Visa, Quality Compounder by Nature

Discover one of the stocks that best represents the quality-oriented investment style

Visa is a fascinating company. It is the leader in one of the best-known duopolies. Its business is a demonstration of the power of the strongest moat: the network effect.

This is reflected in the sheer scale of its results. Since 2010, its sales have multiplied by 3. Its net income exceeds 50%, and its ROIC exceeds 25%. The annual FCF generated is around $20B.

But what lies behind the surface of this payments giant? What is its market and, above all, how can Visa continue to grow as fintechs and cryptos do their utmost to disrupt the huge payments market? Let’s find out together.

As a reminder, I chose Visa as one my 8 favorite stock picks for 2024.

If you like stock deep dives, you have articles about Paypal, Arista, Novo Nordisk, LVMH or Palo Alto Networks.

Company overview

Visa’s business is very well described in this infographic. Their activities:

Their core products are credit, debit and prepaid cards

Around this core business, they develop services with Click-to-Pay and Top-to-Pay. Tokenization is used to increase transaciton security

They also develop in close businesses linked to their core business. In this category, we can find Cross-Border Solutions (huge margin for this one), Commercial Solution (dedicated to business needs) and Visa Direct

The last activities lies in their Value Added Services Category where we find a lot of diversification. A lot of them use the data created by the incredible business of Visa

During 2023, the Visa network enabled $15 trillion in total volume and 276 billion transactions.

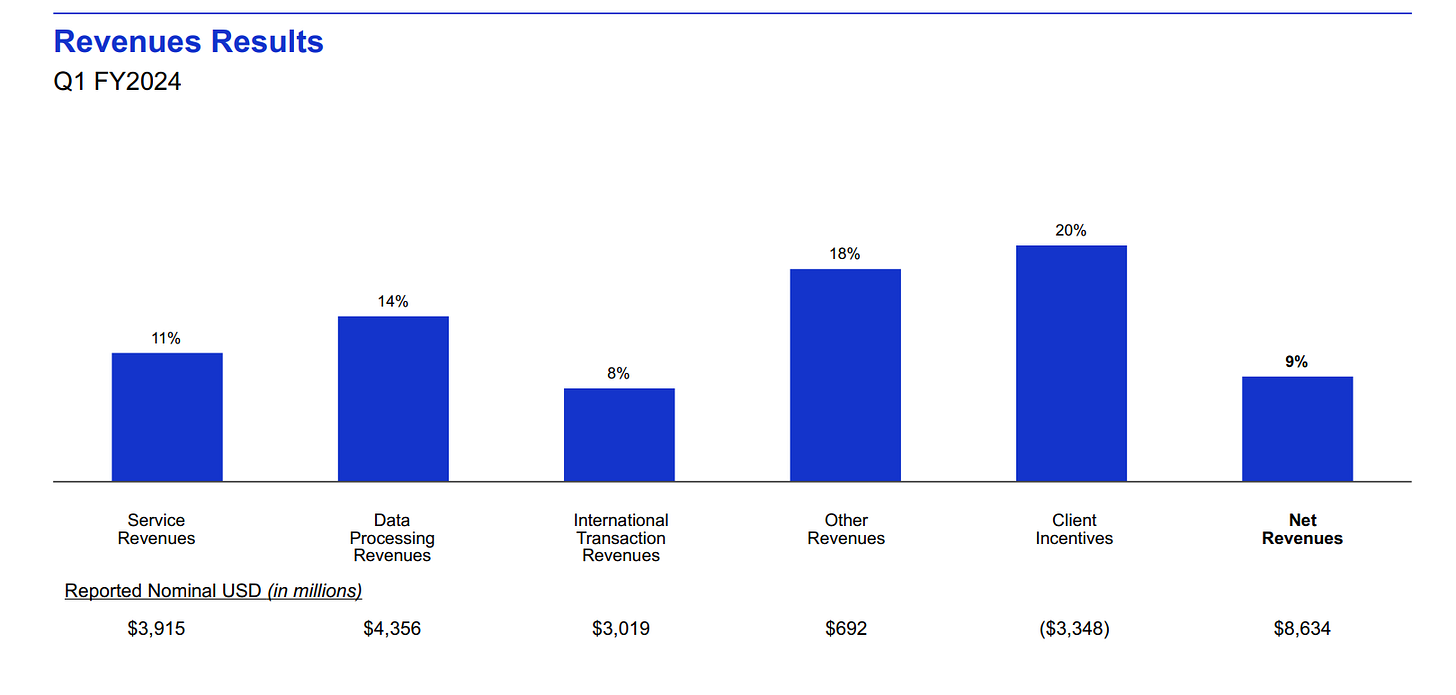

Revenue and costs breakdown

The 3 main revenue sources are:

Service. It consists of revenue from services provided to support client usage of Visa's payment services.

Data Processing. It includes revenue generated as a result of the company's clearing, settlement, authorization, value-added, network access, and other similar services.

Internation Transactions. It consists in cross-border transaction processing and currency conversion.

Other revenues are interesting are they are growing quickly, despite still being a small portion of the total revenue.

Interesting to note that Client Incentives ($3.3B) are used to incentive banks that route more through its network. The amount is huge and is not included in the net revenues.

