Hello fellow investor,

In this section, I present a transparent monthly update of my portfolio. It follows my investment strategy that you can find here. Note that I also detailed my approach with the TSR (Total Shareholder Return) in this article.

This presentation is divided into several parts:

Global view of the valuation and the portfolio’s metrics

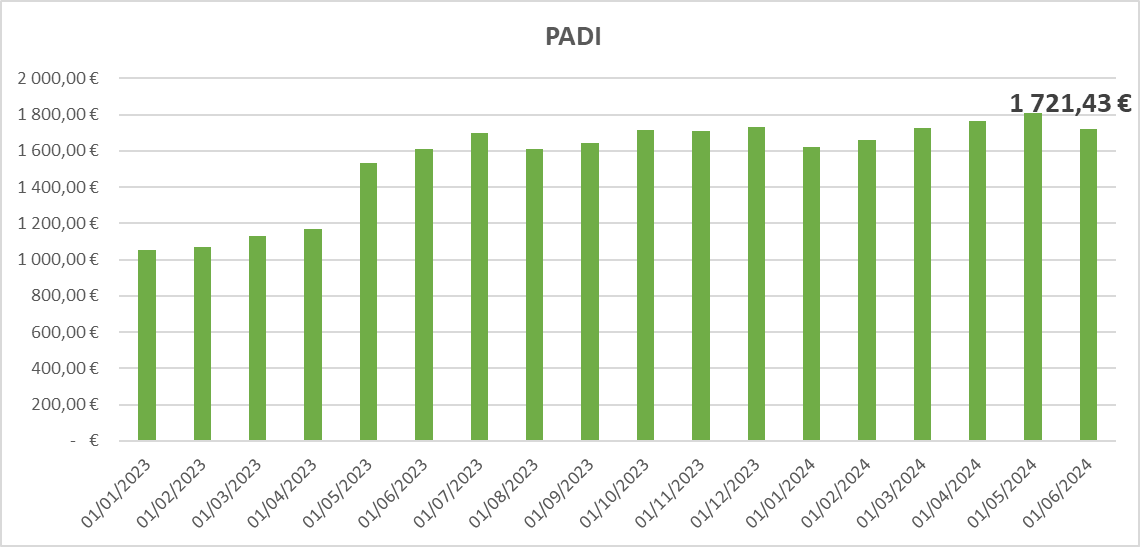

For dividend lovers, presentation of the Projected Annual Dividend Income (PADI) and a monthly calendar

Sector and geographical breakdown

For paid subscribers, there is also:

An explanation of the month's movements

Review of the month's news

Presentation of current portfolios (small cap and big cap)

My reinforcement price for potential stock purchases

Please note that my portfolio is in euros, so I am subject to exchange rate fluctuations, especially the euro-dollar exchange rate.

Before starting, I wanted to provide an overview of the Quality Stocks newsletter. We are now more than 3,500 in this investment journey. I believe that this success is due to the quality, variety and consistency of the publications that I offer. This allows me to bring you value in improving your investments and provides information to satisfy your curiosity.

.As a reminder, here are the various pieces of information offered here:

Once a week, an analysis of a company, its business, prospects, metrics, risks, and opportunities and the fair price estimation

All information, metrics, and movements of a portfolio of quality big caps

All information, metrics, and movements of a portfolio of quality small caps, with exclusive research and hidden gems

Screener tools to identify high-potential stocks along with a rating system

Educational posts sharing insights on the stock market, investment methods, and strategies

All of this is based on years of experience and thousands of hours of analysis, research, and synthesis along with various paid tools.

For these reasons, the subscription price will increase to reflect the overall value provided:

The monthly subscription will increase from $8.99 to $20

The annual subscription will increase from $89 to $167, over 30% discount compared to the monthly subscription price

The prices will be increased this Wednesday. All current subscriptions will remain at the same price. It seems only fair to continue offering my earliest supporters this advantage. So, you have until Wednesday to take advantage of the old rates.

Overall performance

The performance for the month of May was modest, with a rebound of approximately 1%.

From now on, I will also present the performance of the small-cap portfolio separately. Please note that this performance may be volatile as the portfolio is still under construction.

Valuation and metrics

In total, for the month, I injected 2,000€ into my big-cap portfolio and 2,550€ into my small-cap portfolio. With a positive performance, this explains the significant growth of the portfolio. Money inflows for the coming months are expected to be lower but still existent.

Here are the portfolio’s key metrics (weighted average):

Past growth: 12.9% / Estimated future growth: 9.8%

Net profit margin: 25.0%

ROE: 40%

Debt leverage: 0.08x EBITDA

PE: 29.3x / PE Y+2: 22.1x

FCF yield: 3.78% / FCF yield Y+2: 5.09%

Dividend yield: 1.45%

Dividend growth: 9.61%

Buybacks: 0.80%

You can note that a lot of metrics improved (growth, net profit margin, ROE, debt leverage, buybacks). This is due to portfolio rebalancing and new stocks. This might continue to improve in the coming months. This rebalancing has begun after my portfolio review that you can fin here.

PADI decreased due to the portfolio rebalancing. The expected TSR (Total Shareholder Return) of one stock was too low so I preferred to sell it despite a high dividend yield. As I am not primarly focused on dividend this is not an issue for me.

And now it is time to discover the 2 portfolios (stocks and news)

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.