Stock of the Week: Adobe Posts Strong Results, But Market Remains Unimpressed

Negative sentiment persists even as valuation cools

Here is the 21st edition of “Stock of the Week”. You can find all the previous analyses and my articles on my main page (for an easier search, use a computer, mobile version is harder to navigate).

Here are the links to the 3 previous “Stocks of the Week” as well

This week we are focusing on Adobe. The stock posted more than decent results but despite that the market reacted badly and lost 6%. Time to dig in to identify whether the stock is a buy or not.

While free subscribers already benefit from a wealth of valuable content, upgrading to a paid subscription unlocks exclusive research, in-depth insights, real-time portfolio tracking, advanced stock screeners, and more giving you an edge to stay ahead of the market. Don’t miss out: subscribe now and supercharge your investing journey!

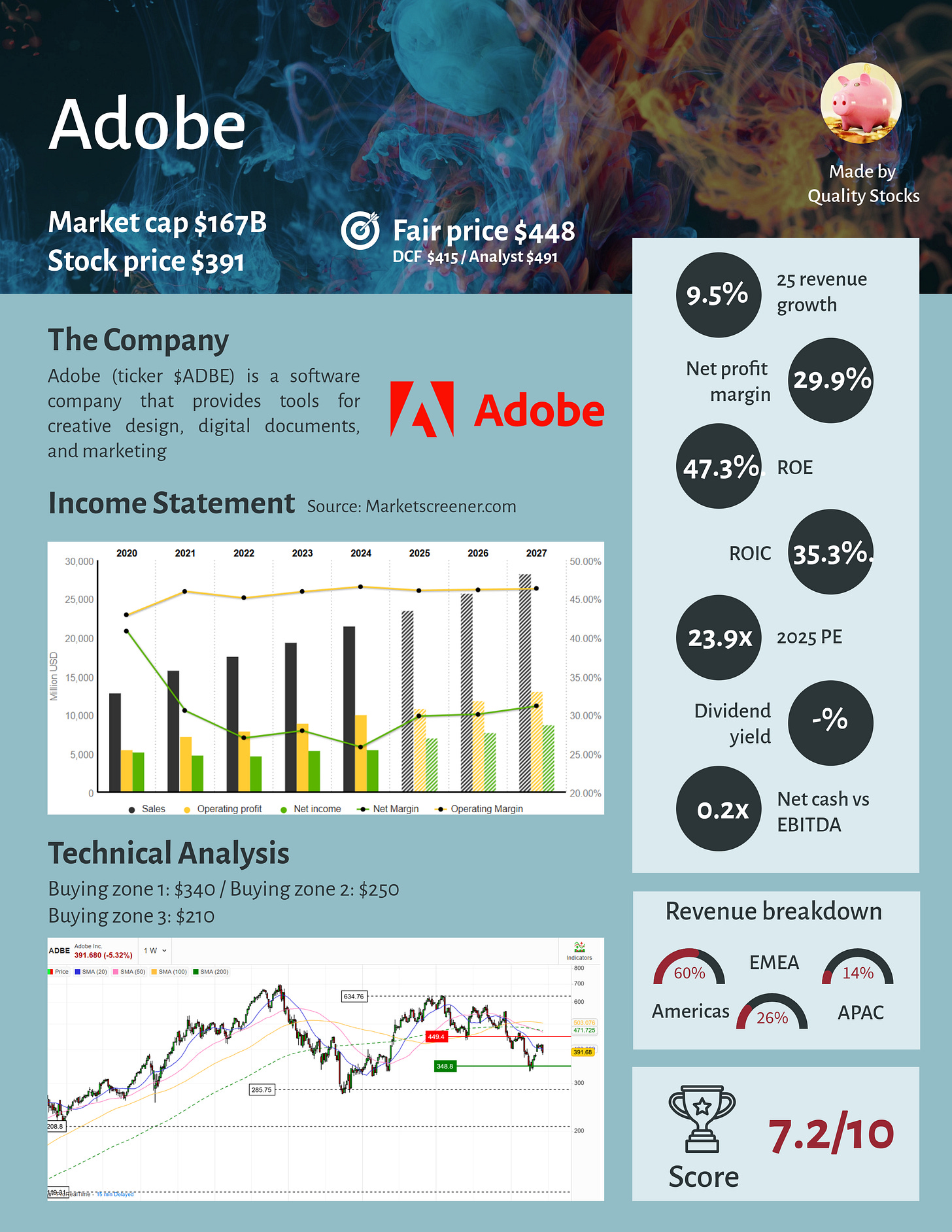

One Pager

The stock at a glance

Recent news

Adobe canceled its $20B acquisition of Figma in December 2023 after regulatory scrutiny from EU and UK authorities (and probably after realizing that it was a bad deal!)

Adobe faced backlash for new terms of service, with users alleging the company demanded access to content and could monitor files, prompting accusations of "spyware”

Concerns are mounting over the adoption and monetization of Adobe’s new AI features, raising questions about its vulnerability to disruption

Adobe agreed to cut software prices for the US government following a Department of Government Efficiency (DOGE) review

Last earnings report

Adobe reported solid financials in its latest earnings, with revenue up 10.6% and EPS growing 12.9%, both slightly ahead of analysts’ expectations. However, a drop in net income margin raised red flags for investors, though this weakness was masked at the EPS level, thanks to a significant share buyback program that reduced shares outstanding by nearly 5% over the past year.

Buybacks are accelerating, which is arguably a smart move given the cooling valuation. This trend is reflected in a 35% decline in cash and cash equivalents, suggesting the company is actively deploying capital to repurchase stock at attractive levels. While I might have preferred to see Adobe pursue strategic acquisitions to open up new revenue streams, management appears to see limited compelling opportunities and is instead opting to return excess capital to shareholders.

Looking ahead, the company modestly raised its financial targets for 2025. Notably, it now expects to exceed its previously stated goal of $250M in AI-driven revenue by the end of that year.

Analysts’ recommendations

Bernstein. Buy. $525 —> $530

Oppenheimer. Buy. $530 —> $500

TD Cowen. Buy. $490 —> $470

Melius. Hold. $387 —> $400

DA Davidson. Buy. $450 —> $500

Mizuho. Buy. $575 —> $530

Wolfe. Buy. $450 —> $465

Stifel. Buy. $525 —> $480

Bank of America. Buy. $424 —> $475

Despite differing views, analysts are converging on a narrower price range.

My analysis

Market sentiment around Adobe is currently quite negative, with a dominant narrative suggesting that competition and AI advancements will ultimately render the company obsolete

However, while competitive pressures are rising, Adobe continues to maintain a strong market position and is still growing revenue at a solid 10% annually. Its AI-related revenue (measured as annual recurring revenue) is expected to double from $125M to $250M this year. If spun out as a standalone business, this would resemble a high-growth tech company with 100% annual growth

Fundamentally, Adobe remains a free cash flow powerhouse, boasting exceptional quality metrics across the board: strong net margins, high return on equity (ROE), robust return on invested capital (ROIC), a healthy balance sheet and a dependable stream of recurring revenue

Of course, for investors, it is crucial to monitor any signs of weakening fundamentals, especially market share erosion, which could signal that competitive threats are starting to take a tangible toll

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for Adobe.

Buying zone 1. $340

Buying zone 2. $250

Buying zone 3. $210

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Used source: Marketscreener.com. Affiliate link just here