Stock of the Week: Deckers Outdoor - Down 42% YTD, Ready for a Comeback?

Fundamentals vs. fear: what is really driving the drop?

Here is the 13th edition of Stock of the Week. You can find all the previous analyses and my articles on my main page (for an easier search, use a computer, mobile version is harder to navigate).

Here are the links to the 3 previous “Stocks of the Week” as well

This week, we are focusing on Deckers Outdoor. After falling more than 40% YTD, the stocks has reached new interesting support levels. Let's analyze whether it is a compelling investment opportunity!

Would you consider investing in Deckers Outdoor? Share your thoughts in the comments

While free subscribers already benefit from a wealth of valuable content, upgrading to a paid subscription unlocks exclusive research, in-depth insights, real-time portfolio tracking, advanced stock screeners, and more giving you an edge to stay ahead of the market. Don’t miss out: subscribe now and supercharge your investing journey!

One Pager

The stock at a glance!

Recent news

Investor concerns stem largely from Deckers' heavy reliance on international manufacturing, making it vulnerable to tariff risks and geopolitical tensions

Performance is driven by two core brands: UGG (53% of total sales) and HOKA (39% of total sales). Other brands (Teva, Sanuk, etc.) make up the remaining 8%, but are currently facing negative growth

Direct-to-Consumer now accounts for 40% of sales and remains a strategic priority for growth and margin expansion

Deckers continues its aggressive share buyback program, with over $1B in repurchase authorization still available

Last earnings report

Deckers Outdoor reported strong results for the third quarter of fiscal year 2025, with net sales increasing 17.1% YoY, 5% above analyst expectations. EPS came in at $3.0, representing a 19% increase from the previous year and beating consensus estimates by 15%.

Despite the solid performance, the company’s guidance points to a deceleration in growth. Revenue for the fourth quarter is expected to grow around 5%, bringing FY25 growth to approximately 16%. Looking ahead, Deckers projects FY26 revenue growth of about 11%, signaling a slowdown but still reflecting a robust trajectory.

Analysts’ recommendations

Feb, 07. Citigroup. Hold —> Buy. $215

Feb, 03. CICC. Buy. $202 —> $230

Jan, 31. TD Cowen. Buy. $244 —> $199

Jan, 31. BNP. Buy. $224 —> $234

Jan, 31. Williams Trading. Buy. $250 —> $260

Jan, 31. Wells Fargo. Buy. $215 —> $210

Jan, 31. Truist Securities. Buy. $235 —> $225

Jan, 31. Barclays. Buy. $190 —> $231

Jan, 28. Jefferies. Buy. $180 —> $200

It is worth noting that analyst recommendations may lag in reflecting the recent price drop. Given the speed of the decline, many have not yet had time to revise their valuations accordingly.

My analysis

Prior to the recent price drop, Deckers was trading at a PE of 38x. Once again, the correction highlights a key market truth: valuation matters, and elevated multiples eventually normalize. Even with 17% growth, such a premium valuation was difficult to justify, especially as growth shows signs of slowing

Tariffs will be the main concern of the market and we could see a lot of pain in the short-term. The first buying zone may not hold at all, so it would probably be better to wait for the second buying zone

Tariffs will be a great test to see the pricing power of the company. Too much sales erosion would cancel the investment thesis. It is important to keep that in mind especially for lobg-term shareholders!

