MSCI, Helping Investors Navigate the Financial Landscape

An interesting company in the financial data sector

As the world becomes more complex, the financial world follows the same trajectory. As a result, structured, high-quality financial data is becoming a necessity for industry professionals. MSCI provides critical decision support tools and services for the global investment community. It aims to help its customers improve their performance and manage their risks.

The importance of this activity can be seen in MSCI revenue. From $443M in 2009 to $2,529M in 2023, MSCI has known a 13.3% revenue CAGR. With a net profit margin around 40%, what are the reasons of the success of the company? What are its activities? And of course what is its strategy to continue this success story?

In this article we will also identify the opportunities and the threats of the company and its fair price.

Interested in finding more content from deep dives to analysis and screeners? You can find everything just here.

Company overview

The company is divided into 4 segments:

Index. 58% of the revenue. In this segment, you can find equity market indexes designed to represent full opportunity set across geographies and products with no gaps or overlaps. They can be used as building blocks for portfolio construction in indexed and active portfolios.

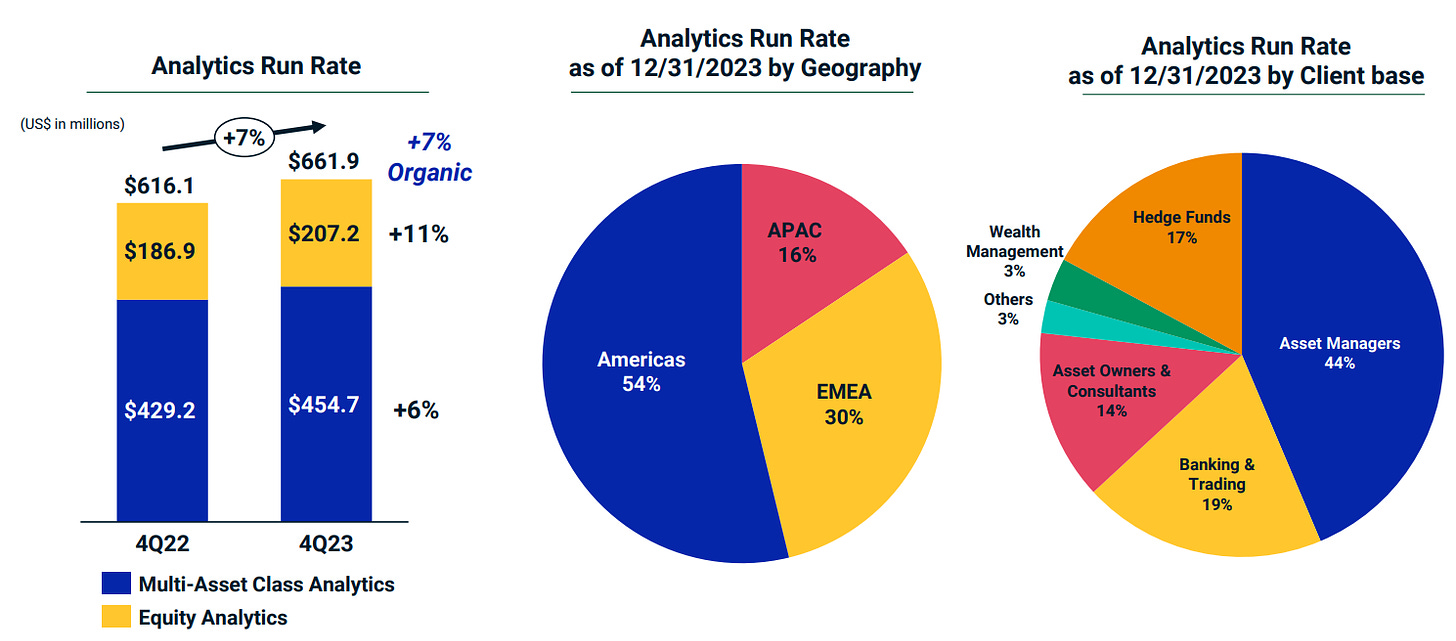

Analytics. 24% of the revenue. MSCI Analytics are used by asset owners, asset managers and hedge funds to build and customize portfolios using different factors. The content is distributed through APIs, partners and digital marketplaces.

