Arista Networks, Leader in Cloud Networking

How Arista Networks stands out and gains market share

In the exciting cloud market, Arista Networks is one of the pick-and-shovel businesses. It specializes in cloud infrastructure, specifically datacenter servers.

Let's find out more about the Arista Networks business and its competitive advantages. We will then look at its market potential up to 2030, its metrics, a SWOT analysis and a valuation exercise.

Without further ado, let’s dig in!

Company overview

With a 2023 revenue of $5.8 billion, the growth of Arista is huge. By way of comparison, 2018 sales were $2.1 billion, a 22% CAGR. Their revenues can be split into 2 main categories: products (around 85%) and services (around 15%).

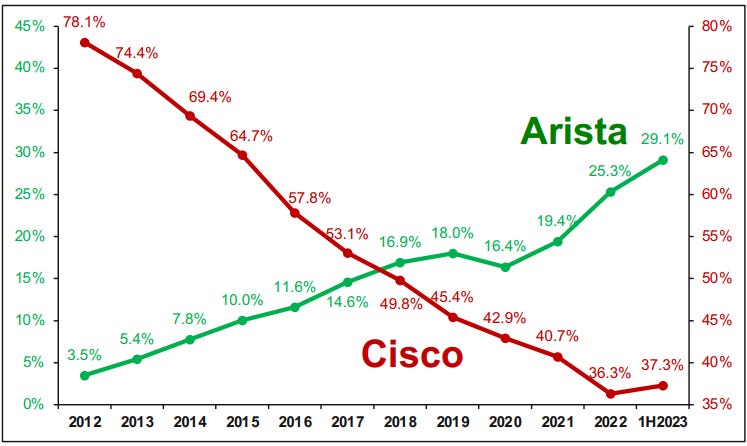

The success is impressive as they manage to gain marketshares from Cisco, their main competitor (note that this Chart from Arista is a little bit misleading as the scale is not the same; the core message is the same: Arista is gaining market share and Cisco is not).

This leadership is even more visible in the high speed segment since they lead the market share.

This domination of the high speed segment is all the more important as the market is moving in that direction. The race to 800 Gbps is being launched right now, and will be crucial since this is the segment expected to be the most important in 2027.

Their product porfolio offers a wide range of solutions. Some of their products, like the 7800R3 is suited for AI intensive workload.

Their competitive advantage is defined by them with their Arista’s “Five A’s”:

Available Architecture: delivers a self-healing architecture of quality and aperture of data-collection across a highly available leaf-spine network with link, path, device, and network-wide redundancy.

Agile Work-X: orchestrates microservices, workloads, work-streams, and workflows based on Arista universal data-driven network foundation.

Automation: supports workload mobility across the cloud network, and the emerging container infrastructures for rapid and agile provisioning in minutes instead of hours or days

Analytics: CloudVision Analytics engines and Telemetry Apps take full advantage of the state streaming infrastructure to give customers an unprecedented level of visibility into their network operations.

API and AI Driven: enables the state of the network (via Arista NetDLTM) and open APIs, seamlessly connecting the cloud and premises.

Software and services revenues rely on their software helping to manage cloud infrastructure and help integrate their products into a global IT architecture.

Please note, however, that while growth is impressive, the business is that of an equipment supplier. Growth and sales are therefore subject to the investment cycle of its customers and the cycle of its market, which Arista may even amplify. This should not be forgotten when the speed of growth dries up, as performance is likely to fall sharply until the low point is reached.

The profit margin of the company has been constantly above 27% since 2019, often reaching more than 30%. Return on Equity (ROE) and Return on Invested Capital (ROIC) are also very high with a 5-year average of 27% and 25% respectively. Cash conversion is good, therefore the Free Cash Flow (FCF) is good and rising. Those are signs of a very qualitative company and business model.

