Microsoft, the World's Most Magnificent Company

Strengths, risks, opportunities, and outlook

Microsoft is currently one of the world's most capitalized companies with a market capitalization of over $3T. With revenues multiplied by 3 since 2010, incredible prospects with AI and the cloud, diversified positioning, and exemplary capital allocation, this is understandable.

In this article, we will describe the company and the reasons behind its success. We will also examine the outlooks within each of its divisions. We will also calculate its fair price.

Business overview

Microsoft is a behemoth with numerous diverse activities, organized into three segments:

Productivity and Business Processes: This segment includes products designed to enhance productivity and business operations. Key offerings include Microsoft Office (Word, Excel, PowerPoint), Office 365, Dynamics 365, and LinkedIn. These tools are aimed at both individual users and enterprises, helping with tasks ranging from document creation to customer relationship management.

Intelligent Cloud: This segment focuses on cloud services and enterprise products. It encompasses Microsoft Azure, a leading cloud platform offering a wide range of services such as computing, storage, and networking. Additionally, it includes server products such as Windows Server, SQL Server, and development tools like Visual Studio. This division supports the infrastructure and development needs of businesses worldwide.

More Personal Computing: This segment covers products and services aimed at making computing more personal and accessible. It includes the Windows operating system, Surface devices, and gaming (Xbox hardware, Xbox Live services, and games). The division also manages search (Bing) and other personal computing initiatives. Its focus is on providing seamless and integrated user experiences across devices and platforms.

