RVRC, a Future Leader of the Outdoor Industry?

Discover a very interesting and overlooked Swedish small cap

Founded in 2014 and listed on the Swedish market since 2021, Revolution Race (RVRC) is a relatively new company. It is known for its quality products and a scalable model - as the company is digital native. This article aims to discover the company, its business and advantages. We will also compare it to its peers which will highlight the performance of the business model. As usually, we will also identify the risks and estimate the fair price.

Company overview

The mission of the company is to become the “most recommended outdoor brand”. This is interesting as it emphasizes the effort that the brand puts into the quality of its products and the satisfaction of its customers.

The products are for now dedicated to outdoor activities:

Outdoor clothing for men, women and teens (trousers, jackets, tops, underwear, socks)

Shoes

Accessories (bags, hats, belts, gloves)

The business model is interesting as RVRC is mainly a designer and seller of its products, without physical store. No distribution, externalized logistics, this allows the company to maintain a low number of FTEs (around 120) and to but easily scalable as the cost to open a new market is minimal. This is a digital native brand.

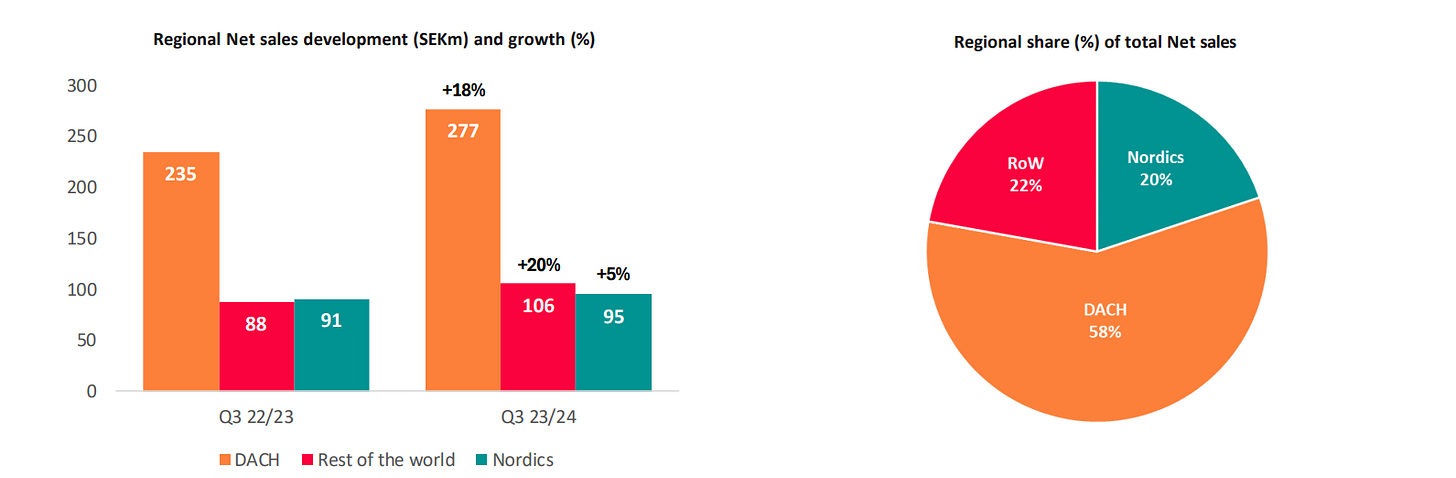

The geographical breakdown is interesting. For now the DACH region (Germany, Austria and Switzeland) is growing quickly as the Rest of the World. Nordics, the original market, represent only 20% of the sales and is growing slowly.

An improving digital recognition

With always more reviews and followers on social media, the company is scaling. This is a good metrics for future sales.

This is also visible with google trends, as the company is quickly gaining recognition. We see it expanding geographically, as the sales do.

Growth strategy

The growth strategies has 7 pillars:

Growth in existing and newly launched markets

Continue international expansion and launch new markets - very interesting as the business model allow to scale easily

Growth in marketplace - like Amazon and other marketplaces

Expansion through new product categories - it will allow to sell to existing customers, reducing the acquisition cost per product sold, and expand the TAM (Total Addressable Markets)

Increased loyalty and returning customers - leveraging the strong link the company has with its community

Developing in pricing strategy with 3 distinct product ranges - base, pro and statement

Sustainable growth - for marketing and regulation reasons

As we read the customer reviews, an issue due to the quick growth is easily visible: people are mostly happy about their products but sometimes complain about delivery (delay, product availability).

This is a common issue with fast growing companies. The inventory management and the supply chain have difficulties to maintain the level of service as the forecasting and manufacturing processes take time to scale. Another issue comes from the supply chain model: logistics is externalized. 3PL (third party logistics) are often difficult to manage especially when volume are changing quickly. As the company continues its growth, it will have to address these problems.

The departure of the founder

In 2022, Pernilla Nyrensten, the co-founder, stepped down as CEO. More recently, Niclas Nyrensten, the other co-founder, declined re-election and will leave the board.

“The reason for declining re-election is that our son has been accepted to high school in Spain and that the family will move with him. I have full faith in the Board and management of RevolutionRace to continue in the same spirit as we have had since the start” said Niclas Nyrensten in a comment.

This, of course, creates uncertainty, as it is never certain that the new management will succeed. Although this is a risk to monitor, there are currently no signs of issues. The next few quarters will be particularly interesting since the new management has projected a higher revenue growth.

Comparison with peers

Using my scoring system, on a pure metric analysis, RVRC gets a great score despite a lower market score due to a smaller size than the 10 other ones.

Among its peers, we find Nike, Lululemon, Decker Outdoors, Dick’s Sporting Goods or On Holdings.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.