Monthly Portfolio Update - October 2024 + Key Movements

Portfolio performance enhancement amid strong volatility

Hello fellow investor,

In this section, I present a transparent monthly update of my portfolio. It adheres to my investment strategy, which you can find here. Additionally, I have detailed my approach to Total Shareholder Return (TSR) in this article.

This presentation is divided into several parts:

Global view of the portfolio’s valuation and metrics

For dividend enthusiasts, a presentation of the Projected Annual Dividend Income (PADI) and a monthly calendar

Sector and geographical breakdown

For paid subscribers, there is also:

An explanation of the month's movements

A review of the month's news

A presentation of current portfolios (small-cap and large-cap)

My reinforcement price for potential stock purchases

My fair price estimation

And, of course, access to all my content, including stock deep dives, industry analyses, screeners and scoring, and real-time updates on my buy/sell movements

Please note that my portfolio is denominated in euros, making it subject to exchange rate fluctuations, particularly the euro-dollar exchange rate.

Overall performance

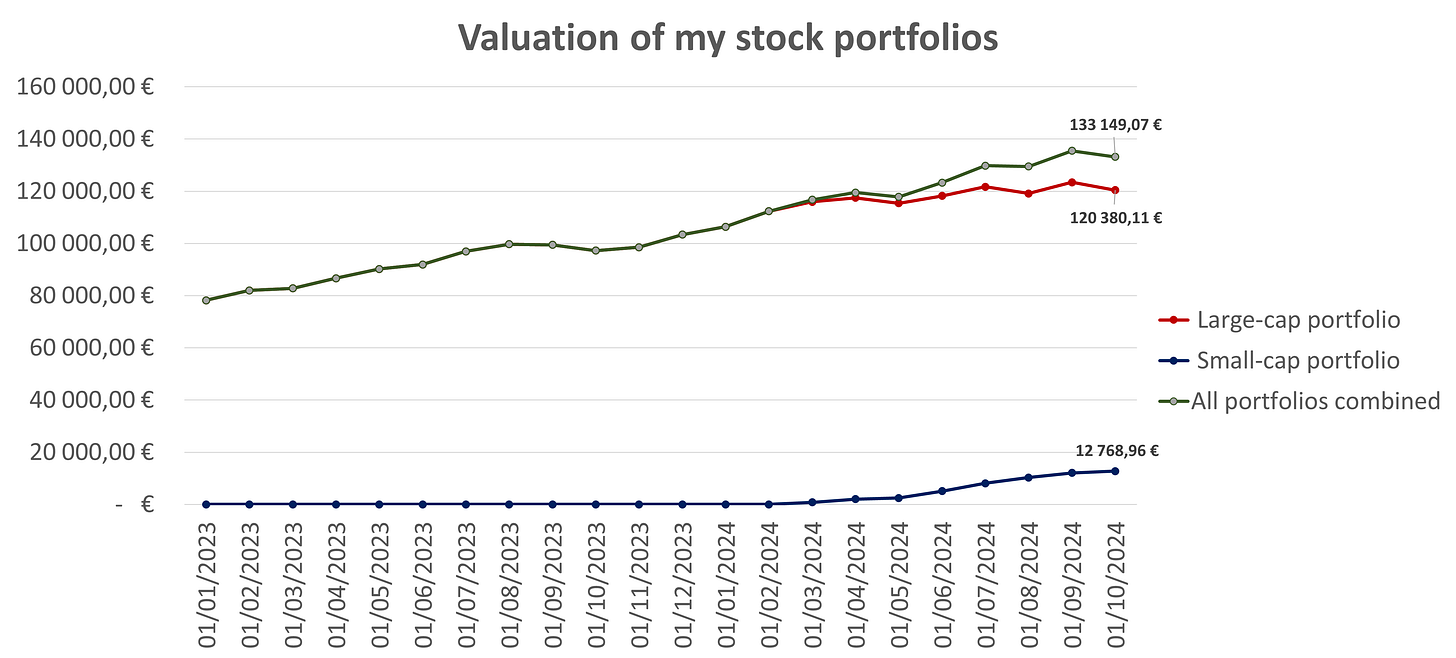

This month's performance was disappointing. The contrast between the results of my small-cap portfolio and the underperformance of my large-cap portfolio reinforces the need for further optimization, cutting the weeds and watering the flowers. In line with this strategy, I sold five stocks to free up more cash (and I have to admit, the timing was incredibly bad).

I plan to use this cash to strengthen positions in stocks with the best outlooks and potential Total Shareholder Return (TSR). Additionally, I may consider adding one or two high-growth stocks from the quality universe to the portfolio.

A new guideline to maintain a balanced portfolio is to limit holdings to 15 to 20 stocks per portfolio.