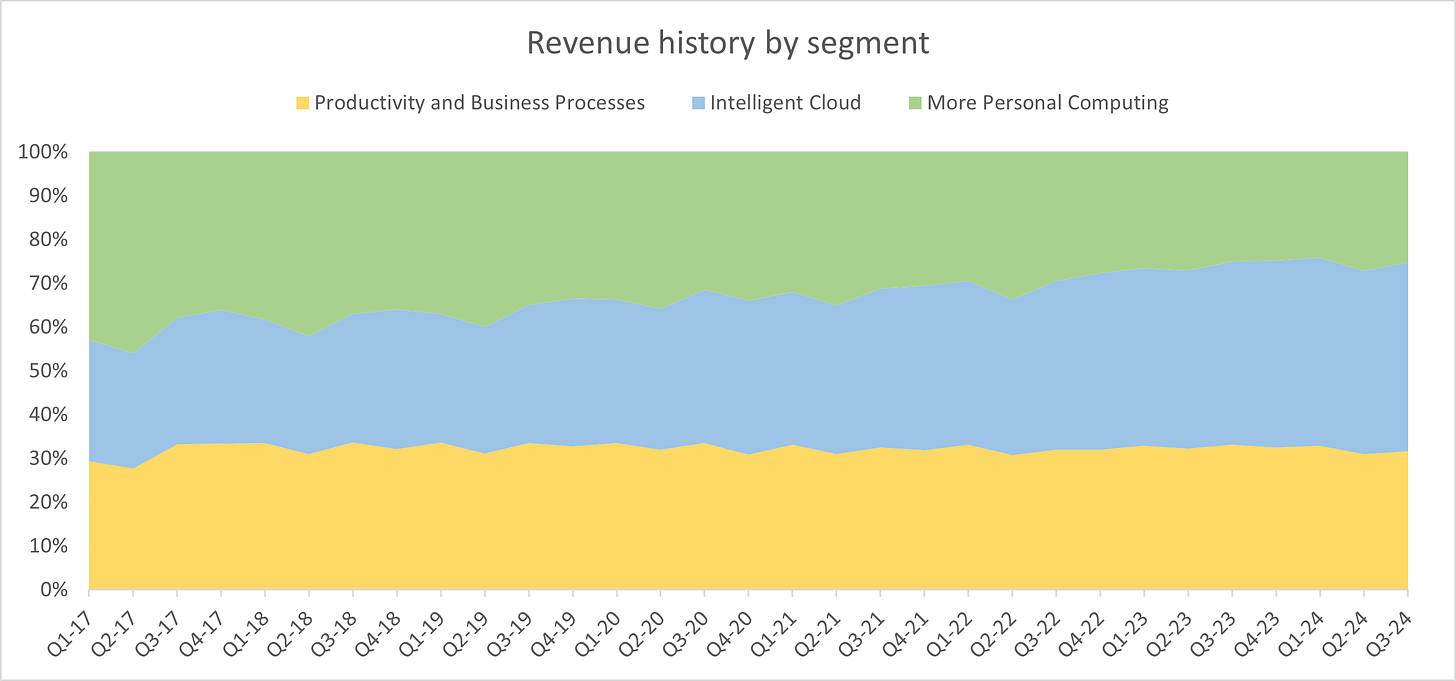

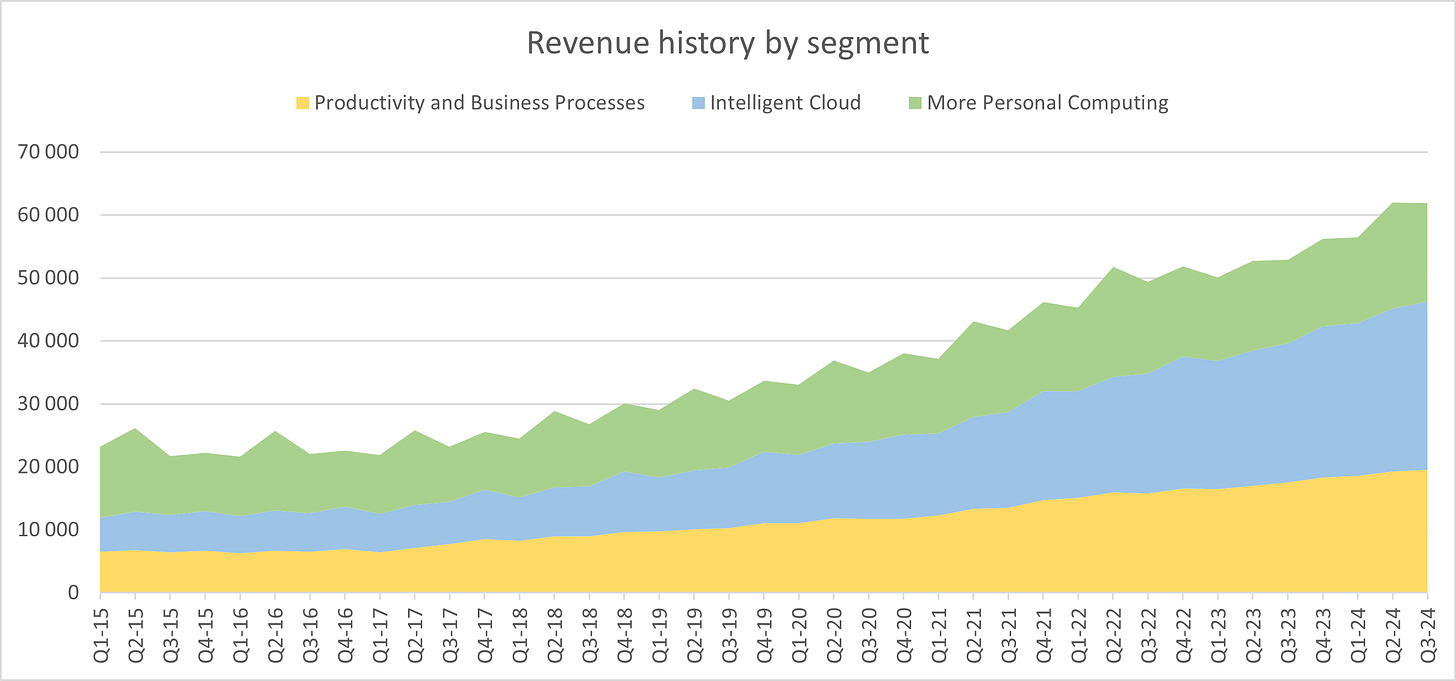

In terms of dynamics, the More Personal Computing segment has seen little revenue growth, rising from $43 billion in 2015 to $54 billion in 2024, despite acquisitions such as ZeniMax Studios (Bethesda).

The proportion of the Productivity and Business Processes segment has remained the same. It is the Intelligent Cloud part that has progressed the most, increasing from 23% of revenues in 2015 to 43% currently. Considering the growth of Azure boosted with AI demand, this trend should continue.