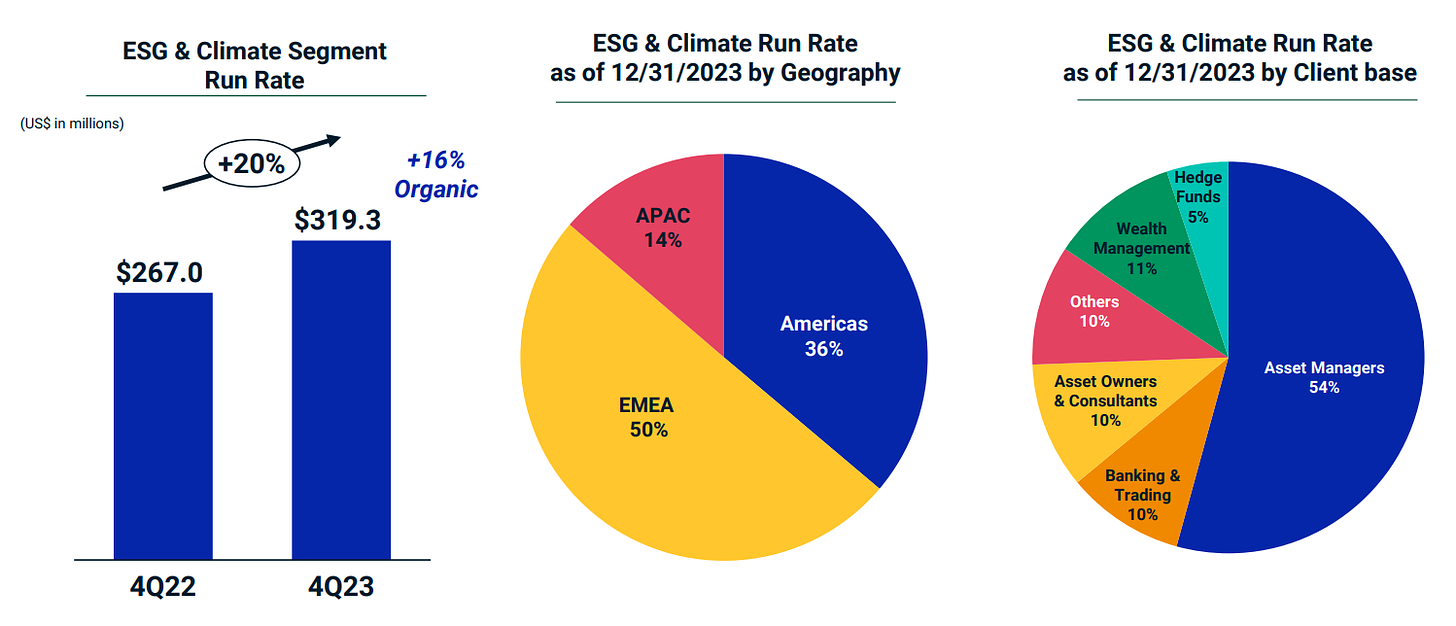

ESG & Climate. 11% of the revenue. In this segment, you can find ESG indexes, ESG ratings and data, climate data & analytics and climate indexes. MSCI provides tools for a lot of ESG used cases: financial materiality, climate exposure, carbon footprint, etc.

Other. 7% of the revenue. In this segment you will find all other revenue streams, especially the real assets solutions. It is a global provider in data, portfolio services and insights for investments in commercial real estate and infrastructure assets.

