Amazon is part of the elite Magnificent 7 and stands as one of the most compelling stocks in the market today. With projected revenues of $637 billion in 2024 and its strong growth trajectory, Amazon could be on track to become the first company to achieve $1 trillion in annual sales, a remarkable feat for a business founded just 30 years ago.

In this article, we will dive into Amazon’s diverse business model, explore its key growth drivers and opportunities, and provide an analysis of its fair market value. Finally, we will estimate the potential total shareholder return for those considering an investment in Amazon.

Company overview

Amazon reports its revenues using 7 categories:

Online stores (39% of the sales). Amazon’s largest revenue stream, covering product sales and digital content sold directly through its e-commerce platform.

Third-party seller services (24% of the sales). It includes commissions, fulfillment, and shipping fees for sellers using Amazon’s marketplace. It is a major driver of profitability and logistics.

AWS (17% of the sales). AWS, the cloud division, is the company’s primary engine of growth, offering cloud computing and services to businesses worldwide

Advertising services (9% of the sales). A high-growth segment, driven by sales of ad space to sellers, vendors, and publishers through programs like sponsored ads and video ads

Subscription services (7% of the sales). It includes annual and monthly fees associated with Amazon Prime memberships, as well as digital video, audiobook, digital music, e-book, and other non-AWS subscription services

Physical stores (3% of the sales). It includes product sales where our customers physically select items in a store

Other (1% of the sales). It includes sales related to various other offerings, such as health care services, certain licensing and distribution of video content, and shipping services, and our co-branded credit card agreements

Excluding the Other segment, Amazon's two fastest-growing categories are AWS (with a 3-year revenue CAGR of 19.4%) and Advertising (with a 3-year revenue CAGR of 23.5%).

