in this article.

This presentation is divided into several parts:

Global view of the portfolio’s valuation and metrics

For dividend enthusiasts, a presentation of the Projected Annual Dividend Income (PADI) and a monthly calendar

Sector and geographical breakdown

For paid subscribers, there is also:

An explanation of the month's movements

A review of the month's news

A presentation of current portfolios (small-cap and large-cap)

My reinforcement price for potential stock purchases

My fair price estimation

And, of course, access to all my content, including stock deep dives, industry analyses, screeners and scoring, and real-time updates on my buy/sell movements

Please note that my portfolio is denominated in euros, making it subject to exchange rate fluctuations, particularly the euro-dollar exchange rate.

I also made some adjustments by selling 4 stocks to enhance my portfolio efficiency, in response to disappointing results or low expected total shareholder return (TSR).

Overall performance

The poor monthly performance of just 5 stocks accounts for the majority of this underperformance. Despite this, my overall returns remain positive, and it could soon present long-term opportunities.

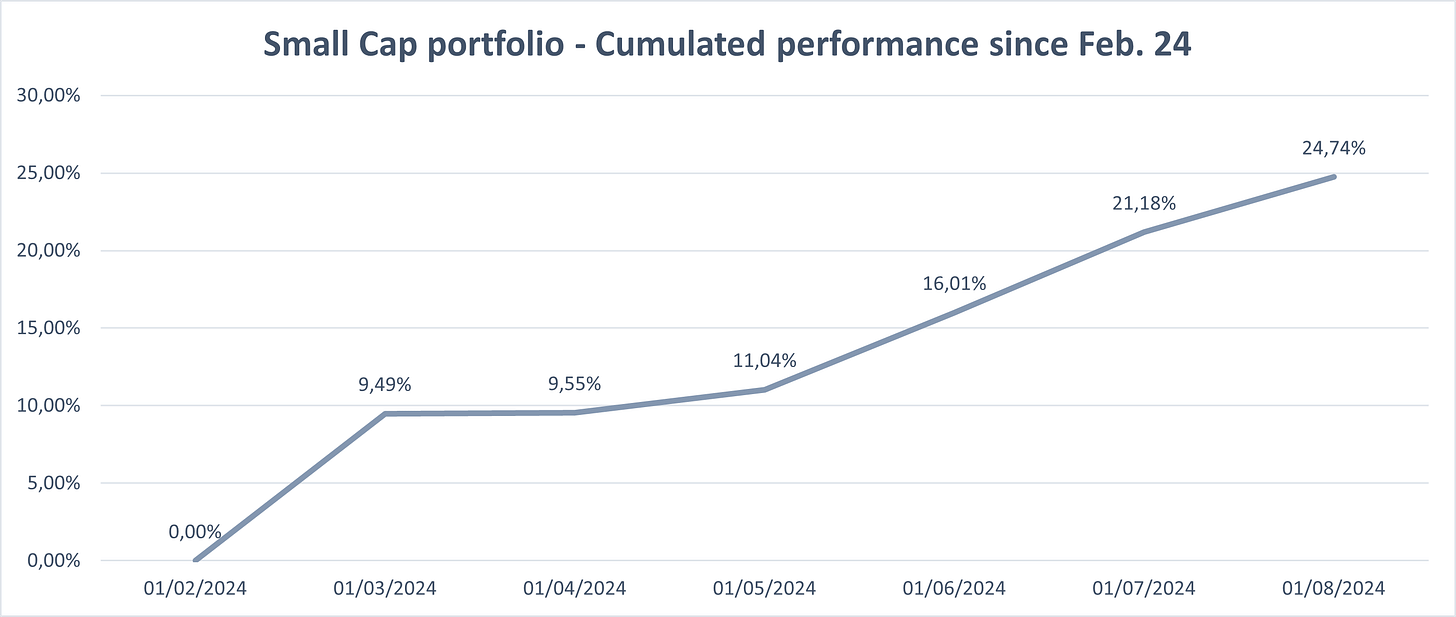

The small-cap portfolio continued its run with a great performance considering the difficult month for the stock market. The performance was 2.94%. The total returns since February 2024 are now close to 25%/

These consolidation periods provide a good opportunity to clean up my portfolio, removing underperformers to focus on strong TSR (Total Shareholder Return) prospects. In the rest of this article, I detail the stocks I sold.