Acquisition history

Since 1994, Microsoft has made more than 240 acquisitions to help the development of the 3 division. Among these, some are particularly well-known due to their significant amounts:

Activition Blizzard, video games, 2022, $68.7B

LinkedIn, social network, 2016, $26.2B

Nuance, software, 2021, $19.7B

Skype, software, 2011, $8.5B

ZeniMax, video games, 2020, $7.5B

GitHub, software, 2018, $7.5B

The company's track record is impressive, and they have consistently demonstrated the ability to make their investments profitable by creating synergies between activities.

LinkedIn serves as a prime example. Since its acquisition, revenue has increased by over 40% annually to $15.7B and the number of users is close to 1 billion.

A multitude of growth drivers with synergies among them

Microsoft operates in a multitude of markets, with significant opportunities in many of them. It would indeed be too lengthy to describe them all. However, it is important to understand that the strength of the company lies in its ability to create significant synergies between its activities.

Cloud Computing Demand: The increasing adoption of cloud computing, driven by factors such as digital transformation, remote work trends, and the need for scalable infrastructure, fuels demand for Microsoft's cloud services, particularly Azure. Last quarter growth of Azure was above 30% helped by AI. Most of the Intelligent Cloud growth comes from Azure and it is currently the main growth driver of the company.

Digital Transformation: As businesses undergo digital transformation initiatives, there's a growing reliance on Microsoft's enterprise solutions for data analytics, artificial intelligence, and IoT, contributing to revenue growth in areas like Azure AI and IoT services. The synergy between Microsoft's various solutions is substantial, creating an entire ecosystem that incentivizes companies to use its products.

Artificial Intelligence: Integration of artificial intelligence across its products and services enhances functionality and efficiency, attracting customers seeking advanced solutions for automation, analytics, and personalization. Its investments in ChatGPT and other initiatives position Microsoft as one of the key players poised to benefit from AI advancements.

Gaming Ecosystem: Microsoft's gaming division, including Xbox hardware, software, and services, remains a significant contributor to its revenue. With the growth of gaming as a form of entertainment and the expansion of Xbox Game Pass, this segment continues to see robust growth. Cloud gaming represents an intriguing market opportunity for Microsoft, allowing them to offer games via subscription (like Game Pass) without requiring users to invest in expensive gaming consoles. I discussed this potential market in detail in my video game industry analysis here.

Cybersecurity Solutions: The increasing importance of cybersecurity drives demand for Microsoft's security products and services, such as Microsoft Defender and Azure Security, as organizations prioritize safeguarding their digital assets. Acquisitions may help this division to capture more market share.

These growth drivers, combined with Microsoft's strong market position, innovative technology offerings, and strategic investments, contribute to its sustained growth and competitiveness in the global tech industry.

Moreover, Microsoft's substantial free cash flow generation enables the company to continue making strategic acquisitions, bolstering existing segments and creating new ones.

Cloud domination

If AI is poised to be the next primary growth driver, it is important to recognize that Cloud computing serves as the current powerhouse. Moreover, it seamlessly aligns with AI initiatives, as AI computations often necessitate substantial cloud capacity.

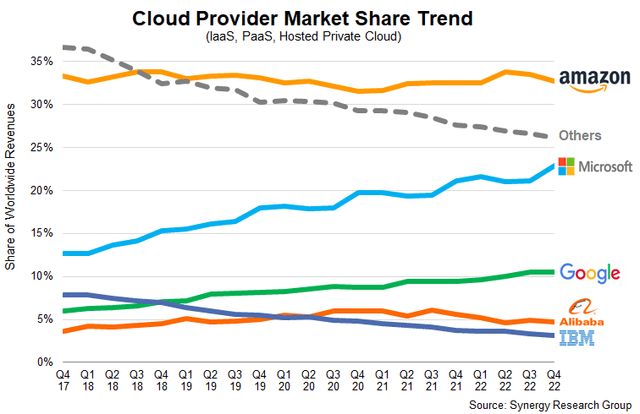

Microsoft is not only growing but also gaining market share in the cloud. If the current momentum continues, Azure is expected to surpass AWS as the leader.

Outlooks

To discover the outlooks, stock metrics, the SWOT analysis and the fair price estimation, you can become a paid subscribe.

This will give you access to a wealth of resources: stock analysis, screeners, portfolio sharing, industry analysis, one-pagers, stock duels, and much more to help and inspire you to improve your investments, discover hidden gems, and stay informed about the stock market.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.