Waste Management, turning Waste into Gold

Discover the secret of the waste management leader in the US

When investing, in addition to growth companies, we can look for companies that are not sensitive to the economic cycle. Waste Management falls into this category.

As the US market leader in their sector, it has some very interesting metrics. Its robust business model is very attractive and combine resilience and decent growth. Let's take a look at their business, prospects and competitors. Welcome to the world of waste!

If you like stock deep dives, you have articles about Paypal, Arista, Novo Nordisk, LVMH or Palo Alto Networks. All the already published articles can be found easily following this link.

Company overview

Waste Management is the largest integrated provider of traditional solid waste services in the United States. The company serves residential, commercial, and industrial end markets and is also a leading recycler in North America.

Their huge network allows them to cover most of the territory and to benefit from scale effect, allowing to reduce costs and serve customers efficiently.

The four main activities are:

Collection. With more than 50% of the revenue, collection is the main part of the activity. More than 15,000 collection routes allow to pick waste and recyclables.

Transfer. The transfer activity (9% of the revenue) are a way to consolidate the different waste flows and sort them to disposal sites and facilities. There are 340 transfer stations.

Landfill. 260 landfill locations in the US and Canada represent 19% of the revenue. This network is a huge barrier to entry.

Recycling. Recycling is a growing part of the activity with 8% of the revenue.

Other diverse activities represent around 10% of the activity. It includes renewable energy.

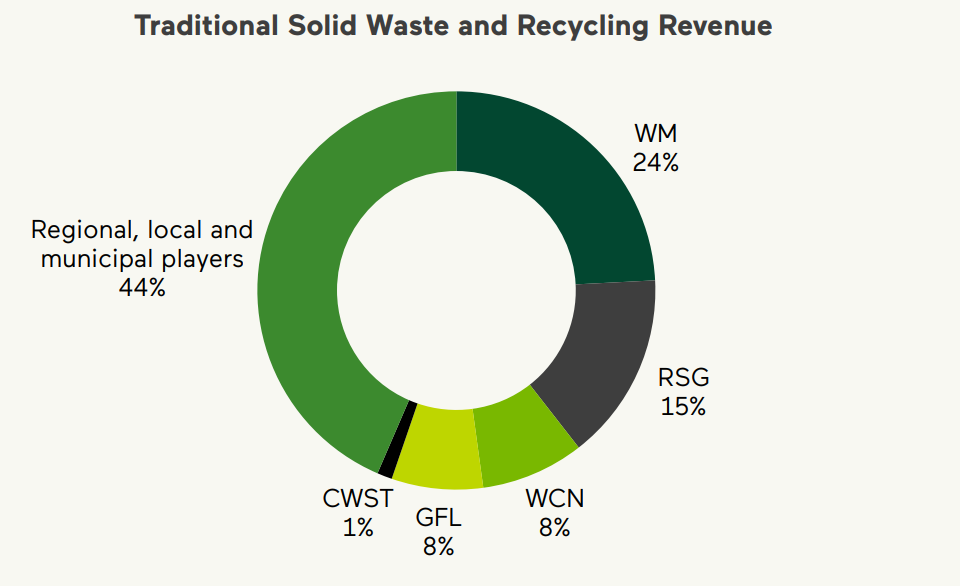

Competitive landscape

Waste Management is the leader in Solid Waste and Recycling activities in North America with almost 25% of the market share. It is followed by Republic Services (15%) then Waste Connections and GFL Environnemental (8% each).

For now it successfully managed to use its first position to get the best capital efficiency in the industry. It has the best ROIC.

This fragmented market allows Waste Management to find a lot of interesting new targets. Every year, it buys tens of companies.

Strategy and outlooks

To grow, Waste Management is focusing on 4 pillars:

Collection and disposal price & volume growth - a slow but steady growth on their core market

Technology enabled cost reductions & growth - new technologies to improve costs, improve offer and get new customers

Sustainability-led growth - developing new markets linked to sustainability. These new markets appear to be highly profitable

Strategic M&A - growing through acquisitions

Technology and automation can be used for multiple uses: automated side-load trucks, online customer systems, streamlined and automated customer orders. Technologies are also used to increase growth in recycling market. They allow to increase the amount of material recycled, increase efficiency.