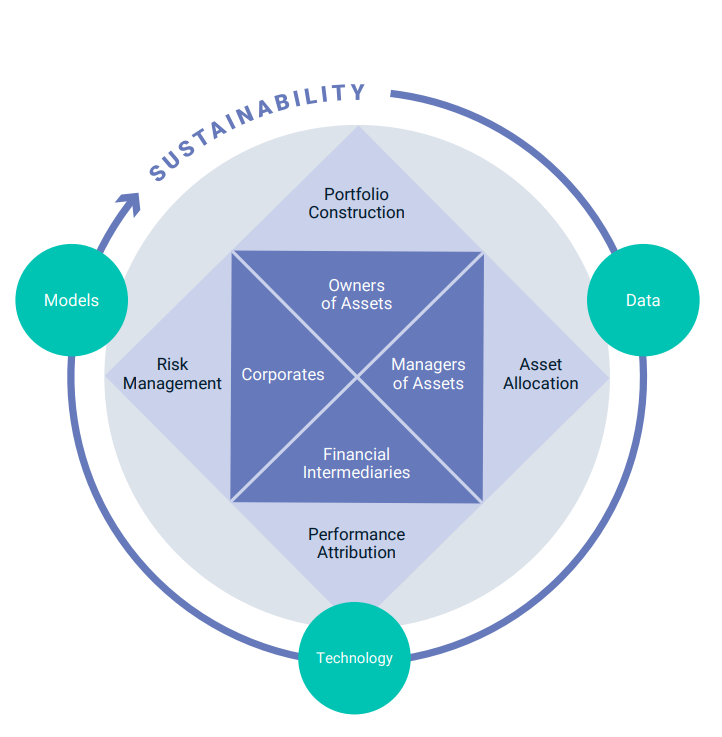

This infographic simply represents MSCI’s clients (Owners of Assets, Managers of Assets, Financial Intermediaries and Corporates), why they use its services (Portfolio Construction, Asset Allocation, Performance Attribution and Risk Management) and how they do it: through data, technology and models.

MSCI value comes from its capability to navigate increasingly complex global financial landscape. Some interesting metrics: 115k public equities, millions fixed income instruments, 13k private equity funds, 185k private equity-owned companies.

MSCI is present at every step of the investment process:

Strategy design (portfolio construction, indexes)

Strategy management (models, risk and performance)

Strategy evaluation (benchmark, analytics, reporting)

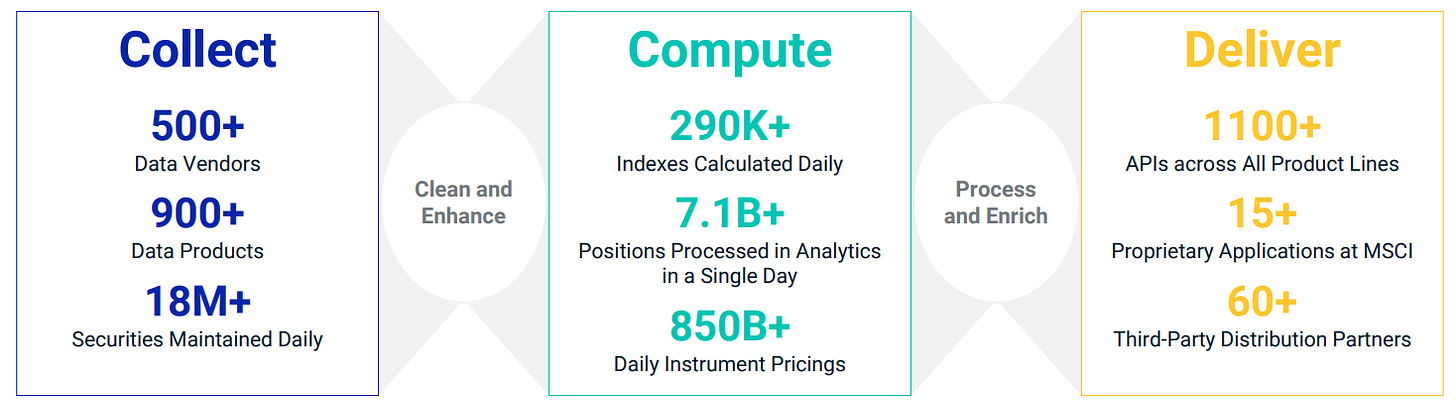

The process of data collection and delivery if well describe in this infographic. This is a 3-steps process: collect, compute and deliver.

One of the most interesting aspects of MSCI is its performing and robust business and financial model:

97% of the revenue is recurring - mostly from subscription but also from asset-based fees

The retention rate for analytics is above 94%

The number of MSCI products by customer is increasing and the average client spend growth for client onboarded in 2018 is 2.7x

The FCF conversion is above 100% with 131% average operating cashflow conversion since 2007 IPO

EBITDA is above 60%

Segment description

Index

MSCI Indexes are built using a modular approach with a rules-based, consistent and transparent methodology. Equity market indexes are designed to represent full opportunity set across geographies and products with no gaps or overlaps. It can be used as building blocks for portfolio construction in indexed and active portfolios representing the performance of investment strategies, using a consistent framework.

