Novo Nordisk, Miracle Drug Creator?

What does the future hold for Europe's largest capitalization?

With the recent success of its anti-obesity drugs, Novo Nordisk has been much talked about. And with good reason: the share's performance is very impressive, with gains of over 50% over 1 year, 230% over 3 years and almost 600% over 10 years. With its main competitor, Eli Lilly, they are shaking up the world of pharmaceuticals and even raising questions in other sectors.

In this article, we present the company and its characteristics. We will zoom in on its flagship drugs, notably GLP-1 and its potential impact. The pipeline will also be examined. After sizing up the market between now and 2030, we will look at the company's metrics and draw up a SWOT, which will be particularly useful for identifying the inherent risks. Finally, we will take a look at the fair price estimate.

Company overview

Nordisk is specialized in 4 segments:

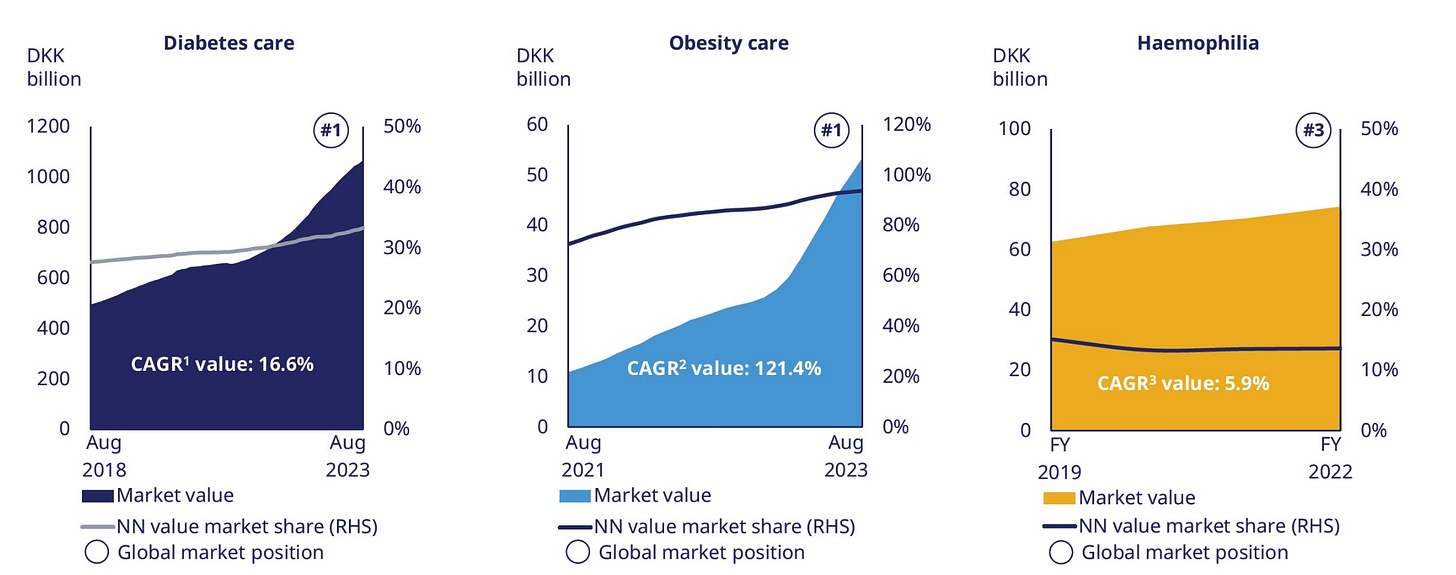

Diabetes, reaching a market of 537M people with diabetes. Novo Nordisk is #1 worldwide on this segment

Obesity, reaching a market of 764M people with obesity, 2% of them being currently medically treated. Novo is also #1 worldwide on this segment

Rare Disease, mainly with an haemophilia treatment. This disease affects 600k people, 35% being currently medically treated. Novo Nordisk is #3 worldwide on this particular disease

Other Serious Chronic Diseases

The breakdown of the activities show a clear domination of the obesity + diabetes segments with 93% of the revenues. This should last as those are also the more dynamic segments in terms of growth, especially the obesity one.

GLP-1, a revolution

GLP-1 agonists were initially developed for type 2 diabetes. The drugs were also noted to reduce food intake and body weight significantly, and some have also been approved to treat obesity in the absence of diabetes. They are also in development for other indications, such as non-alcoholic fatty liver disease, polycystic ovary syndrome, and diseases of the reward system such as addictions.

Recent studies have shown that the drug may also help reduce cardiovascular risk, and even, although this remains to be validated, the symptoms of Alzheimer's disease.

GLP-1 (Ozempic and Wegovy) showed that their use led to a change in patients' consumption habits.

Many investors then wondered what the impact might be on all the other activities in the economy: lower consumption of sodas and fast food, lower aircraft operating costs (less fuel if people are less fat), fewer dialysis treatments, increased sales of clothing to renew wardrobes, etc.

Although the reaction seems disproportionate, and the concrete impact is probably overestimated for many activities, the fact remains that there is a measurable impact on other activities. In this respect, it is indeed a revolution.

The patent cliff and portfolio

One of the main risks for a big pharmaceutical company if the patent cliff. This represents the date on which the patent expires and enters the public domain. Competitors will then be able to offer the same drug, reducing prices and market share for the initial laboratory.

For Novo Nordisk, this risk will be very high when Ozempic will lose its patent as a huge share of its revenues depend on it. As it will not happen before the next decade, it is not urgent, but every investor should keep that in mind.

This is a weakness of Novo Nordisk vs Eli Lilly, as the wider pipeline, if proved successfull, has the potential to take over from its GLP-1 revenue.

To continue its development, the laboratory is focusing on new drugs, new uses for its existing molecules or digital health solutions.

External acquisitions are on the increase, aided by the laboratory's abundant financial resources. Recently, Novo Nordisk acquired the Ocedurenone molecule for the treatment of hypertension for $1.3B. In August 2023, they also acquired Inversago Pharma, for the treatment of obesity, for over a billion dollars.

If these acquisitions are necessary, they will necessarily reduce the company's return on capital, as purchases are made at a premium.

Market size by 2030

Novo Nordisk is active in 2 main markets: anti-obesity drugs and diabetes treatment drugs.

The diabetes segment should represent a market of $134B in 2030. It is a 7.8% CAGR.

According to Goldman Sachs, the anti-obesity segment should represent a market of $100B in 2030, compared with $6B today, representing a CAGR of almost 50%.

The current market share are 54% for the anti-obesity segment 33% for diabetes. Let’s keep more conservative assumptions of respectively 45% and 30%.

This should represent a revenue of $85B + the Rare Disease and Other Serious Chronic Disease. With a 10% share for this 2 segment, the total revenue of the company in 2030 should be $93B, this gives a 15% CAGR for the company for the 7 next years.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.