The Rise of the Silver Economy

A new Gold Rush, capitalizing on the aging population

The silver economy is a term used to describe the economic activities and opportunities associated with an aging population. It has emerged as one of the most significant socio-economic trends of the 21st century. As life expectancy increases and birth rates decline in many developed countries, the proportion of older adults in the global population is rising rapidly. This demographic shift is not just a challenge; it presents a lot of opportunities for investors and companies.

The implications of this shift are far-reaching, touching nearly every sector of the economy. From healthcare and technology to financial services and real estate, the silver economy is driving innovation and creating new markets.

This article aims to visit the world of the silver economy, exploring its stakes, metrics, magnitude, and the potential markets it encompasses. We will examine various end markets that are poised for growth and transformation, highlight potential stocks that investors might consider, and discuss the risks and challenges inherent in this evolving economic landscape.

Demographic trends

The silver economy is fundamentally driven by demographic changes that are reshaping the global population landscape, and more specifically the Western population. According to the United Nations, the global population aged 60 years or over numbered 962 million in 2017, more than twice as large as in 1980 when there were 382 million worldwide. This number is projected to double again by 2050, reaching nearly 2.1 billion. This represents a 2.6% CAGR.

In more developed regions, the population aged 60 or above is growing faster than the population in all younger age groups. By 2050, it is estimated that one in four persons living in Europe and Northern America could be aged 65 or over. This trend is not limited to developed countries: many developing nations are also experiencing rapid population aging.

Several factors contribute to this demographic trend:

Declining fertility rates. Many countries, particularly in the developed world, have seen birth rates fall below replacement level (2.1 children per woman).

Increasing life expectancy. Advancements in healthcare, nutrition, and living conditions have significantly extended average lifespans.

The aging of the baby boomer generation. In many Western countries, the large cohort born between 1946 and 1964 is now entering retirement age.

Improvements in early and mid-life survival. Reduced mortality has allowed more people to reach old age.

These demographic shifts are not uniform across the globe. While Japan, Italy, and Germany are among the countries with the highest proportions of older adults, many African nations still have predominantly young populations. However, the trend towards an aging population is global, with implications for economies worldwide.

Economic impact

The economic stakes of this demographic shift are immense. The silver economy is not just about healthcare and retirement homes; it encompasses a wide range of sectors, from financial services and technology to tourism and real estate.

According to different studies, the silver economy in the EU alone could reach €5 to €6 trillion by 2025. This figure includes both direct spending by older consumers and the ripple effects throughout the economy.

This represents a significant portion of the GDP and highlights the economic weight of this demographic.

The economic impact of the silver economy can be broken down into several key areas:

Consumer spending. Older adults, particularly in developed countries, often have significant disposable income and wealth accumulated over their lifetimes. Their spending patterns can drive demand in sectors ranging from healthcare and leisure to luxury goods and personalized services.

Healthcare expenditure. As people age, their healthcare needs typically increase. This drives growth not only in traditional healthcare services but also in preventive care, wellness products, and innovative medical technologies.

Labor market changes. The reduction in available manpower leads to productivity needs. This will increase the need of automation.

Public policy and government spending. Aging populations often necessitate changes in public policy, particularly around healthcare, pensions, and social services. This can significantly impact government budgets or even slowdown potential growth.

The economic impact of the silver economy is not just about the direct spending of older adults. It is about how this demographic shift is reshaping entire industries and creating new ones.

Different markets in the Silver Economy

The silver economy includes a wide range of sectors. Understanding these markets is crucial for investors seeking to capitalize on the opportunities presented by an aging population. Here are some end markets linked with this investment theme:

Healthcare and Pharmaceuticals. A significant portion of this market’s growth is driven by the aging population. Some subsegments:

Digital Health and Telemedicine. Telemedicine, in particular, has seen rapid adoption among older adults, especially in the wake of the COVID-19 pandemic

Medical Devices and Assistive Technologies. Medical Devices and Assistive Technologies

Financial Services and Insurance. Wealth and insurance management needs will increase with the number of older adults

Travel and Leisure. Increasing disposable income and free time among retirees will develop these industries

Real Estate and Senior Living. Increasing number of older adults requiring specialized housing. A subsegment:

Smart Home Technologies. Technologies that enhance safety, comfort, and independence for older adults are a significant driver of this growth.

Anti-Aging Products and Services. Cosmetics, cosmetic procedures, preventive health and wellness.

Education and Skills Development. This sector is growing as more older adults seek continuing education and skills development

Automation to increase productivity. It iss crucial to boost productivity not only for older adults but for all employees. This increase in productivity will help compensate for the demographic shift

Robotics and AI for Eldercare are being developed to assist with everything from medication management to companionship for older adults

These markets represent significant opportunities within the silver economy. However, it is important to note that these markets are not isolated; they often overlap and influence each other.

5 stocks poised to benefit from an aging population

There are numerous companies poised to benefit from an aging population. I will highlight five of them to showcase the diversity of business models and sectors involved.

Please note: You can find all the data I am using through the following link to marketscreener.com. I use this website daily, and I am confident it can be helpful to you as well. (This is an affiliate link)

These stocks are interesting and largely belong to the quality category. However, to achieve strong returns, it's crucial to consider the appropriate entry points.

1. Sonova

Sonova is a Swiss company specializing in hearing care solutions. As hearing loss is more common in older adults, Sonova is well-positioned to benefit from an aging population's increased demand for hearing aids and cochlear implants.

