8 Profitable Companies Poised to Triple Their Revenue by 2030

Growth is the main driver for stock long-term performance

As illustrated by this chart from BCG Analysis and Morgan Stanley Research, while many factors can influence performance, growth remains the primary driver of long-term returns.

Profitable companies have the advantage of having already proven their business models. In this article, we will highlight profitable companies that are positioned to potentially triple their revenue by 2030, based on 2023 figures.

If you are aware of other fast-growing stocks with strong business models and sustainable growth prospects, please share them in the comments!

Please note that many of the stocks mentioned in this article are trading at high valuations. Therefore, it may be wise to optimize entry points, consider adding to positions strategically, or wait for significant market corrections before investing.

1. ServiceNow

ServiceNow is a cloud-based platform that automates enterprise workflows to improve business operations and IT service management. If you are interested in the company, you can find my deep dive here.

Country: USA

Market cap: $170B

2023 revenue: $10,916M

2024 growth: 21.7% / 2025 growth: 20.6%

Net profit margin: 12.4%

PE: 130x / FCF yield: 2.06%

ROIC: 17.6%

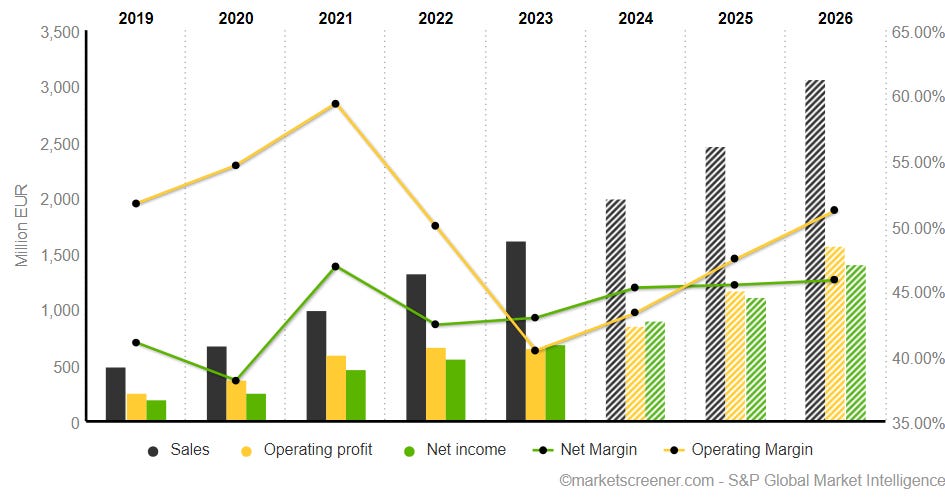

2. Adyen

A global payment platform providing seamless transactions across online, mobile, and in-store channels.

Country: Netherlands

Market cap: €39B

2023 revenue: €1,626M

2024 growth: 22.4% / 2025 growth: 23.8%

Net profit margin: 45.3%

PE: 43.9x / FCF yield: 2.73%

ROIC: 17.3%

You can find all the data I am using through the following link to marketscreener.com. I use this website daily, and I am confident it can be helpful to you as well. (Please note that this is an affiliate link)

3. On Holding

A global payment platform providing seamless transactions across online, mobile, and in-store channels.

Country: Switzerland

Market cap: 11.9B CHF

2023 revenue: 2,281M CHF

2024 growth: 27.3% / 2025 growth: 26.6%

Net profit margin: 9.6%

PE: 54.4x / FCF yield: 2.03%

ROIC: 10.9%

4. MercadoLibre

MercadoLibre is Latin America’s largest e-commerce and fintech company, offering online marketplaces and payment systems.

Country: Argentina

Market cap: $100B

2023 revenue: $20,480M

2024 growth: 41.5% / 2025 growth: 20.4%

Net profit margin: 9.0%

PE: 54.6x / FCF yield: 2.08%

ROIC: 13.5%

5. WiseTech

A software company specializing in logistics solutions, particularly its flagship platform, CargoWise, for supply chain management

Country: Australia

Market cap: AU$40B

2023 revenue: AU$1,334M

2024 growth: 28.0% / 2025 growth: 25.7%

Net profit margin: 29.8%

PE: 104x / FCF yield: 0.68%

ROIC: 12.2%

6. Nu Holdings

The parent company of Nubank, a leading digital bank in Latin America offering financial services with a focus on customer-centric technology.

Country: Brazil

Market cap: $65B

2023 revenue: $11,379M

2024 growth: 41.7% / 2025 growth: 28.4%

Net profit margin: 16.8%

PE: 34.5x / FCF yield: -%

ROIC: -%

7. AppLovin

AppLovin is a mobile technology company that provides app developers with software solutions for user acquisition, monetization, and analytics.

Country: USA

Market cap: $37B

2023 revenue: $3,283M

2024 growth: 35.1% / 2025 growth: 13.6%

Net profit margin: 26.5%

PE: 33.1x / FCF yield: 4.56%

ROIC: 24.2%

8. TransMedics

TransMedics is a medical technology company specializing in organ transplant systems that preserve and monitor donor organs outside the human body for transplantation.

Country: USA

Market cap: $5B

2023 revenue: $242M

2024 growth: 83.8% / 2025 growth: 30.8%

Net profit margin: 10.7%

PE: 112x / FCF yield: -1.08% (strong CAPEX to keep up with growth)

ROIC: 0.22%

Conclusion

Of course, there are a lot of other companies that could be on this list (BoneSupport, Qt Group, Pro Medicus, Kinsale, etc) and even more if we do not use the profitability criterion. As explained, growth alone is important but assessing the sustainability of the growth and the business model and trying to optimize the entry point as most of these stocks are expensive is very important: patience is a key virtue of the investor.

Can you include if these companies are paying a dividend and what the growth rate of the dividend is? Thank you