Thematic indexes are aligned with megatrends transformative tech, health & healthcare, society & lifestyle and environment & resources. Customers can also customize indexes for specific uses.

Indexes can be used for portfolio construction (define investable universe, asset allocation, factor, ESG, thematic), risk management (risk profile, risks and opportunities, exposure), portfolio management (performance, models) and reporting (benchmark, reporting, regulatory support).

Analytics

Analytics growth drivers come from equity portfolio management (factors use, model data) and multi-asset class solutions (from institutional and individual investors, complexity management). Fixed income portfolio and wealth management might also grow fast, as the requirement for quality data is improving for different use cases.

ESG & Climate

MSCI is a pioneer and a market leader for ESG & Climate measurement and models. 1,200 employees are dedicated to this segment. It is deeply integrated across MSCI products. It can be found on ESG indexes, ESG ratings & data, climate data & analytics, climate indexes.

MSCI solutions evolve with regulation, support financial climate risk integration and help to align with net-zero objectives. MSCI ESG Research normalizes, standardizes and cleans up data so that disclosed information is comparable between issuers and usable in a dataset. ESG data are mapped to almost 1 million securities.

Other

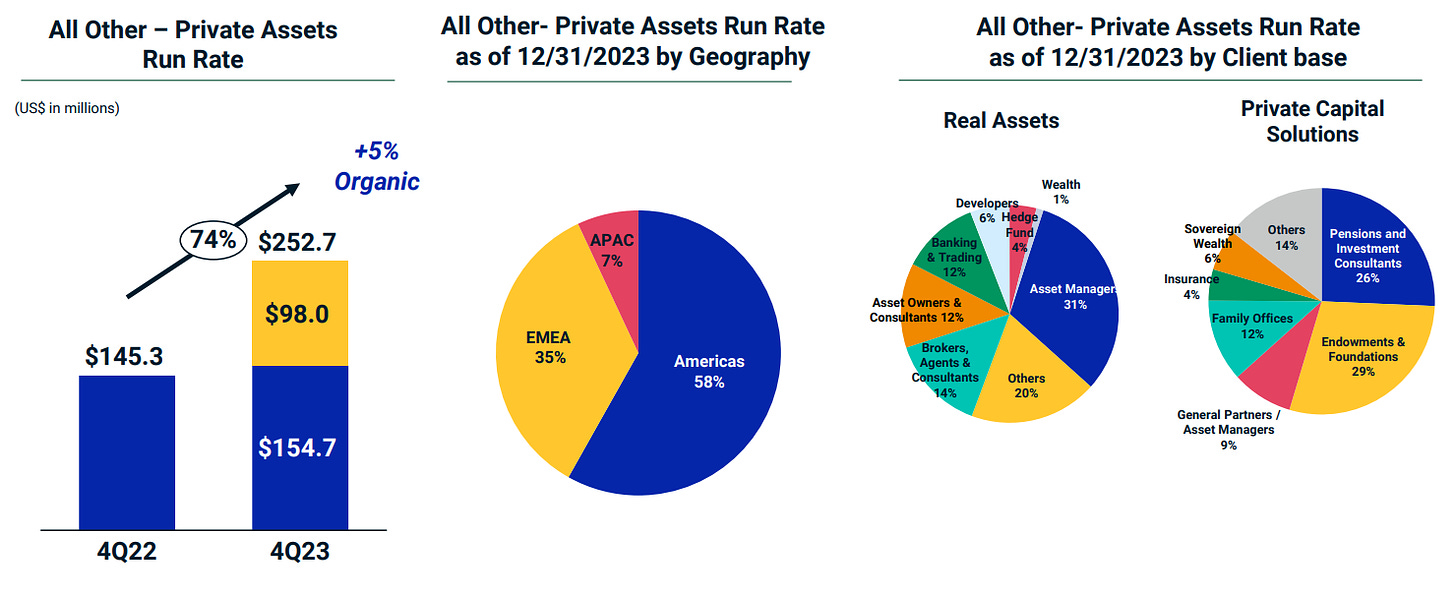

MSCI Real Assets is the only global provider of in data, portfolio services and insights for investments in commercial real estate and infrastructure assets. The other part of this segment is Private Capital Solutions offering data, analytics and software solutions for private real assets and private debt investment.