2015 - 2024 revenue CAGR: 6.6%

2024 - 2027 revenue CAGR: 7.6%

PE 2024: 25.2x

Net profit margin: 16.0%

ROE / ROIC: 25.7% / 15.0%

Dividend: 1.7%

Net debt: 1,319CHF (1.3x EBITDA)

10y average buybacks: 1.2%/year

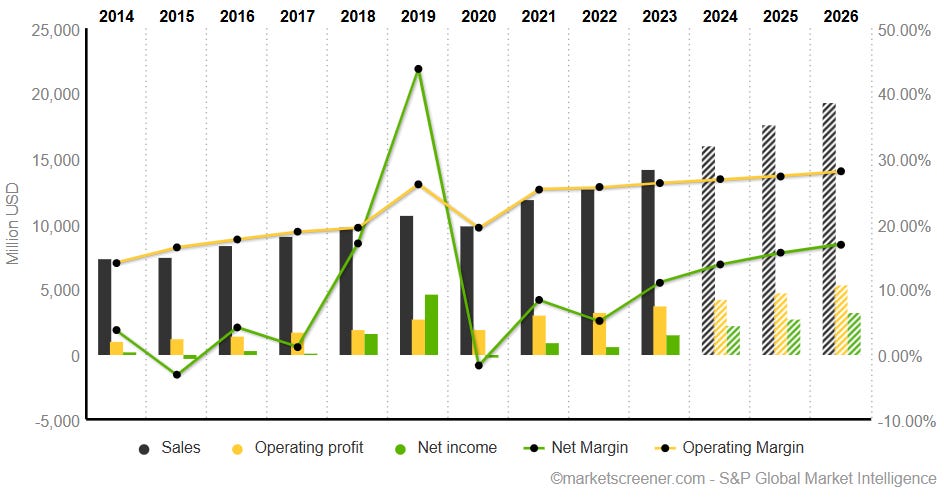

2. Royal Caribbean

Royal Caribbean is a cruise line operator. Cruise vacations are popular among retirees. An increasing older population with disposable income could drive demand for their services.

2014 - 2023 revenue CAGR: 6.2%

2023 - 2026 revenue CAGR: 11.6%

PE 2024: 15.7x

Net profit margin: 18.1%

ROE / ROIC: 52.6% / 11.6%

Dividend: -

Net debt: $19.6B (3.4x EBITDA)

10y average dilution: -1.6%/year

3. Unitedhealth

The largest health insurance providers in the US. As healthcare needs typically increase with age, UnitedHealth stands to benefit from increased demand for health insurance and medical services among older populations.

2014 - 2023 revenue CAGR: 12.3%

2023 - 2026 revenue CAGR: 7.6%

PE 2024: 20.1x (normalized)

Net profit margin: 6.1%

ROE / ROIC: 18.3% / 11.4%

Dividend: 1.4%

Net debt: $40.8B (1.0x EBITDA)

10y average buybacks: 0.4%/year

4. Boston Scientific

A medical device manufacturer producing a wide range of products, many of which are used to treat age-related conditions such as heart disease and chronic pain. An aging population is likely to increase demand for their products.

2014 - 2023 revenue CAGR: 7.6%

2023 - 2026 revenue CAGR: 10.7%

PE 2024: 53.2x

Net profit margin: 13.8%

ROE / ROIC: 9.3% / 6.8%

Dividend: -

Net debt: $6.5B (1.4x EBITDA)

10y average dilution: -1.0%/year

5. Welltower

A REIT focusing on healthcare infrastructure, including senior housing and assisted living facilities. As the population ages, demand for these types of properties is expected to grow.

2014 - 2023 revenue CAGR: 7.9%

2023 - 2026 revenue CAGR: 10.9%

PE 2024: 83.7x

Net profit margin: 9.8%

ROE / ROIC: 1.8% / 2.7%

Dividend: 2.3%

Net debt: $14.0B (4.8x EBITDA)

10y average dilution: -5.8%/year (REIT)

ETFs to invest in the Silver Economy

Investing in the silver economy can also be done through ETFs. These ETFs typically allocate mostly around healthcare stocks, then financials and consumer discretionary sectors, and the remaining to other areas, including real estate.

Here are 3 examples

iShares Ageing Population $AGED

1y performance: 8.1%

3y performance: 3.6%

5y performance: 24.3%

VanEck Bionic Engineering $CYBO

1y performance: -2.1%

Global X Longevity Thematic $AGNG

1y performance: 11.9%

3y performance: 2.2%

Conclusion

The silver economy represents a significant and growing segment of the global economy, driven by the demographic shift towards an older population. This trend offers numerous opportunities for investors and companies across various sectors, including healthcare, financial services, real estate, and technology. As the aging population continues to expand, so too will the demand for products and services tailored to meet their unique needs.

Investors looking to capitalize on the silver economy should consider the diverse markets and sectors it encompasses, from healthcare innovations and senior living solutions to leisure and financial services. The stocks and ETFs mentioned in this article are examples of potential investment opportunities that align with this theme.

However, investing in the silver economy also comes with its challenges, such as navigating the complexities of evolving consumer preferences, economic cycles and regulatory changes. The growth of this theme is also relatively slow as the number of older adults is expected to grow at a 2.6% rate.

This is a really interesting topic!

In Italy, we're already seeing the silver economy in action, much like in other countries with aging populations, limited birth incentives and significant economic inequality between generations. Older generation often holds more financial stability, while younger face greater challenges. It feels like governments play a key role in managing these dynamics. Do you think the U.S. government should be more involved in preparing for this shift, perhaps by studying policies from countries like Italy?

Thanks!