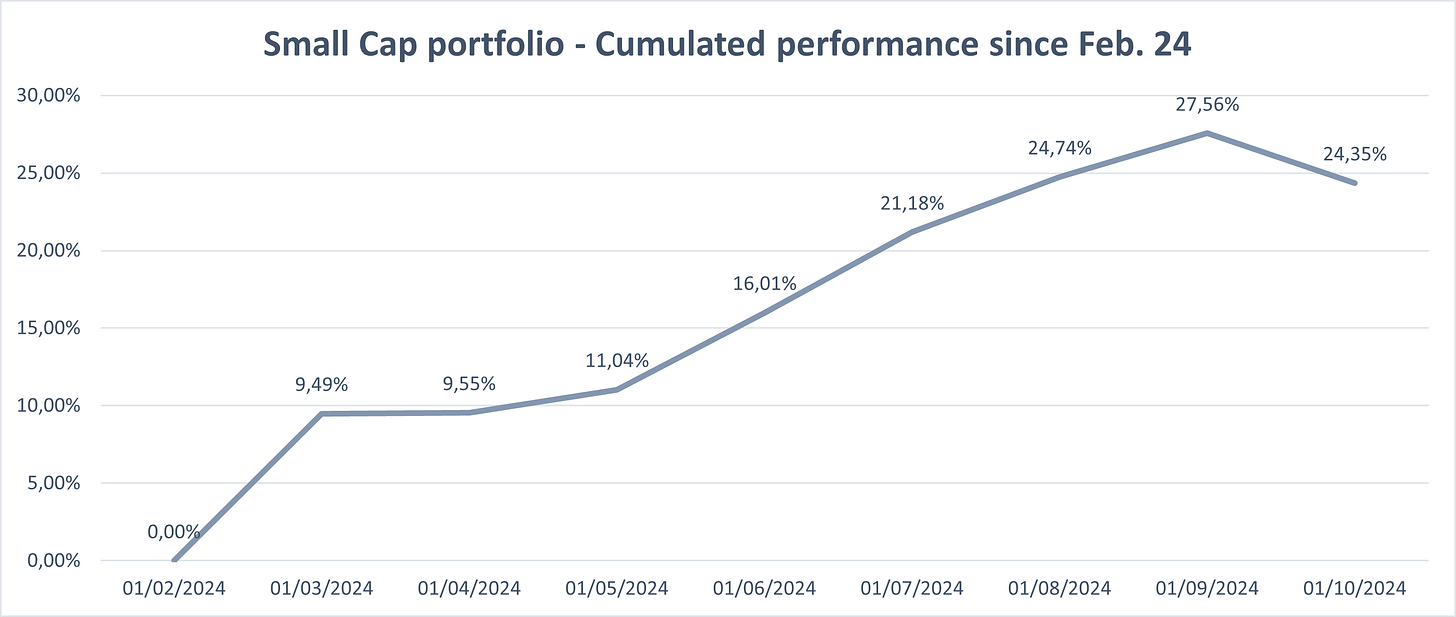

The small-cap portfolio also experienced a period of consolidation. This can largely be attributed to many of the stocks entering a consolidation phase from a technical analysis perspective after a good rally. This is a positive development, as it provides an opportunity to strengthen my key positions and reinforce my core convictions.

Valuation and metrics

This month I added 1k€ in my small-cap portfolio.

My portfolio’s key metrics significantly improved with the stocks I sold:

Past growth: 15.6% —> 17.3% / Estimated future growth: 11.2% —> 12.1%

Net profit margin: 26.4% —> 28.8%

ROE: 40.5% —> 42.6% / ROIC: 24.8% —> 26.4%

Debt leverage: -0.28x —> -0.39x EBITDA (so average net cash position)

PE: 29.2x —> 29.1x / PE Y+2: 21.4x —> 21.0x

FCF yield: 4.08—> 4.06% / FCF yield Y+2: 5.64% —> 5.75%

Dividend yield: 1.33% —> 1.29%

Dividend growth: 9.9% —> 9.9%

Buybacks: 0.72% —> 0.77%

Expected TSR: 12.6% —> 13.1%

Focusing solely on my small-cap portfolio, here are the key metrics (weighted average):

Past growth: 23.2% / Estimated future growth: 16.7%

Net profit margin: 22.7%

ROE: 39.6% / ROIC: 30.1%

Debt leverage: -0.7x EBITDA (so average net cash position)

PE: 23.1x / PE Y+2: 16.5x

FCF yield: 5.4% / FCF yield Y+2: 8.8%

Dividend yield: 2.2%

Dividend growth: 11.8%

Dilution: -0.1%

Expected TSR: 17.4%

PADI saw a significant decline following the sale of the stocks I previously mentioned.

Published articles in July

Stock deep dives

Industry analysis

Screeners

One Pagers

Stock Duels

Stock market news and culture

Stock picking

And now it is time to discover the 2 portfolios (stocks and news).

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.