Stock of the Week: LVMH – Is a Luxury Rebound on the Horizon?

Valuation near multi-year lows: bargain or value trap?

Here is the 24th edition of “Stock of the Week”. You can find all the previous analyses and my articles on my main page (for an easier search, use a computer, mobile version is harder to navigate).

Here are the links to the 3 previous “Stocks of the Week” as well

As discussed in a previous article, luxury stocks appeared to be approaching peak pessimism; setting the stage for a potential rebound. Since then, the sector has shown encouraging signs of recovery. So, is now the right time to reenter? And what risks still loom on the horizon? Let’s explore the answers in this article.

While free subscribers already benefit from a wealth of valuable content, upgrading to a paid subscription unlocks exclusive research, in-depth insights, real-time portfolio tracking, advanced stock screeners, and more giving you an edge to stay ahead of the market. Don’t miss out: subscribe now and supercharge your investing journey!

One Pager

The stock at a glance

Recent news

Hospitality expansion. Hospitality is an important diversification for LVMH. For example, the company projected to open Bulgari Hotels & Resorts in Abu Dhabi

Tariffs. LVMH is exploring relocating some production to the US due to potential tariff impacts, as the U.S. accounts for more than a quarter of its sales

Brand initiatives. Despite a slowing environment, LVMH never stopped marketing and expansion initiatives showing long-term vision. LVMH’s brands unveiled new projects, including Moynat’s boutique opening in Paris with exclusive tote bags, Bulgari’s “Polychroma” jewelry collection, and Louis Vuitton’s ship-shaped store in Shanghai

Acquisitions. The company continues to expand its portfolio through strategic acquisitions in media and real estate

Tensions with China. LVMH’s cognac brands, including Hennessy, were recently exempted from China’s up to 34.9% tariffs on EU brandy, provided they adhere to minimum pricing

Last earnings report

LVMH delivered a mixed Q1 2025 report. While overall growth turned negative, the most pronounced weakness came from the Wines & Spirits division, which faced significant headwinds. Despite challenging market conditions, several other segments demonstrated resilience. However, Fashion & Leather Goods (a key division accounting for nearly 50% of total sales) contracted by 4% organically, placing substantial pressure on the group’s overall performance.

Geographically, the US market held up relatively well, while China experienced the sharpest decline.

Analysts’ recommendations

July, 4. Barclays. Hold. 550€ —> 520€

July, 1. Goldman Sachs. Buy. 600€ —> 610€

June, 27. Bernstein. Buy. 600€

June, 20. RBC. Buy. 680€ —> 550€

June, 19. Deutsche Bank. Hold. 565€ —> 535€

My analysis

Despite short-term headwinds, LVMH remains one of the most outstanding stocks in the luxury sector and firmly holds its position as the global leader.

The group benefits from broad geographic diversification and is increasingly expanding into new business segments (such as hospitality) through strategic acquisitions that offer strong synergy potential. These moves open new avenues for cross-selling high-end products to an exclusive clientele, further reinforcing the brand ecosystem

LVMH's management team and talent pool are among the most respected globally, combining long-term strategic vision with operational excellence. This leadership strength is a critical intangible asset that continues to differentiate the company in a volatile and competitive industry

However, it is important to acknowledge that brand power, while a formidable moat, is inherently fragile. Consumer tastes can shift rapidly, and brand desirability is always at risk, something recently highlighted by the decline of Gucci under Kering. LVMH is not immune to these dynamics

At current levels, the stock offers an attractive entry point with a reasonable valuation.

While a return to all-time highs may take time, the long-term fundamentals remain solid. Key indicators to monitor in the coming quarters include a rebound in topline growth and recovery in margins

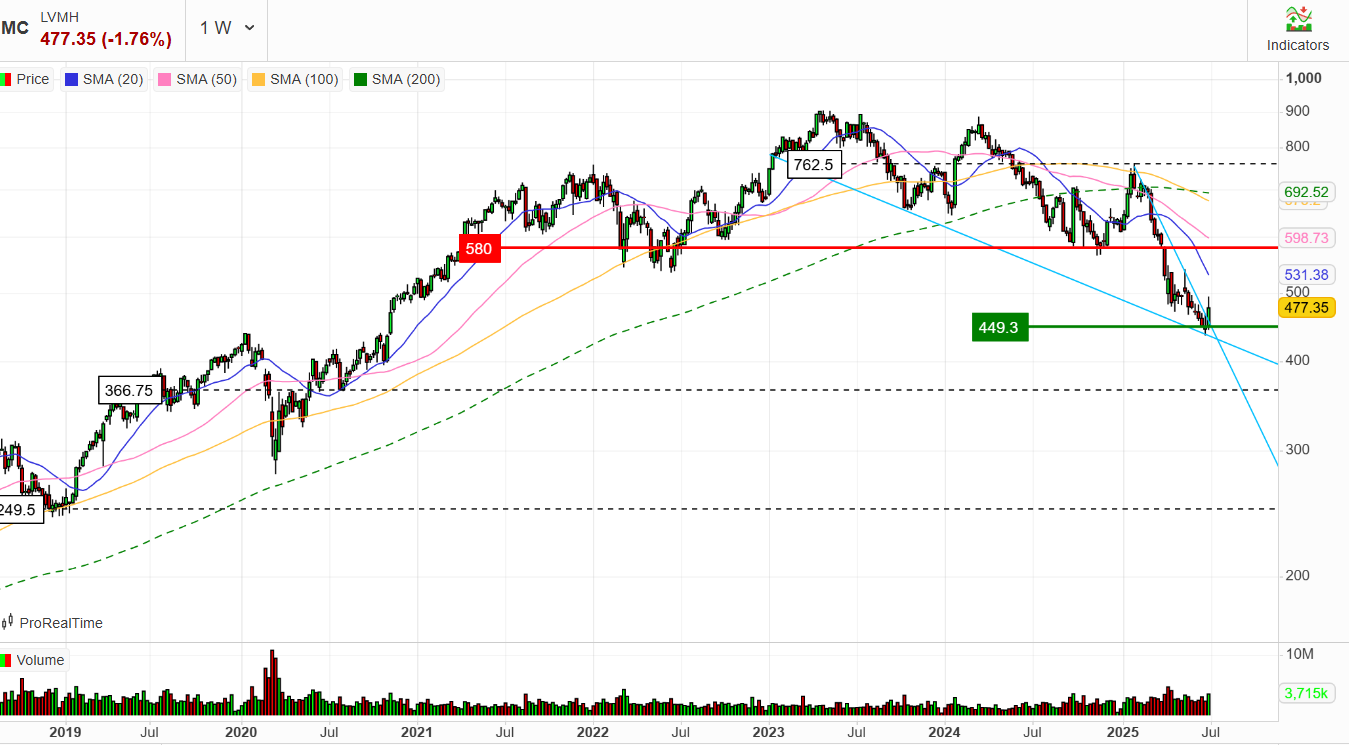

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for LVMH.

Buying zone 1. 450€

Buying zone 2. 370€

Buying zone 3. 250€

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Used source: Marketscreener.com. Affiliate link just here