Beyond tariff risks, the company’s dependence on 2 growth engines, HOKA and UGG, remains a structural concern. While the brands are currently gaining market share, brand-driven momentum is not the strongest moat; consumer trends can shift quickly

That said, the recent decline has brought the stock to a more reasonable valuation, now trading at around 19x earnings. At this level, buybacks become more impactful, enhancing shareholder value. The company also boasts exceptional capital efficiency. However, from a strategic standpoint, diversification through acquisitions could be a more useful than continued repurchases

Following a period of bullish excess, markets often overcorrect in the opposite direction, particularly in the current risk-off environment. For long-term investors, this pullback presents a compelling entry point, though any position should be built gradually, with attention to key technical and fundamental support levels

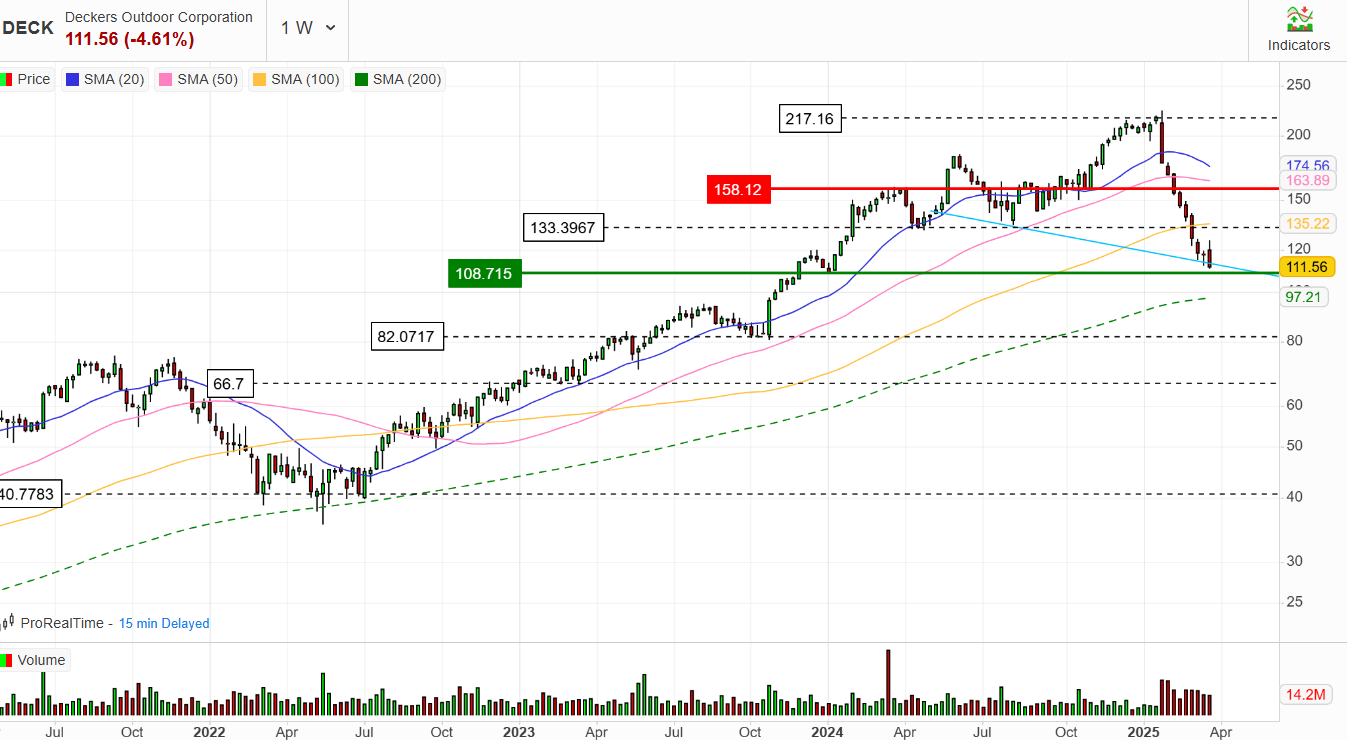

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for Deckers Outdoor.

Buying zone 1. $108 (roughly the current price, but may not hold due to tariffs)

Buying zone 2. $82

Buying zone 3. $73

Once again, tariffs may hit the company a lot. So be ready to deploy capital progressively and to experience a bearish excess.

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Used source: Marketscreener.com. Affiliate link just here

Very interesting