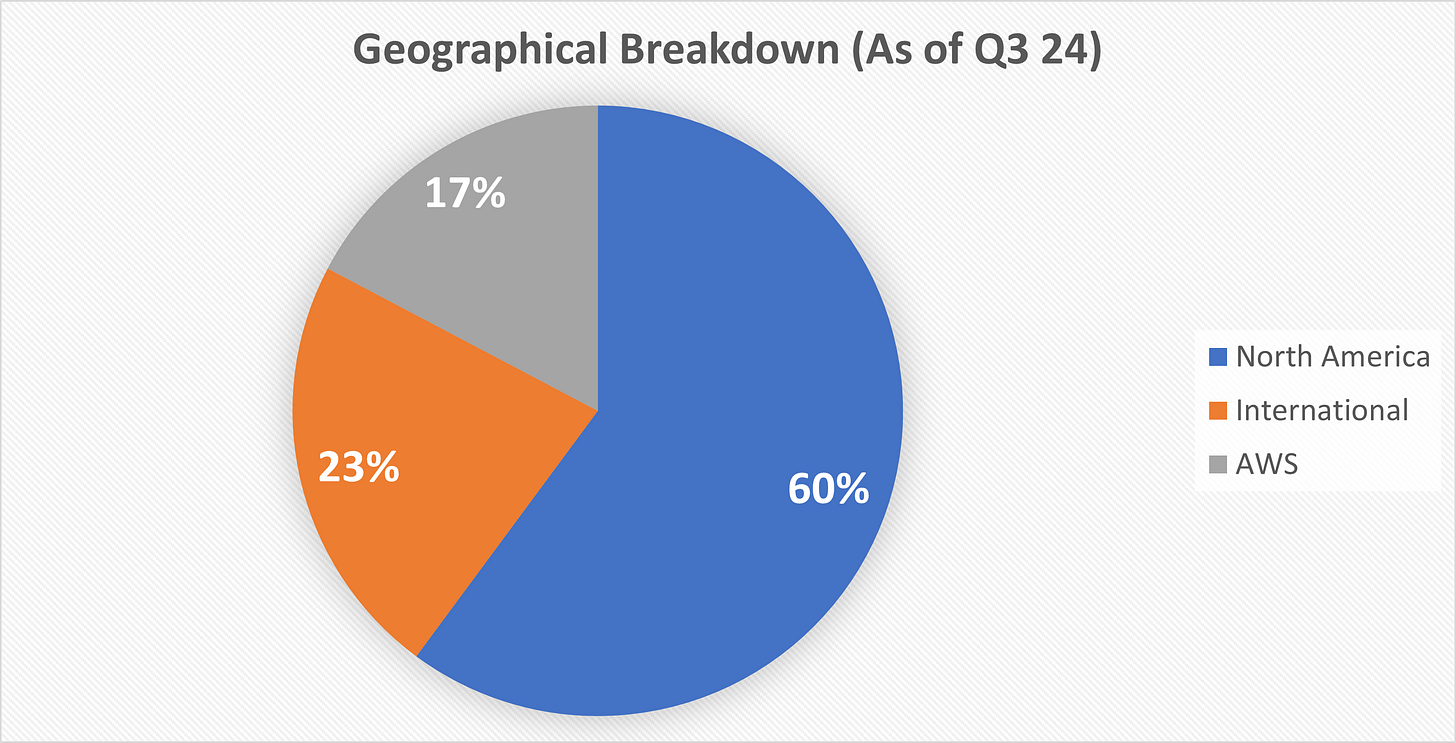

Currently, North America accounts for the majority of the company’s sales. However, with faster growth in AWS and International Markets, this balance is set to shift in the coming years.

AWS the main growth driver

AWS is the main growth driver. Though it has the biggest market share, it is currently growing slower than Alphabet and Microsoft. As the cloud market is expected to grow at a 15% in the next years, the company should maintain a strong growth for this division. AI is currently accelerating the whole market and explains why the YoY growth is accelerating.

I described the market and the competition in this article about the cloud market

Significant investments are essential for this division, as data centers are costly and demand immense computing power, a key reason behind NVIDIA's rapid growth. However, data centers are also energy-intensive, which is why the company has recently invested in nuclear energy (and especially SMR - small modular reactors) to ensure a reliable and clean power source. This article dives into the trends and strategies driving these developments.

A sign of the company’s strength: advertising services

The company’s advertising business showcases its true power, leveraging its vast platform and the rich data gathered from customers to deliver highly targeted ads. With users already in a buying mindset, the quality of this data provide a significant competitive advantage, especially as the company goes head-to-head with giants like Google and Meta.

This segment now accounts for 10% of total revenue, up from 6.5% in 2021. What’s more impressive is that Advertising services are expanding rapidly, with a 23% CAGR since 2021, a clear growth engine for the company’s future. It is even faster than the AWS CAGR around 19%.

Toward higher margins and profitability

With a period of strong growth behind them, management is now prioritizing higher margins and cash generation from the existing business. At the same time, they are maintaining robust investments to fuel future growth and expand market share.

In Q3 2024, AWS contributed $10.5B of the total $17.4B in operating income, accounting for 60% (down slightly from 62% a year earlier). As the company scales new activities, many of which are higher-margin businesses with stable revenue streams, the overall profit profile will continue to improve.

The company’s net profit margin was 5.3% in 2023. It is projected to rise to 8.5% in 2024, with further growth expected, reaching 9.3% in 2025 and 10.5% by 2026.

Key growth drivers for the company beyond Online Stores

While online stores are expanding at a solid 7% growth rate, the company has several other powerful engines of growth:

AWS. Contributing 17% of total sales, AWS is a key revenue driver, growing at a 19% annual rate

Advertising services. Accounting for 9% of sales, this high-margin segment is experiencing rapid expansion, with a 23% growth rate. It leverages the company's platform and customer data

Subscriptions. A strong growth area, subscriptions provide recurring and highly predictable revenue. Currently, they are growing at 11% per year

International expansion. The company is rapidly scaling in international markets, achieving 11% growth

Third-party seller services. This segment optimizes the company's infrastructure by increasing volume without the risk of holding inventory, boosting profitability and efficiency

Innovation and new services. The company continually launches new products and services, capitalizing on its robust distribution network and logistics infrastructure. Recent examples include Amazon Pharmacy and various AI-driven initiatives

AI at the core. AI is a major focus, driving innovations across the company:

Generative AI models like Rufus, a shopping assistant, and Amelia, an AI assistant for sellers, enhance productivity and customer experience

Advanced video generation and live imaging capabilities for advertisers

AI models like Claude 3.5 Sonnet

Before diving into stock metrics, SWOT analysis, fair valuation, and potential return calculations, subscribe now to gain full access to this section. Unlock exclusive content, including in-depth stock analyses, screening tools, industry reports, and valuable portfolio insights!

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.