Taking these client incentives as costs and not top line reduction would change the net margin from 55% (net margin / net revenues) to 39% (net margin / gross revenues). Anyway this is still very high.

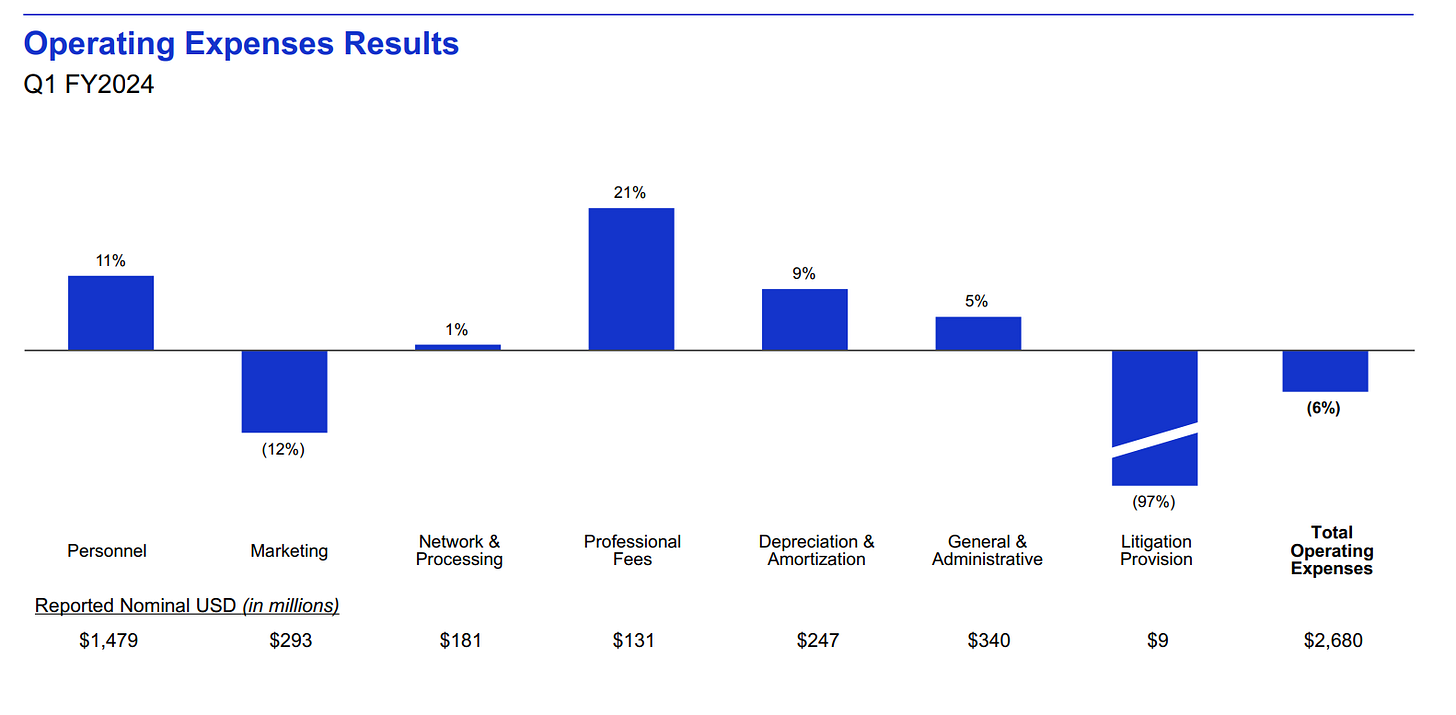

Visa’s operating expenses represent around 25% of net revenue. By the way, they are under the cost of incentives!

What does Visa do with its FCF?

As we saw, Visa is a great FCF machine. This FCF is used for dividends (around 20% of the FCF), share repurchase (40% of the FCF), the rest is used to increase their share position and therefore future acquisitions.

Over the years, Visa has made numerous acquisitions, either to strengthen its technology or to develop the services it can offer its customers. These acquisitions also allow the company to avoid or limit the disruption risk.

Last acquisitions mainly were fintech companies like Pismo.

Current net cash position of Visa is above $6B and should reach $15B within 2 years. Considering a 3x EBITDA maximum leverage, this could give Visa a financial acquisition capability above $80B! This will give a lot of strategic options.

The strength of the moat and the network effect

What constitutes the moat of Visa:

The sheer size of the infrastructure, international reach, security, and ability to process transactions much faster than anyone else are all positives

Its long history means Visa is seen as a safe and established

The ability to process thousands of transactions a second, including across borders, is unparalleled and very hard to replicate

Its advanced security features mean customers have consistency, reliability, and trust in its systems. This explains high customer satisfaction and acceptance rates

New payment processing companies face tough barriers in trying to gain a foothold in this market. High levels of security compliance and regulation standards create huge barriers. Moreover, merchants and customers are so accustomed to the duopoly (Mastercard and Visa) that breaking through with new methods is an enormous challenge. But globally, there are two forces pitted against the giants’ dominance.

However, this is not a riskless situation:

Regulation could try to break their duopoly with Mastercard or to limit processing fees

Technological disruptions could always arrive

Its main markets are mostly Western countries (US, Canda, Europe, Australia, …)

Market size by 2030

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.