Monthly Portfolio Update - January 2025

This year was strong, and our portfolio is prepared for next year!

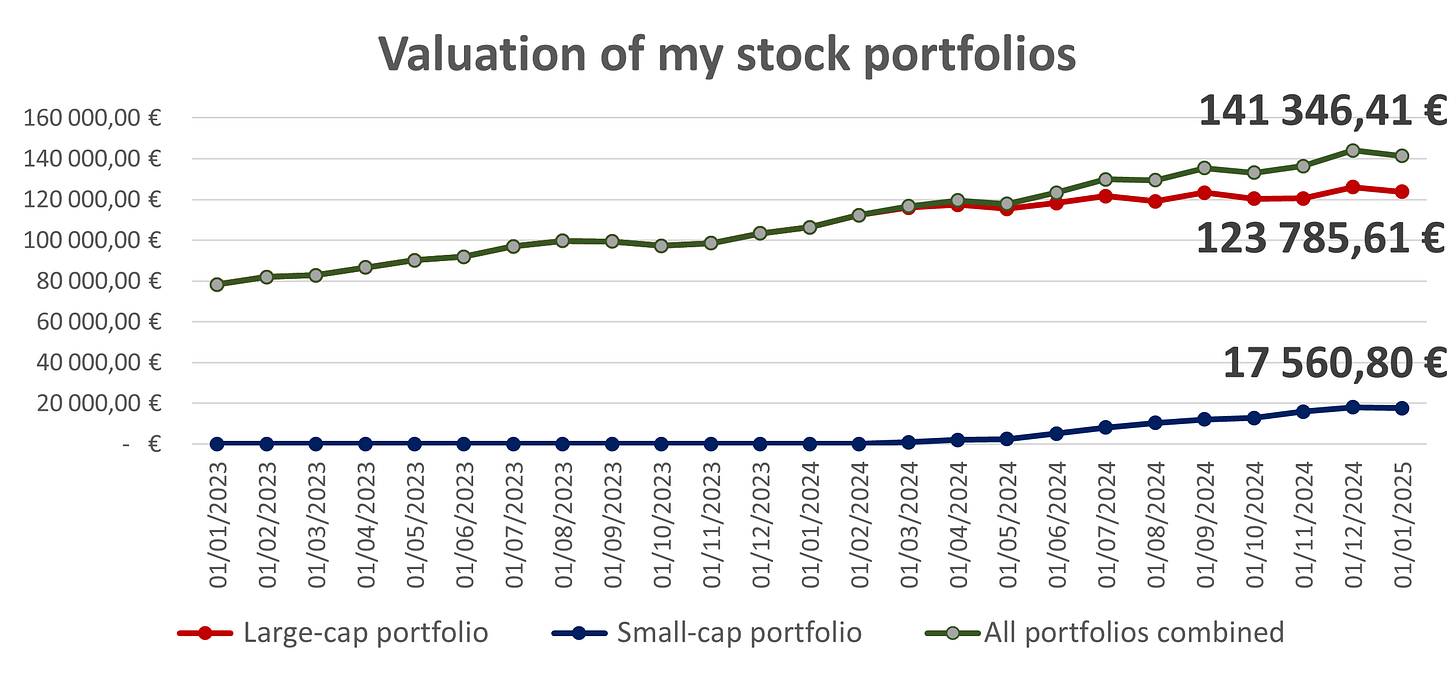

The year has ended and it is time for my last portfolio reporting of the year. This year has been an excellent year in the stock market. My performance is decent - remember I have a diversified approach to limit risks as I cannot predict market conditions. My small-cap portfolio returned more than 2.5x as much as my large-cap portfolio even if it was only begun at the end of February.

If you are curious or missed out, you can find my method here and how to react in case anything bad happens here.

In this section, I present a transparent monthly update of my portfolio. It adheres to my investment strategy. This presentation is divided into several parts:

Global view of the portfolio’s valuation and metrics

For dividend enthusiasts, a presentation of the Projected Annual Dividend Income (PADI) and a monthly calendar

Sector and geographical breakdown

My positions, fair price, price targets and moves

While this newsletter provides valuable content for free subscribers, becoming a paid subscriber unlocks even greater benefits to help you gain an edge in the market.

Here is why upgrading to a paid subscription is worth it:

Access exclusive content. Dive deeper with detailed analyses, advanced insights, and premium research not available to free subscribers

Follow my portfolio. Gain exclusive access to my portfolio, including monthly updates, tracking my moves, and watchlists

Discover more stock ideas. Explore in-depth stock ideas, technical analyses, and strategies tailored to uncover hidden opportunities

Support this newsletter. Your subscription directly supports the creation of high-quality, valuable content to help you achieve your investment goals

Upgrade today and take your investing knowledge and performance to the next level!

Overall performance

Despite a slight drawdown in December, the year has been positive, building on an already strong 2023. This is even more notable considering some mistakes I made along the way, such as overexposure to luxury and too much focus on French markets. I experienced also a lot of unpredictable events with my stocks. However, I have addressed these issues, learned valuable lessons (which I have shared with you), and kept the impact limited. The portfolio is now stronger and ready for 2025.

Strong performance from my small-cap portfolio, up +27% (even though it only began at the end of February! I hold strong convictions in my major weightings, though some of these stocks are still developing their business models. As a result, their performance may take time, which is why I apply a specific money management strategy for them.

Since launching my small-cap portfolio earlier this year:

6 stocks have delivered returns of over 40% (excluding dividends)

1 stock have achieved returns of over 85%

1 stock experienced a takeover, delivering a return of more than 50%

I believe that focusing on value, metrics, and business models is the key to finding good opportunities with a strong risk/reward profile.

Valuation and metrics

My portfolio’s key metrics continued to evolve this month (weighted average)

Past growth: 18.2% —> 18.4% / Estimated future growth: 12.9% —> 13.1%

Estimated EPS growth: 15.8% —> 16.0%

Net profit margin: 28.5% —> 28.5%

ROE: 40.9% —> 40.6% / ROIC: 24.9% —> 24.4%

Debt leverage: -0.60x —> -0.64x EBITDA (so average net cash position)

PE: 29.3x —> 29.9x / PE Y+2: 21.1x —> 21.5x

FCF yield: 4.06% —> 3.97% / FCF yield Y+2: 6.05% —> 5.89%

Dividend yield: 1.15% —> 1.19%

Dividend growth: 8.8% —> 8.7%

Buybacks: 0.71% —> 0.69%

Expected TSR: 13.5% —> 13.5%

Key metrics remain very strong, reflecting my commitment to quality. The slight reduction is attributed to the addition of several early-stage development stocks.

Published articles in December

Stock deep dives

Industry analysis

One Pager Thursdays

Stock duel

Portfolio update

Investing knowledge

Stock market news

I also presented the new structure of the newsletter in the last article of 2024 with the goal to have a clearer structure and offer more value to all my subscribers.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.