Stock of the Week: On Holding Is Running Strong

Strong growth and market share gains

Here is the 17th edition of “Stock of the Week”. You can find all the previous analyses and my articles on my main page (for an easier search, use a computer, mobile version is harder to navigate).

Here are the links to the 2 previous “Stocks of the Week” as well

This week, we are focusing on On Holding. The company is capturing market share and just delivered standout earnings. Let’s take a closer look.

What are your thoughts on Transmedics? Share them in the comments!

While free subscribers already benefit from a wealth of valuable content, upgrading to a paid subscription unlocks exclusive research, in-depth insights, real-time portfolio tracking, advanced stock screeners, and more giving you an edge to stay ahead of the market. Don’t miss out: subscribe now and supercharge your investing journey!

One Pager

The stock at a glance!

Recent news

On Holding has transitioned to a single-CEO structure, with Co-CEO and CFO Martin Hoffmann stepping in as the sole Chief Executive Officer. The change was announced on April 1st

Over the past several years, the company has steadily expanded its market share. With annual growth exceeding 20%, On continues to outperform its underlying market by a wide margin

For a deeper look into the company’s strategy, strengths, and growth trajectory, you can find my full deep dive right here.

Last earnings report

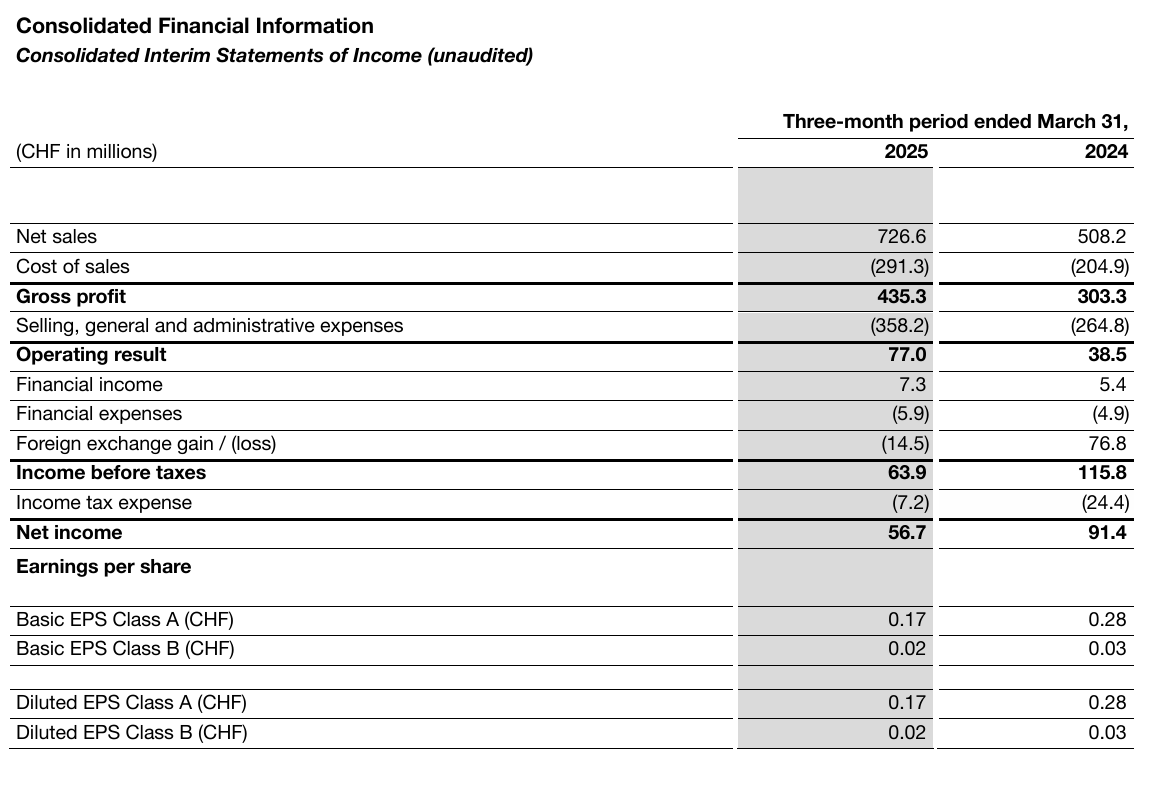

The company reported impressive 43% YoY revenue growth, reaching $727M, well ahead of analysts’ expectations of approximately $680M. Direct-to-Consumer (DTC) sales grew 45%, slightly outpacing the wholesale channel’s 41% growth.

This favorable channel mix contributed to a stronger gross margin, which has now reached 60%. Management also raised FY guidance, now projecting 28% YoY revenue growth.

My analysis

On Holding stands out as the footwear brand with the strongest momentum in the market today. In contrast to legacy players like Nike, we are witnessing a clear shift toward more dynamic, premium-positioned brands that are rapidly capturing market share

However, this exceptional growth and market share expansion come at a cost: a PE above 60x. At this valuation, there is little to no margin of safety

For cautious investors, waiting for a pullback may be the prudent move, especially considering the stock has nearly doubled since its April low

The key metric to monitor going forward is market share. If On's share gains begin to slow or reverse, the investment thesis could weaken significantly, potentially prompting investors to reassess their positions

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for On Holding.

Buying zone 1. $47

Buying zone 2. $35

Buying zone 3. $24

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Used source: Marketscreener.com. Affiliate link just here

They look very cool!

What a timing, i bought one additional ON stock yesterday :)