Last December, in this article I selected 8 stocks that I believed would perform well in 2024. In this article, we will review their mid-year performance and identify 5 stocks that could excel by year-end. The initial list remains valid, and I will continue to monitor its performance throughout 2024.

As always, my investment horizon is long-term. This short-term selection is intended for entertainment, as my primary focus is on long-term gains.

Initial list, performance review

Here is the performance for each stock

Alphabet +30.40%

With 62% EPS increase in Q1 24, Alphabet has presented very strong financial results

ASML +41.44%

Blank year for ASML in terms of revenue, but 2025 should be a good year with 30% revenue increase

Evolution -8.17%

Dissapointing performance but increasing fundamentals. Eventually, it may rebound

Microsoft +18.86%

AI is creating a good momentum for Microsoft

Novo Nordisk +44.05%

Manufacturing capacities still limit revenue but stock price increases faster than EPS, so it may reach a short term limit

Paypal -5.50%

The stock is still under pressure. New tailwinds (adds, …) appear as fast as new headwinds (Apple’s competition)

Unitedhealth -3.27%

A lot of bad newsflow (regulation, cyberattack) put the stock under pressure

Visa +0.81%

Steady and not disappointing

The overall performance is 14.83%

The MSCI World performance was 10.81% for the same period. This means that the selection had a 4.02% overperformance.

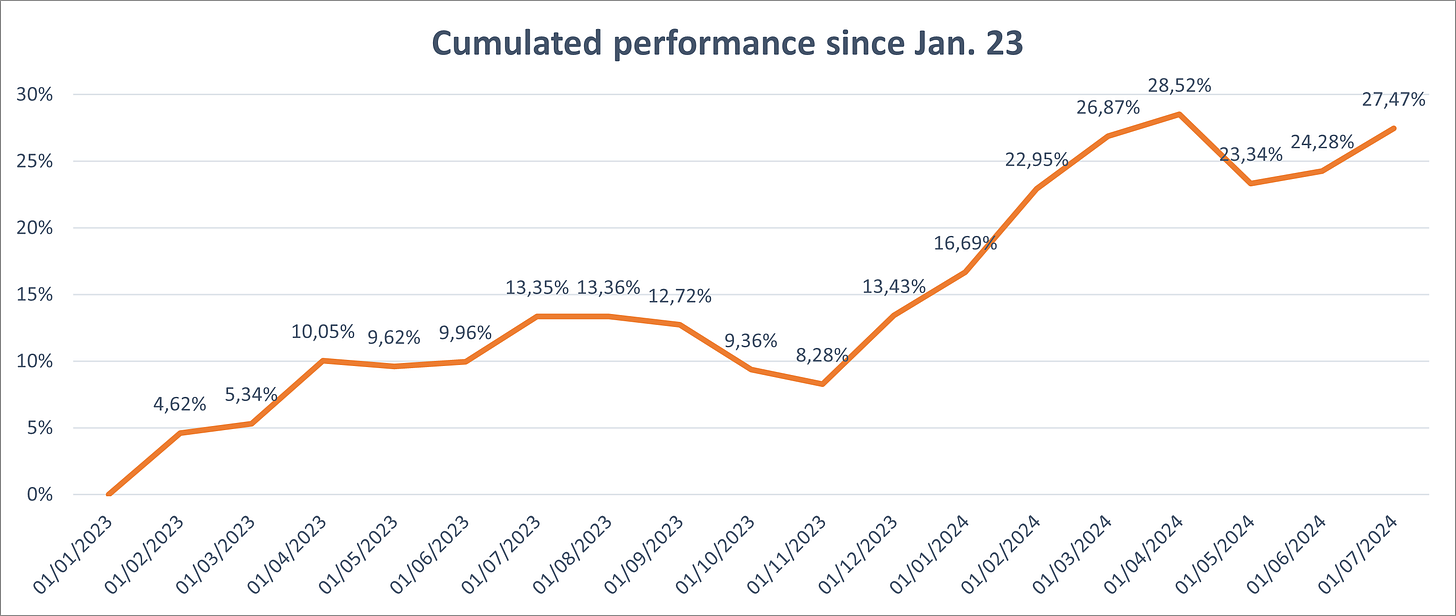

Performance vs my portfolios

My overall performance since the beginning of 2024 is 9.24%. However, my small-cap portfolio has outperformed significantly, returning 21.18% since its inception in mid-February.

For my overall performance, I use a diversified approach to reduce risk, which naturally tempers potential returns. In contrast, my strategy for the small-cap portfolio is more aggressive, targeting annual total returns of 15% to 20%.

This highlights the importance of tailored strategies: different approaches entail different risks and yield different returns. If you are curious, you can find detailed portfolio reports here.

Comparison with Forbes’ Top 10 stocks for 2024

The stock picks are:

Visa +0.81%

McDonald’s -14.05%

TSMC +62.90%

Microsoft +18.86%

Zoetis -12.16%

Adobe -6.88%

Booking +11.68%

Apple +9.40%

Monster -13.30%

Union Pacific -7.88%

The average performance is 4.94%.

Comparison with Barron’s Top 10 stocks for 2024

The stock picks are:

Alibaba -7.11%

Alphabet +30.40%

Chevron +4.87%

Barrick Gold -4.68%

Berkshire +12.83%

BioNTech -23.86%

Hertz -66.03%

Madison Square Garden Sports +3.46%

Pepsico -2.89%

U-Haul -14.03%

The average performance is -6.70%. I analyzed this top 10 at the end of 2023 here. Just an example of what I was writting about Hertz “Yes Hertz is cheap but has a negative FCF and debt is really high $15 billion or 15x EBIDTA. Surely the worst stock in this list as at the moment, risks are ultra high. Maybe they have insider information, but looking at the metrics, it seems dangerous.”

Conclusion

The real (negative) surprise among my top 8 picks is Evolution. Despite its P/E ratio dropping from 22x to 18x and a decrease in margin, the company continues to grow its revenue and expand. We will see if the second quarter brings better results.

Great picks!

PayPal has certainly been a source of frustration for many of us here on Substack.