RELX, High-Quality Data

What are the outlooks of RELX in the Era of Artificial Intelligence?

As a multinational provider of information and analytics solutions, RELX holds a significant footprint across various sectors, serving as a vital source of critical insights and intelligence.

This article aims to understand the business and the different activities. We will then identify the outlooks and the challenges the company confronts. As usual, we will also look at the stock metrics and estimate its fair price.

If you like companies selling data, read this article about MSCI!

Business overview

With more than £9B revenue and 36,000 employees, the size of the company can be surprising for an information provider.

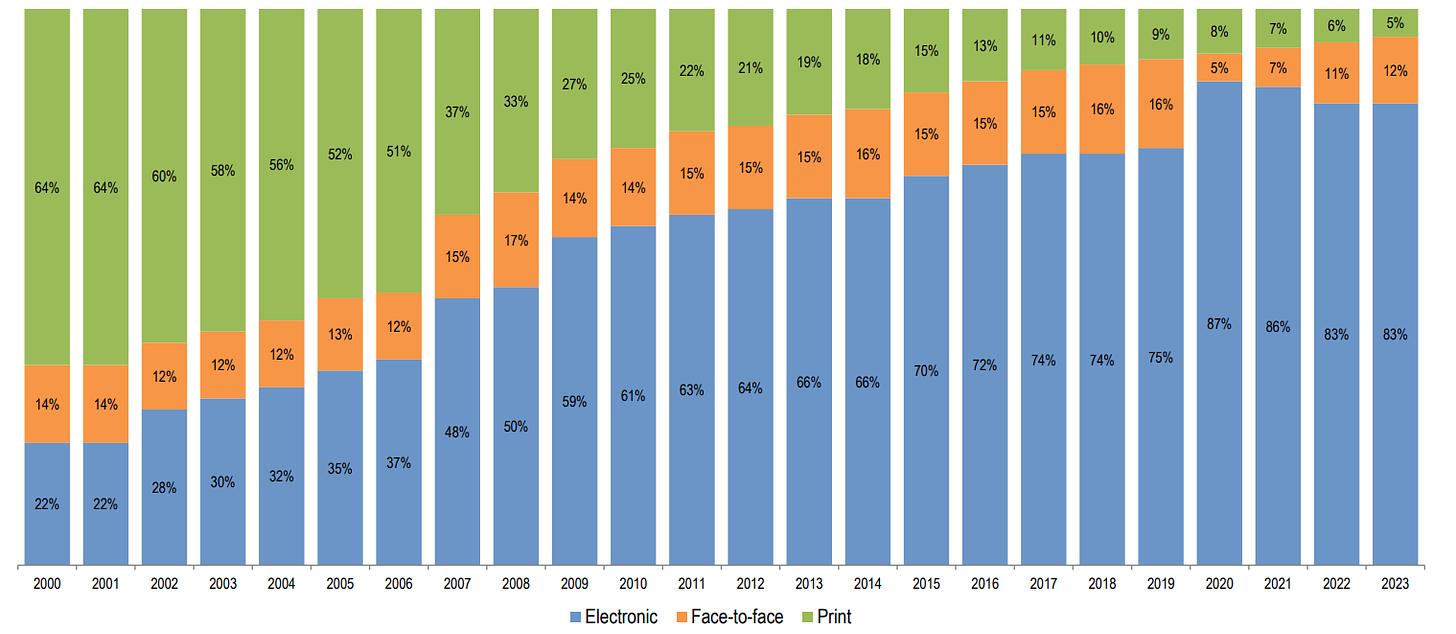

The current business is very different from that of two decades ago. Most of the information and analytics are sold electronically (>80%) currently. In 2000, most of the business was through printed documents.

The company is divided into 4 segments:

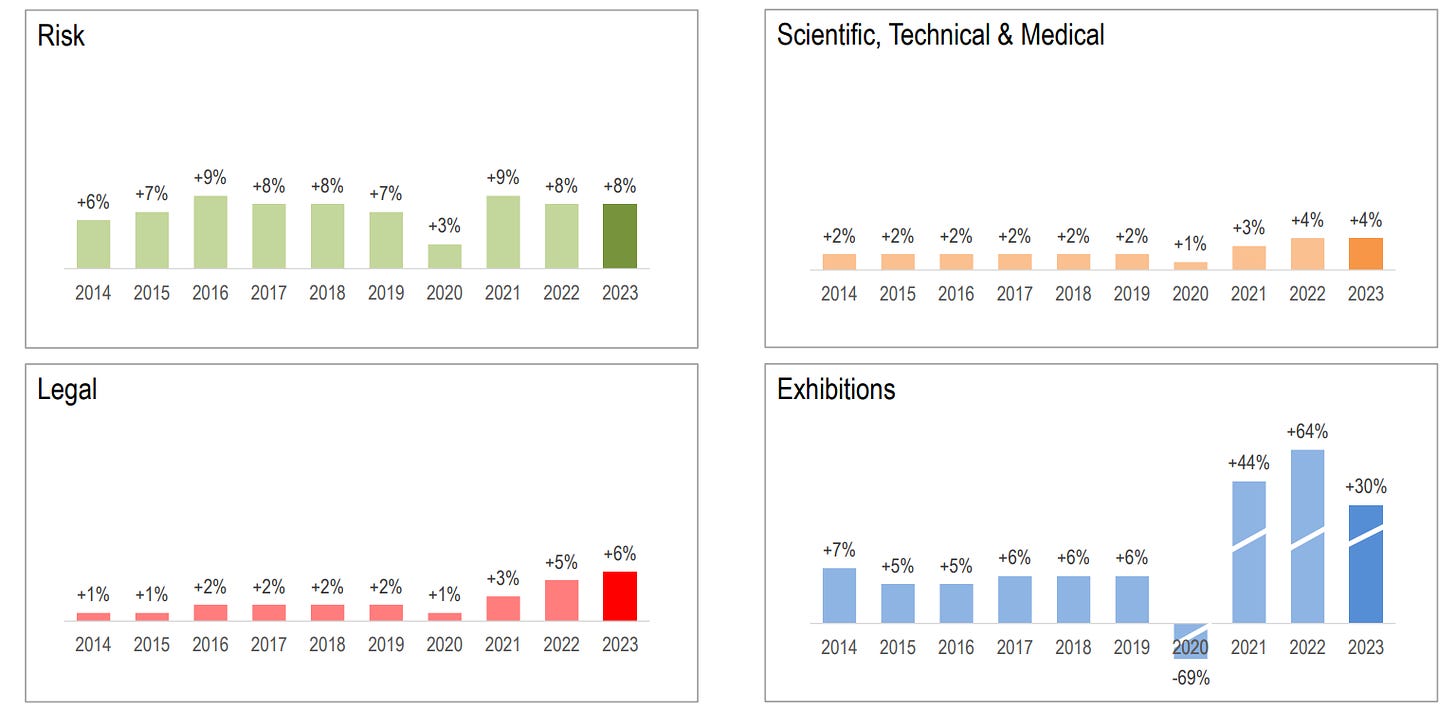

Risk. Provides customers with information-based analytics and decision tools to assist them in evaluating and predicting risk and enhancing operational efficiency. This is the main segment with £3.1B revenue. 2023 growth was 8%

Scientific, Technical & Medical (STM). Helps researchers and healthcare professionals advance science and improve health outcomes to facilitate insights and critical decision-making. This is the second segment with £3.0B revenue but with a slower growth (+4% in 2023)

Legal. Provides legal, regulatory and business information and analytics that help customers increase their productivity and improve decision-making. With £1.8B revenue, its 2023 growth was 6%

Exhibitions. Combines industry expertise with data and digital tools to help customers connect face-to-face and digitally, learn about markets, source products and complete transactions. This is the smallest segment with £1.1B revenue. 2023 growth was 30% - still recovering from the 69% revenue fall of 2020 where exhibitions took a big hit

The fastest growing segment is the risk one. Exhibitions growth can be deceiving as it still hasn’t recover its 2019 level. The company is trying to increase growth for STM and legal with some sucess for legal.

1. Focus on the Risk segment

The risk segment has 4 sub-segments: business segment, insurance, specialized industry data service and government. The main use cases for the business segment are: fraud & identity, financial crime compliance, credit risk. For insurance, the goal will be to get an holistic assessment of risk for different business lines like auto, property, life and commercial.

Most of the business is made electronically. 79% of the sales are in North America. 40% of the business is subscription-based. A huge portion of the remaining are long-term contracts.