Peers recognition

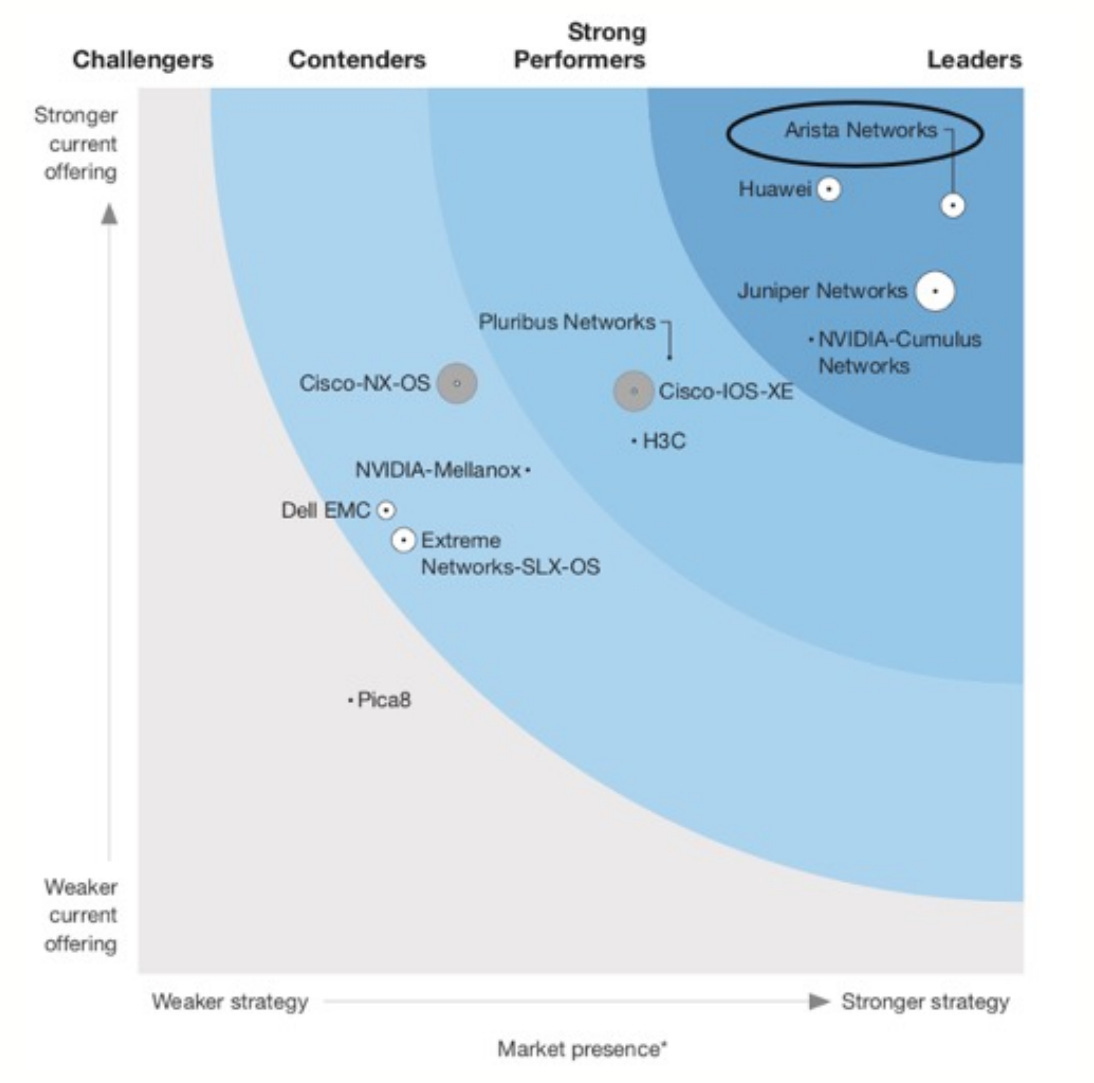

As a recognition to its leadership, Arista Networks scores well on several benchmark. It appears as a Leader in the Gartner’s Magic Quadrant for Datacenter Networking and in the Forrester Wave for Network Analysis and Visibility.

This clearly shows that Arista is a key player in the sector.

Market size by 2030

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.