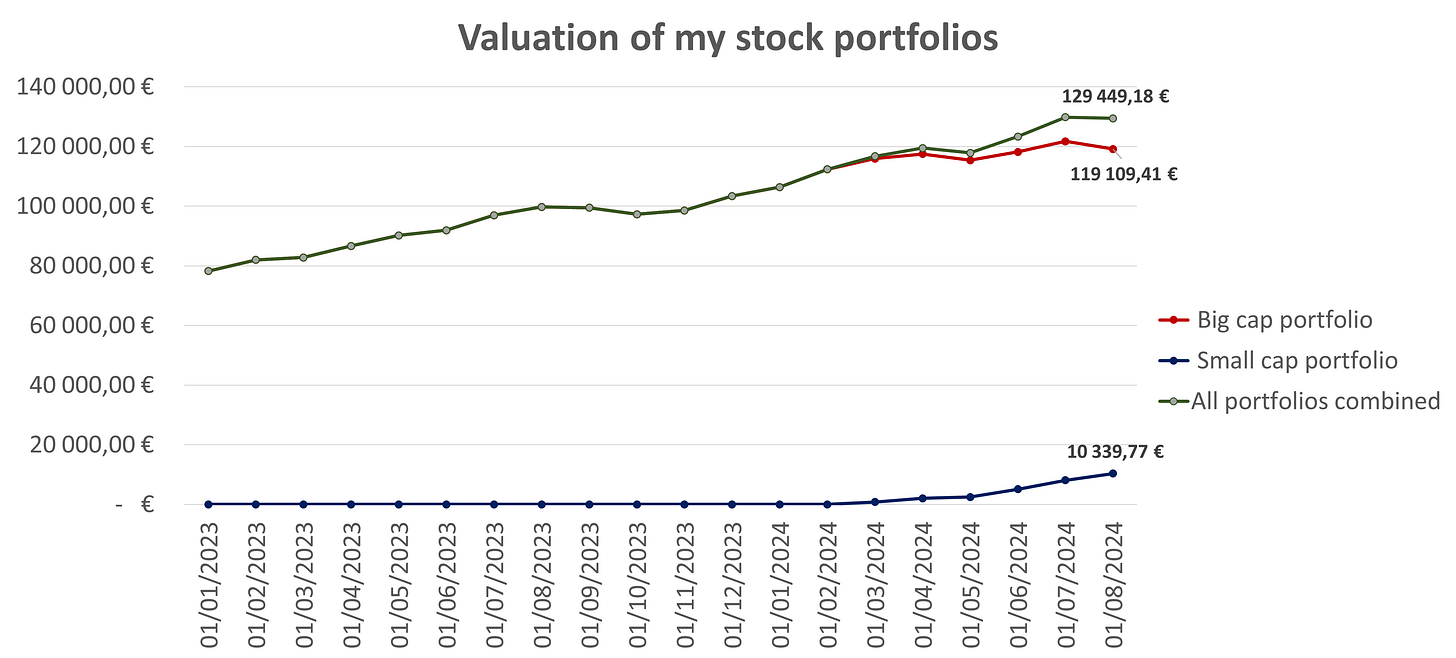

Valuation and metrics

This month I added 2k€ in my small-cap portfolio.

My portfolio’s key metrics improved with the movements I made. Here are the metrics before and after:

Past growth: 14.2% —> 15.3% / Estimated future growth: 10.4% —> 11.1%

Net profit margin: 25.8% —> 26.5%

ROE: 40.9% —> 40.5% / ROIC: 24.4% —> 24.9%

Debt leverage: -0.05x EBITDA (so average net cash position) —> -0.23x EBITDA

PE: 29.5x —> 29.3x / PE Y+2: 22.0x —> 21.5x

FCF yield: 3.85% —> 4.05% / FCF yield Y+2: 5.24% —> 5.58%

Dividend yield: 1.41% —> 1.38%

Dividend growth: 10.1% —> 10.1%

Buybacks: 0.79% —> 0.73%

Expected TSR: 12.0% —> 12.6%

So basically, I have a portfolio growing faster and with a better valuation.

