Here is the 14th edition of Stock of the Week. You can find all the previous analyses and my articles on my main page (for an easier search, use a computer, mobile version is harder to navigate).

Here are the links to the 3 previous “Stocks of the Week” as well

This week, we are focusing on Unitedhealth. On Thursday April 17th, the stock declined by over 20%. Let's examine the current situation and explore why UnitedHealth may now present a compelling investment opportunity (and the risks!).

While free subscribers already benefit from a wealth of valuable content, upgrading to a paid subscription unlocks exclusive research, in-depth insights, real-time portfolio tracking, advanced stock screeners, and more giving you an edge to stay ahead of the market. Don’t miss out: subscribe now and supercharge your investing journey!

One Pager

The stock at a glance!

Recent news

Cyberattack. February 2024, UnitedHealth was hit by a ransomware, impacting 190 million people, largest US healthcare breach. It disrupted claims processing, causing financial strain for providers and cost billions to the company

Murder of Unitedhealthcare CEO. At the end of 2024, Brian Thompson (Unitedhealthcare CEO), was killed in Manhattan

This murder sparked public outrage over insurance practices (claim denials, profit, etc)

DOJ Investigation. US Justice Department launched a civil fraud probe into UnitedHealth’s Medicare Advantage billing practices, focusing on recording diagnoses to trigger extra federal payments

Pressured profitability. Rising medical cost (particularly in Medicare Advantage) are pressuring profitability

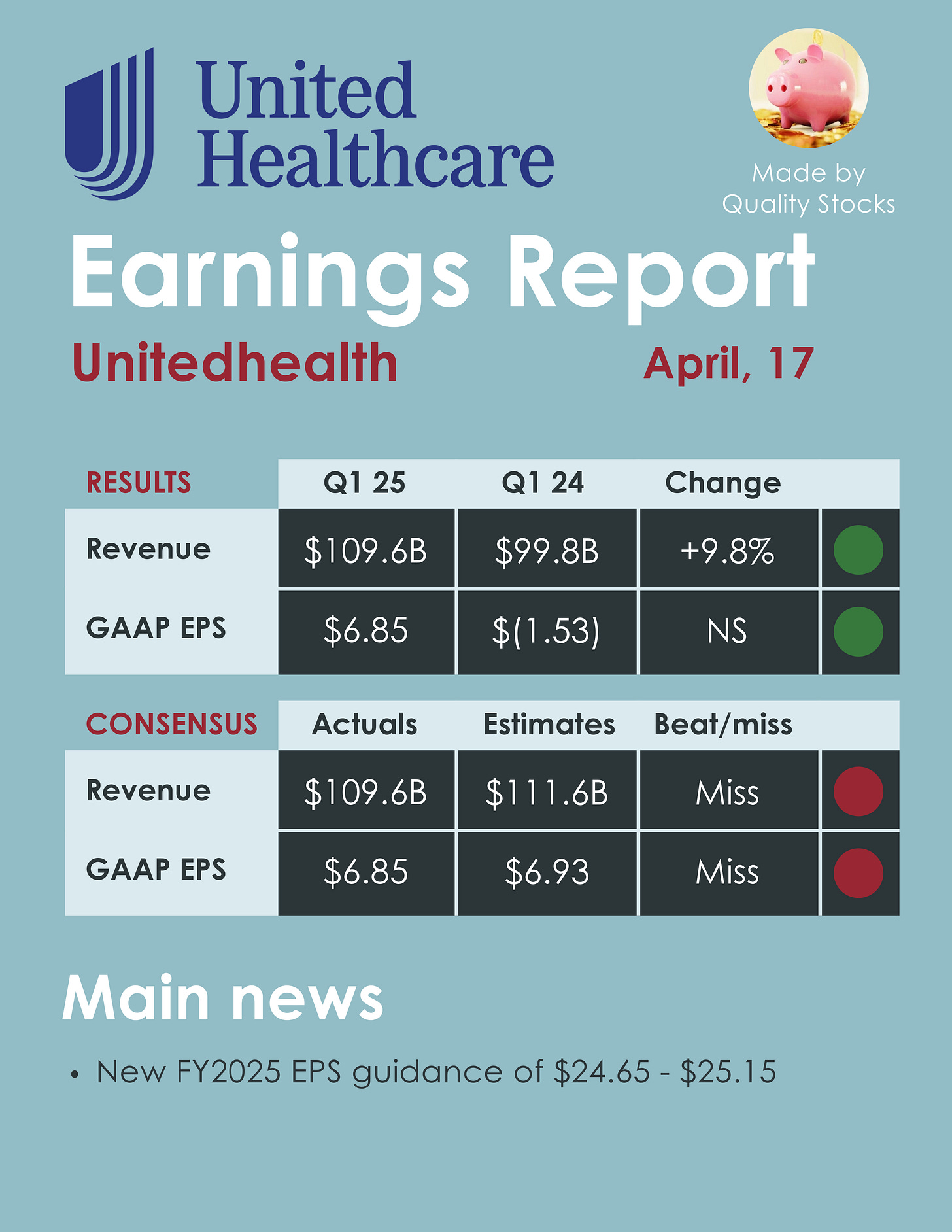

Last earnings

The strong market reaction was due to the slight miss on revenue and EPS but more importantly on the revised full year 2025 EPS guidance (10% under the consensus). 2 main reasons have been presented by management:

“Heightened care activity indications within UnitedHealthcare’s Medicare Advantage businesses, which became visible as the quarter closed, far above the planned 2025 increase which was consistent with the elevated levels in 2024. This activity was most notable within physician and outpatient services.

Unanticipated changes in the profile of Optum Health members impacting planned 2025 reimbursement due to unexpectedly minimal 2024 beneficiary engagement by plans exiting markets. In addition, a greater-than-expected impact to current and new complex patients from the ongoing Medicare funding reductions enacted by the previous administration.”

Analysts’ recommendations

April, 17. Piper Sandler. Buy. $600 —> $592

April, 17. Barclays. Buy. $642 —> $560

I didn’t present previous recommendations as analysts will probably soon change their TP to integrate the new guidance.

My analysis

The company is currently navigating significant pressure from multiple fronts: operational intensity, media scrutiny, heightened competition, regulatory headwinds, and ongoing investigations

While the sector is not among my preferred areas due to its relatively opaque cost structure, the stock does present an appealing combination of defensiveness and growth. Despite the challenging environment, it continues to grow at a solid 10% annually

Notably, management has recently reaffirmed their long-term EPS growth guidance of 13% to 15%, reflecting confidence in the business fundamentals. Although margins are under some pressure, they remain the highest among peers and are clearly a strategic priority for the leadership team

With a current PE of around 17x, the stock may represent an attractive long-term entry point for investors seeking a more dynamic defensive play. That said, the associated risks (particularly regulatory and structural) should not be overlooked, and a cautious approach is warranted

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for Unitedhealth.

Buying zone 1. $440 (close to the current price level)

Buying zone 2. $360

Buying zone 3. $280

What do you think of the current Unitedhealth’s situation ? Share your thoughts in the comments

Used source: Marketscreener.com. Affiliate link just here

UNH is a great investment!

Always invest in crooks.