Investment in recycling are expected to generate $290M additional EBITDA by 2026. This result will strongly depend on the commodity price - the hypothesis taken by the company is $125 per ton.

The most promising investment will be in the renewable energy business - generating renewable natural gas (RNG) from waste. Waste Management aim to build 17 new LFG (landfill gas) to RNG factories. This should generate $510M additional EBIDTA by 2026.

The overall plan in sustainability will require $2.8B/$2.9B in CAPEX from 2022 to 2026 and will improve EBIDTA by $800M. This amount is often increased showing a growing market.

These investment will require a lot of cash reducing FCF from around $2.8B to approximately $2.0B in the next years. They represent a 25% increase from the $2.2B yearly CAPEX required for normal business activities.

What is interesting is that these investment should increase the profitability of the company. The negative impact will be more cyclicity in revenue (depending on energy and commodity prices).

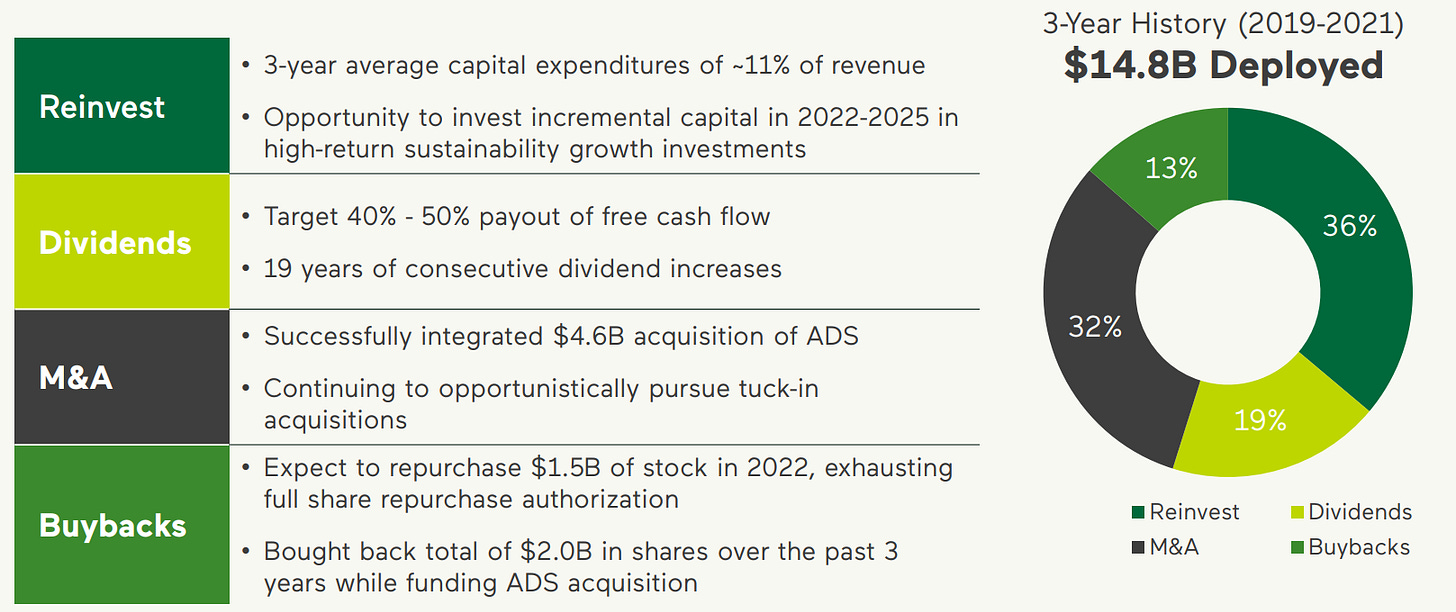

Capital allocation

One of the strengths of the company is its great capital allocation.

Stock metrics

Growth metrics

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.