The Recession-Proof Business Model Behind Waste Connections’ Success

Inside Waste Connections’ business model and how it stands out in the waste management industry

Let’s be honest, finding businesses that actually thrive during tough economic times feels like searching for unicorns. That is exactly what drew me to Waste Connections, one of North America’s largest solid waste and recycling service providers. Despite operating in what many might call a “boring business”, this company has quietly built a business model that is not just durable, it is impressively resilient.

I am especially excited about this one because it marks my second deep dive into a Canadian stock, following my earlier piece on MDA Space (here is the link). Also, if you like the waste management space, you might enjoy my previous article on Waste Management, another major player in the industry and a solid read for anyone who loves exploring the economics of trash.

In this article, we will explore what makes their business model and also compare the company to its major competitors. Let’s dig in!

Business overview

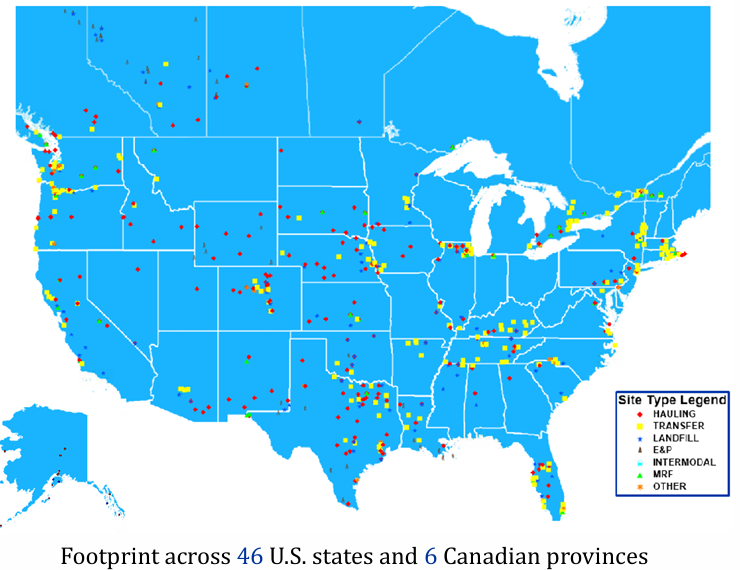

Waste Connections may be headquartered in Canada, but its business is overwhelmingly US-focused with approximately 86% of its revenue generated south of the border.

At its core, Waste Connections controls multiple stages of the waste handling process: from picking up trash to processing and disposing of it. Here is a closer look at how the business is structured:

Solid waste collection (72% of the revenue). This is the frontline of the business. Waste Connections collects trash and recyclables from residential neighborhoods, commercial properties, and industrial clients. Most of these services are backed by long-term contracts, providing predictable cash flows and customer stickiness. The company often operates in secondary and rural markets, where competition is limited and pricing power is stronger

Landfills and transfer stations (16% of the revenue). Waste Connections owns or operates a large network of landfills and transfer stations, particularly in areas with favorable regulatory and economic dynamics. This ownership of disposal infrastructure is a critical advantage, it lowers costs, creates entry barriers for rivals, and locks in a higher margin per ton of waste processed

Recycling services (3% of the revenue). While not the biggest driver of profits, Waste Connections offers recycling services to meet municipal and customer sustainability needs. This segment includes processing materials like paper, cardboard, plastics, and metals. Revenue can be volatile due to changing commodity prices but the trend is clearly positive

Others (9% of the sales). Other notable services include handling waste from oil and gas operations (E&P waste), and developing renewable natural gas (RNG) facilities that capture and convert landfill gas into clean energy

Growth drivers

Waste Connections’ EPS growth is powered by a combination of strategic focus, operational discipline, and structural industry advantages. At its core, the company benefits from operating in a highly defensive and non-discretionary sector: people and businesses generate waste in every economic environment. The decentralized operating model empowers local teams to make decisions tailored to their communities, leading to better customer service and operational efficiency (and it also limits the size of the structure).

Route density optimization, inflation-linked pricing contracts, and long-term demographic trends like population growth also are key organic growth drivers. Additionally, Waste Connections is investing in renewable natural gas (RNG) projects and landfill gas recovery, tapping into sustainability trends and adding new sources of revenue aligned with ESG goals. Automation will accelerate in the coming years: this will positively impact margins but will be very CAPEX intensive.

To complement this steady organic growth, Waste Connections has built a robust acquisition engine that adds scale, density, and strategic assets. The company consistently completes dozens of tuck-in deals each year (small, local haulers or disposal providers that can be integrated into existing operations with minimal disruption).

This combination of strong internal growth and smart external expansion has helped Waste Connections steadily grow revenue, margins, and free cash flow year after year: a strong focus from management.

Benchmark vs competitors

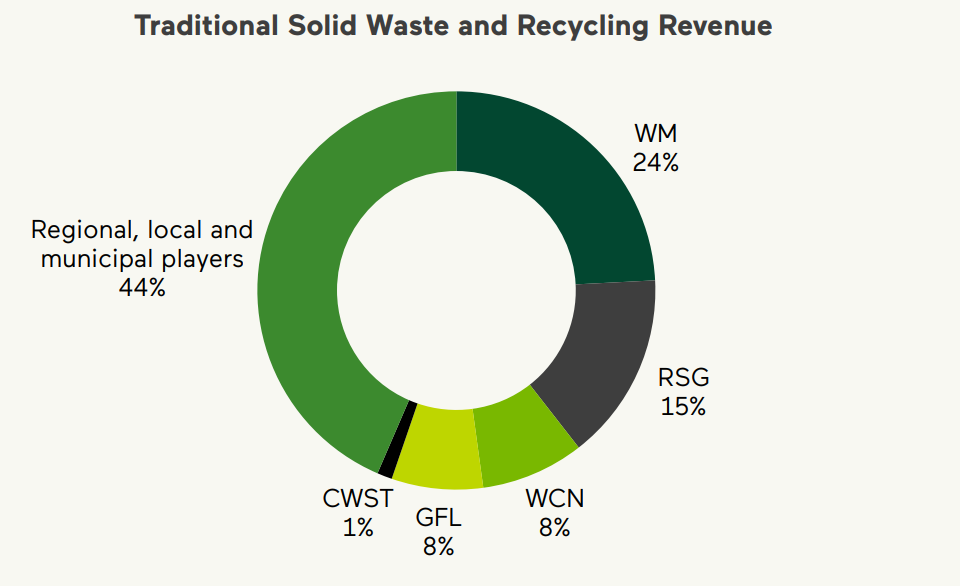

As highlighted in the Waste Management article, here is a look at the market share landscape for the waste services industry in North America.

Waste Connections ranks as the 3rd-largest player in the industry. Here is how it stacks up against its 2 main competitors.

Waste Connections stands out with the strongest growth profile among its peers, delivering impressive performance in both revenue and EPS expansion. Its balance sheet is also healthier than Waste Management’s (WM has taken on additional leverage to acquire Stericycle).

That said, a PE around 41x does raise valuation concerns. Even considering the company’s recession-resistant nature and consistent execution, the current multiple suggests a premium that investors need to weigh carefully.

In the following sections, you will find detailed insights into key metrics, fair price estimation, a comprehensive SWOT analysis (strengths, weaknesses, opportunities, and risks), and precise buy zone identification. Subscribe now to unlock full access to this newsletter, including exclusive analyses, portfolio tracking, screeners and curated stock picks

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.