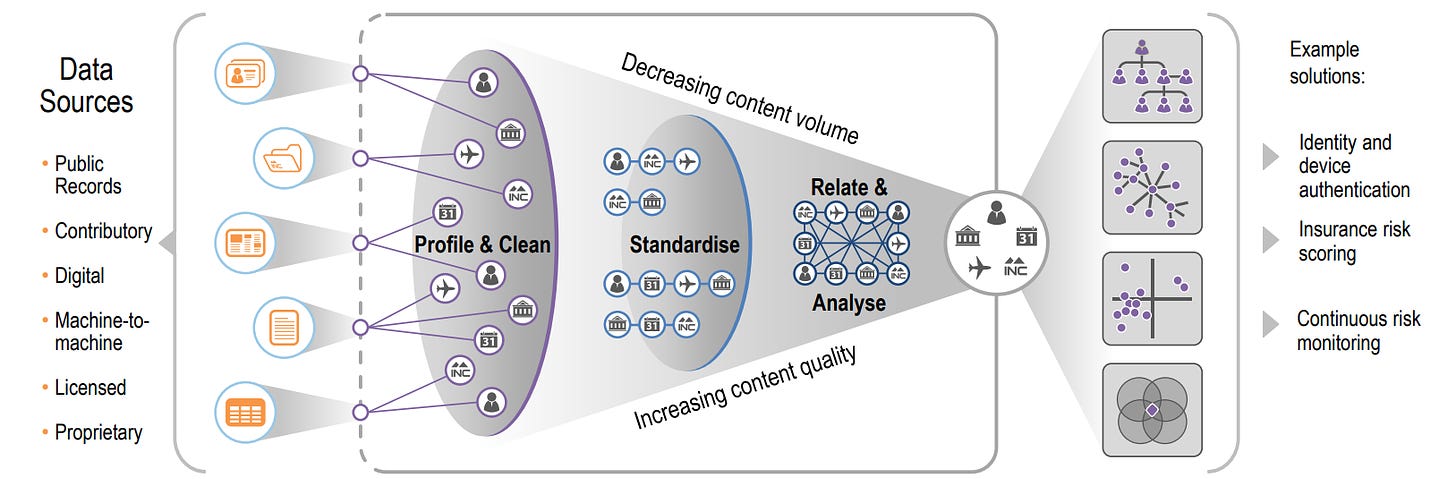

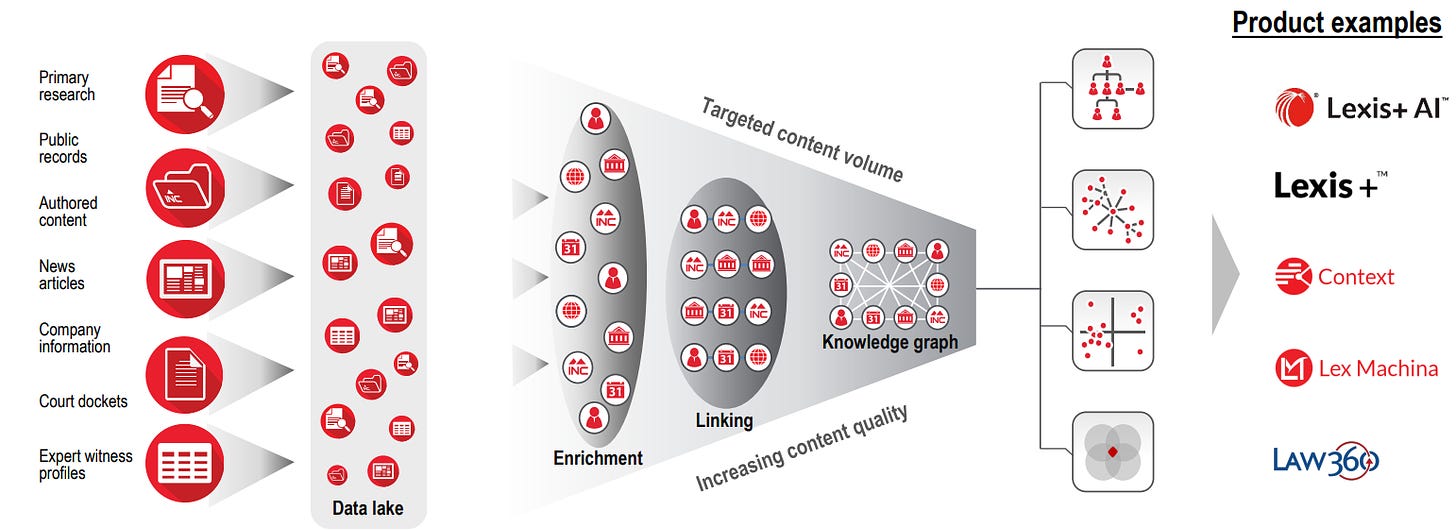

Schematically, RELX takes unstructured data sources (over 14 petabytes from hundreds of thousands of sources) and progressively structure them using big data platforms. After that, they are dispatched through different analysis applications so customers can use them.