MSCI One

MSCI One is an unified platform for real-time portfolio and market data access. It is an interesting tool to help improve the growth and retention rate. The main functionalities are:

Instant access to portfolio, benchmark, and instrument data

Insights into Performance, Liquidity & Market Risk, ESG, Climate Risk at portfolio, and aggregate portfolio levels

Ability to benchmark against standard and client designed benchmarks

Ability to stress test, back test and optimize portfolios

Risks in different markets, sectors, segments, factors, and assets

Construction and rebalancing portfolios in a quick, easy and flexible way, while tracking risk and performance, and generating reports

Strategy and outlooks

MSCI strategy follows 3 pillars:

New growth. Drive new business capabilities through new products and services (climate, thematic indexes, fixed income indexes, private assets)

Scale existing products (ESG indexes, futures and options)

Effiency improvement (cloud migration, streamlining activities, data process improvements)

To maintain a high capital efficiency, MSCI follows its “triple-crown investment criteria” that are: high returns, quick payback (under 3 years) and strong valuation (invest in field that will be able to increase MSCI valuation).

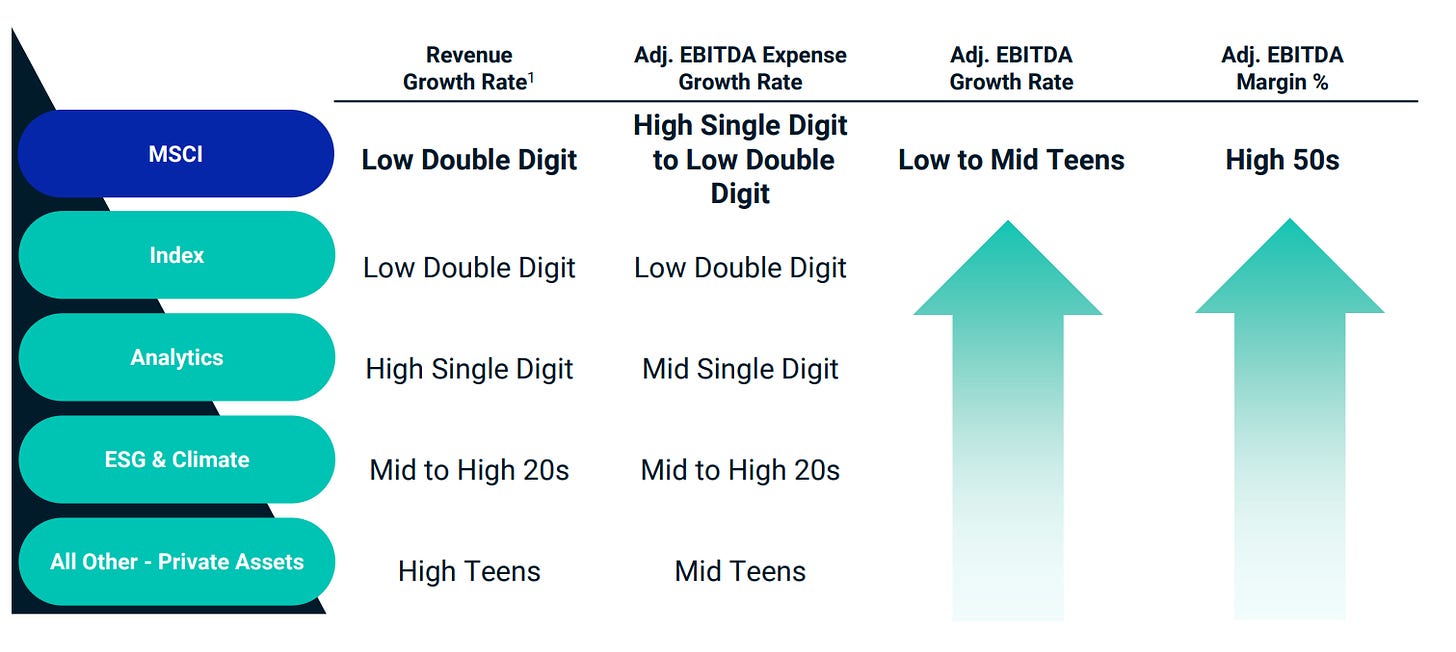

Here are the growth objectives of the management for the different activities of the company.

Stock metrics

Growth metrics

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.