Portfolio Update: 1 Stock Sale and Portfolio Rebalancing

Cut the weeds and water the flower

For the first time since I started sharing my portfolio, I am going to sell a stock because its fundamentals are deteriorating and other opportunities seem more appealing. Sometimes, you have to accept cutting off an arm – even at the risk of seeing a rebound after the sale.

In the meantime, I continue to rebalance my portfolio following the portfolio review I did one month ago.

Here are all the portfolio metrics before the sale and the strengthening of numerous positions, and after.

Past growth: 13.1% —> 14.1%

Future expected growth (3y CAGR): 10.0% —> 10.4%

Net profit margin: 25.1% —> 25.9%

ROE: 41% —> 41%

ROIC: 23% —> 24%

Debt leverage: 0.08x EBITDA —> -0.07x EBITDA

PE: 29.4x —> 29.5x

PE Y+2: 22.1x —> 22.0x

FCF yield: 3.76% —> 3.84%

PADI: 1755€ —> 1758€

Dividend yield: 1.44% —> 1.41%

Dividend growth: 10.0% —> 10.1%

Share buybacks: 0.82%/year —> 0.79%/year

Expected TSR: 11.8% —> 12.0%

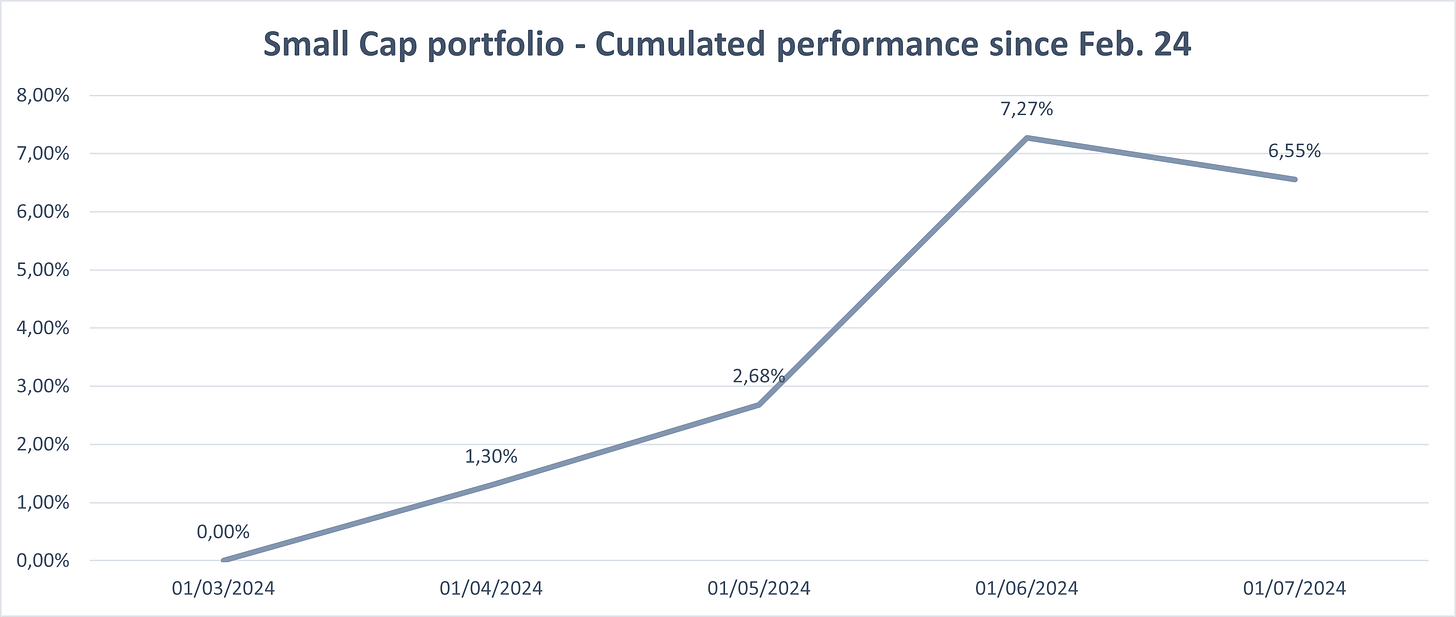

If I focus exclusively on my small-cap portfolio, here is the evolution of the metrics with the new purchases.

Past growth: 22.0% —> 21.2%

Future expected growth (3y CAGR): 15.7% —> 16.1%

Net profit margin: 22.6% —> 24.0%

ROE: 42.4% —> 44.6%

ROIC: 29.7% —> 32.8%

Debt leverage: -0.91x EBITDA —> -0.78x EBITDA

PE: 23.9x —> 22.5x

PE Y+2: 17.2x —> 16.3x

FCF yield: 5.45% —> 5.81%

PADI: 112.93€ —> 170.06€

Dividend yield: 1.94% —> 2.30%

Dividend growth: 12.3% —> 12.9%

Share dilution: 0.00%/year —> -0.03%/year

Expected TSR: 16.6% —> 17.2%

I sold my Pernod Ricard shares

Several factors prompted me to sell my Pernod Ricard shares:

My investment thesis was not holding up: I viewed the company as a defensive business capable of maintaining growth in all circumstances.

While the overall market is struggling, we see competitors faring better. I have no problem holding onto a stock during turbulent times, but underperforming compared to competitors is not a good sign.

Despite the stock price decline, the deterioration in fundamentals results in a low potential total shareholder return (TSR). There are better opportunities available.

Exposure to China in a difficult geopolitical environment.

Of course, the market is expected to rebound and the stock along with it, reaching higher levels again. However, I prefer not to tempt fate and will focus on other companies instead.

And now it’s time to reveal all the transactions made during this portfolio rebalancing.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.