Technology is therefore very important. To ensure the preservation of the technological performance, RELX spends £1.7B annually on technology and employs 11,000 technologists (3,000 for Risk only)

2. Focus on the STM segment

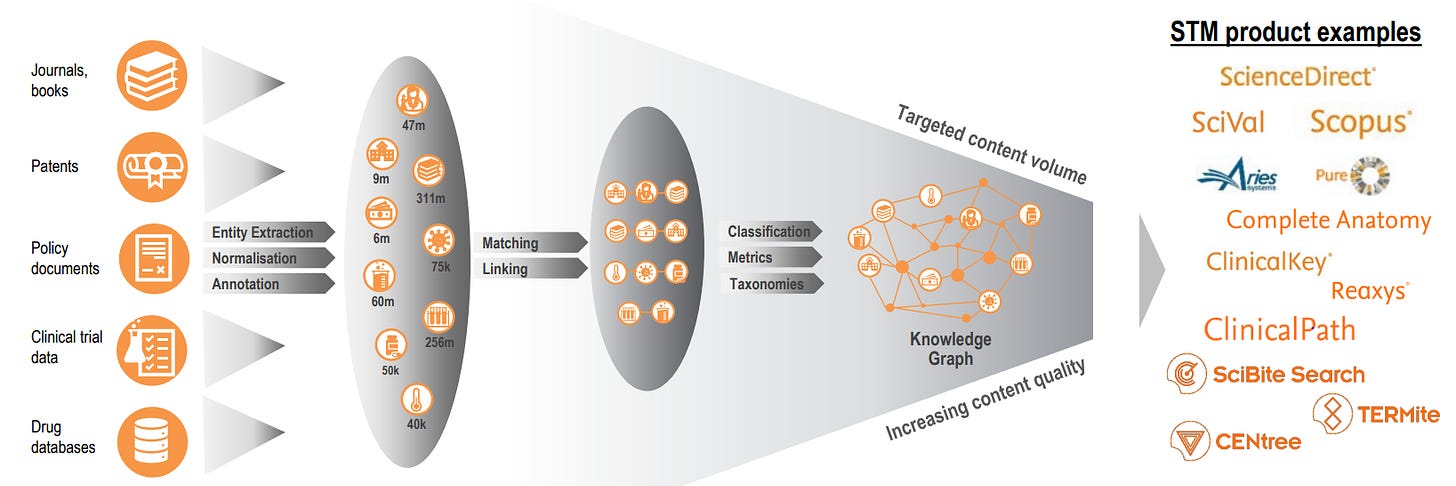

The STM segment has 4 sub-segments: databases, tools & electronic reference, corporate primary research, academic & government primary research and print.

Revenue is geographically diversified and 74% of the revenue is subscription-based. The business mix is changing with a reduction of the print segment. The 5% growth is hiding different growth speeds: from degrowth from the print segment to almost 10% from the database segment.

The process is the same than risk: from structured and unstructured content to customer single point of execution through big data platforms to structure the data. We can note a high number of STM products to gain modularity and flexibility.

3. Focus on the Legal segment

The Legal segment also has 4 sub-segments: law firm and corporate legal, government and academics, news & businesses and print.

90% of the sales are made electronically, 68% in the US. It is also a highly recurring revenue with almost 80% of subscription-based sales. Interesting to note: growth has been accelerating since 2021 from 1/2% to 5/6%.

Here again, we find the classic RELX process that we saw in Risk and STM segments.

Strategy

The company is developing increasingly sophisticated information-based analytics and decision tools that deliver enhanced value to professional and business customers across market segments. This is highly valuable and it will last with AI where the need for curated information and analytics will continue to increase.

The main focus is organic growth, supported by targeted and small acquisitions. Smaller acquisitions are less risky which can be reassuring for the investor. Among the last acquisitions, there are:

Corp Events. 2023. Price undisclosed

Interfolio. 2022. Price undisclosed

Scibite. 2020. £65M

Emallage. 2020. $480M

ID analystics. 2020. $375M

Gamer Network. 2018. Price undisclosed

ThreatMetrix. 2018. $830M

As a comparison 2024 FCF is expected to be £2.3B.

The company is focused on improved organic growth profile, customer satisfaction and returns. Healthy goals!

Competitive landscape

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.