The Importance of Success Rates in Clinical Development for Biotech Investment

Success rates by phase and category are critical for investors

Investing in biotech companies can be challenging, particularly for individual investors. To navigate this complex sector, it is essential to understand the drug development process and the associated success rates.

This understanding is vital for evaluating all types of biotechnological companies, including unprofitable biotech firms, profitable biotech enterprises, and large pharmaceutical groups. A clear grasp of these factors aids in accurate valuation and helps investors avoid costly mistakes.

The development process

The drug development process is a complex and lengthy journey that can be broadly divided into several phases: Preclinical Testing, Phase I, Phase II, Phase III, and Market Reach. Here's a detailed description of each phase.

1. Preclinical testing

Before a new drug can be tested in humans, it undergoes extensive laboratory and animal studies to evaluate its safety and efficacy. This phase includes:

In vitro studies: Testing the drug on cells or tissues in a lab to understand its effects.

In vivo studies: Using animal models to assess the drug's safety profile, pharmacokinetics (how the drug is absorbed, distributed, metabolized, and excreted), and preliminary efficacy.

2. Phase I clinical trials

Phase I trials are the first stage of testing in human subjects. These trials primarily focus on safety:

Participants: Typically 20-100 healthy volunteers or sometimes patients.

Objective: To determine the safety, tolerability, pharmacokinetics, and pharmacodynamics of the drug.

Duration: Several months.

Outcome: Data on side effects, safe dosage range, and how the drug is metabolized and excreted.

3. Phase II clinical trials

Phase II trials involve more participants and provide preliminary data on the drug's efficacy:

Participants: 100-300 patients who have the condition the drug is intended to treat.

Objective: To evaluate the drug's efficacy, optimal dosing, and further assess its safety.

Duration: Several months to two years.

Outcome: Evidence of the drug’s therapeutic effect and side effects, helping to design Phase III trials.

4. Phase III clinical trials

Phase III trials are large-scale studies to confirm the drug's effectiveness, monitor side effects, and compare it to commonly used treatments:

Participants: 1,000-3,000 patients.

Objective: To gather more comprehensive data on safety and efficacy, establish the drug’s overall benefit-risk ratio, and provide information for labeling.

Duration: One to four years.

Outcome: Data supporting the drug’s clinical use, leading to regulatory approval if the results are favorable.

5. Regulatory review and market reach

Once Phase III is successfully completed, the drug developer submits a New Drug Application (NDA) to regulatory agencies like the FDA (Food and Drug Administration) in the US or EMA (European Medicines Agency) in Europe:

Review Process: The regulatory agency reviews all the data from the preclinical and clinical trials, manufacturing information, and proposed labeling.

Outcome: If approved, the drug can be marketed and sold.

6. Post-market surveillance (Phase IV)

Even after a drug reaches the market, it continues to be monitored for safety and effectiveness in the general population:

Objective: To detect any rare or long-term adverse effects and gather additional information on the drug's optimal use.

Outcome: Data can lead to updates in labeling, usage recommendations, or, in rare cases, withdrawal of the drug from the market.

Each phase of drug development is critical to ensuring that new medications are safe and effective for patients, balancing the need for innovative treatments with rigorous safety standards.

The success rate

The success rate of drug development depends on various factors, including the disease area, development phase, company, and country.

The table below illustrates the phase transition success rates categorized by disease area.

The timeframe for the data is 2011-2020. On average, the success rates for each phase are as follows:

52% for Phase I

29% for Phase II

58% for Phase III

91% for market approval after Phase III

Overall, the average success rate across all phases is approximately 7%, though this figure can vary slightly depending on different studies.

The success rate also differs between oncology and non-oncology drug development.

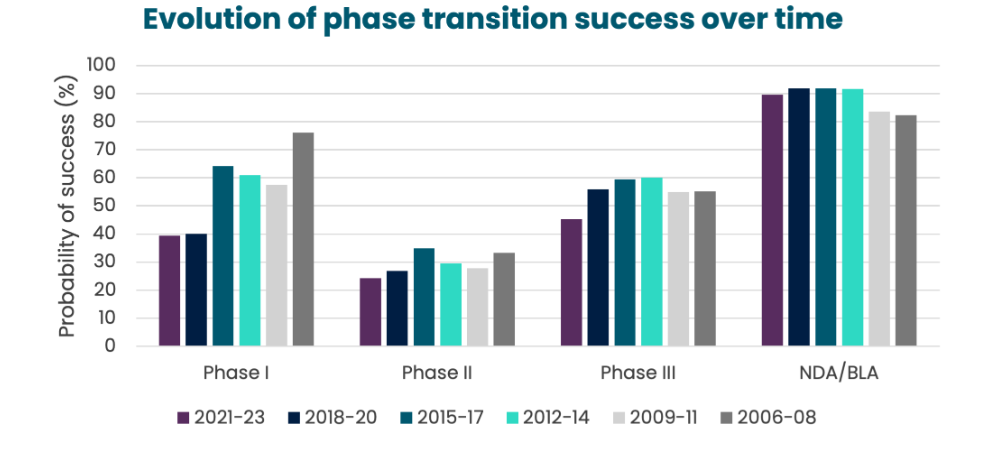

Decreasing trend in success rate

This success rate tends to go down over time: it is more and more complicated to reach the market once a phase I is launched.

Declining success rates in drug development are largely due to the challenges due to biological complexity and competitive intensity.

As drug programs target new diseases to address unmet medical needs, the technical challenge of validating new drug targets or improving upon existing therapies increases significantly.

Additionally, the dramatic rise in funding, the expansion of drug pipelines, and heightened clinical trial activity have made the field increasingly crowded. Consequently, pipeline drugs that are not first-in-class or best-in-class may struggle to achieve a return on investment, leading to the discontinuation of many such programs.

Impact for investors

Investing in Phase I biotech companies is generally not reasonable for individual investors. The development timeline is lengthy, and the company will require substantial funding, increasing the risk of significant dilution for early investors—even if the drug development is ultimately successful.

It is also prudent to avoid investing in unprofitable biotechs. There is a notable survivor bias in this sector: for every major success resulting in a big pharma acquisition, there are often numerous failures.

For those looking to invest in biotech, it is wiser to consider large pharmaceutical companies or profitable biotechs that can self-finance their development (like Genmab or Vertex for instance). The success rate is also notably higher for biotechs that have already achieved success in their development process.

Interestingly, some biotech companies exhibit higher success rates in their development processes due to specific advantages. For instance, Halozyme has maintained a 100% success rate after Phase I for several years. This impressive record is primarily because Halozyme often engages in co-developments of existing molecules to enhance their efficacy, which reduces the inherent risks compared to developing entirely new drugs. However, it is important to note that this may not last indefinitely.

Final thought: exercise caution when investing in biotech companies. While their free cash flow, margins, and potential for growth can be appealing, the risks are often substantial. These risks include development challenges, regulatory hurdles, potential legal actions, and the looming threat of patent cliffs.