I will keep enhancing these metrics by refining the portfolio with each adjustment. Some metrics significantly improved after removing low-potential stocks, which still yielded decent gains.

Focusing solely on my small-cap portfolio, here are the key metrics (weighted average):

Past growth: 20.3% / Estimated future growth: 16.4%

Net profit margin: 23.7%

ROE: 42.3% / ROIC: 32.1%

Debt leverage: -0.6x EBITDA (so average net cash position)

PE: 22.2x / PE Y+2: 15.9x

FCF yield: 5.9% / FCF yield Y+2: 9.4%

Dividend yield: 2.4%

Dividend growth: 13.5%

Buybacks: 0.0%

Expected TSR: 17.6%

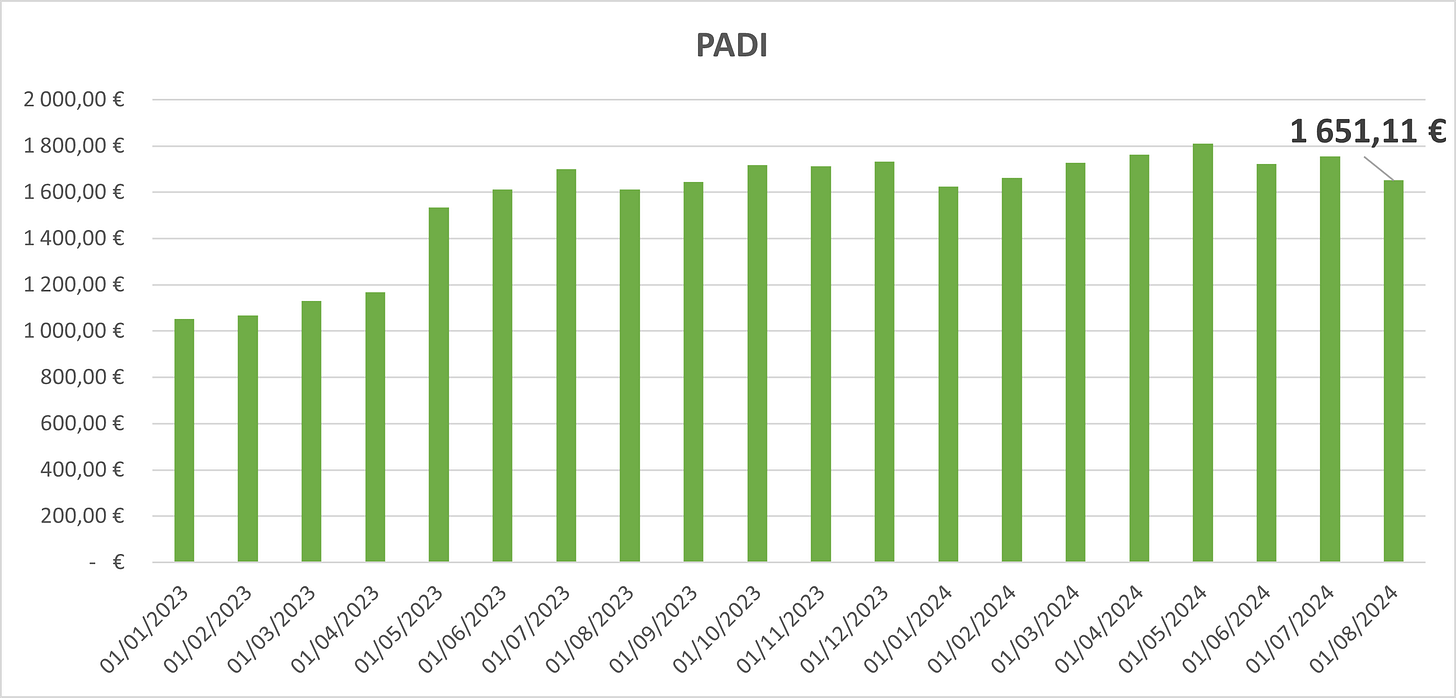

PADI decreased due to closed positions. As it is not my primary focus, it is not an issue as long as the quality and long-term potential of the stocks in my portfolio increase.

Published articles in July

Stock deep dives

Stock market news and culture

One Pager Thursdays

Stock duels

Stock picking

And now it is time to discover the 2 portfolios (stocks and news)

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.