Mercadolibre: South American Growth

What is inside the Amazon of South America?

Mercadolibre (MELI) is one of my 12 top stocks I selected for 2025 - you can find the full list on this article. The company is often referred to as the Amazon of South America, but its business model and revenue mix are different. In this article, we will explore the company's unique business model, its growth prospects, as well as the risks and opportunities it encounters.

While this newsletter provides valuable content for free subscribers, becoming a paid subscriber unlocks even greater benefits to help you gain an edge in the market.

Here is why upgrading to a paid subscription is worth it:

Access exclusive content. Dive deeper with detailed analyses, advanced insights, and premium research not available to free subscribers

Follow my portfolio. Gain exclusive access to my portfolio, including monthly updates, tracking my moves, and watchlists

Discover more stock ideas. Explore in-depth stock ideas, technical analyses, and strategies tailored to uncover hidden opportunities

Support this newsletter. Your subscription directly supports the creation of high-quality, valuable content to help you achieve your investment goals

Upgrade today and take your investing knowledge and performance to the next level!

The business model of the company

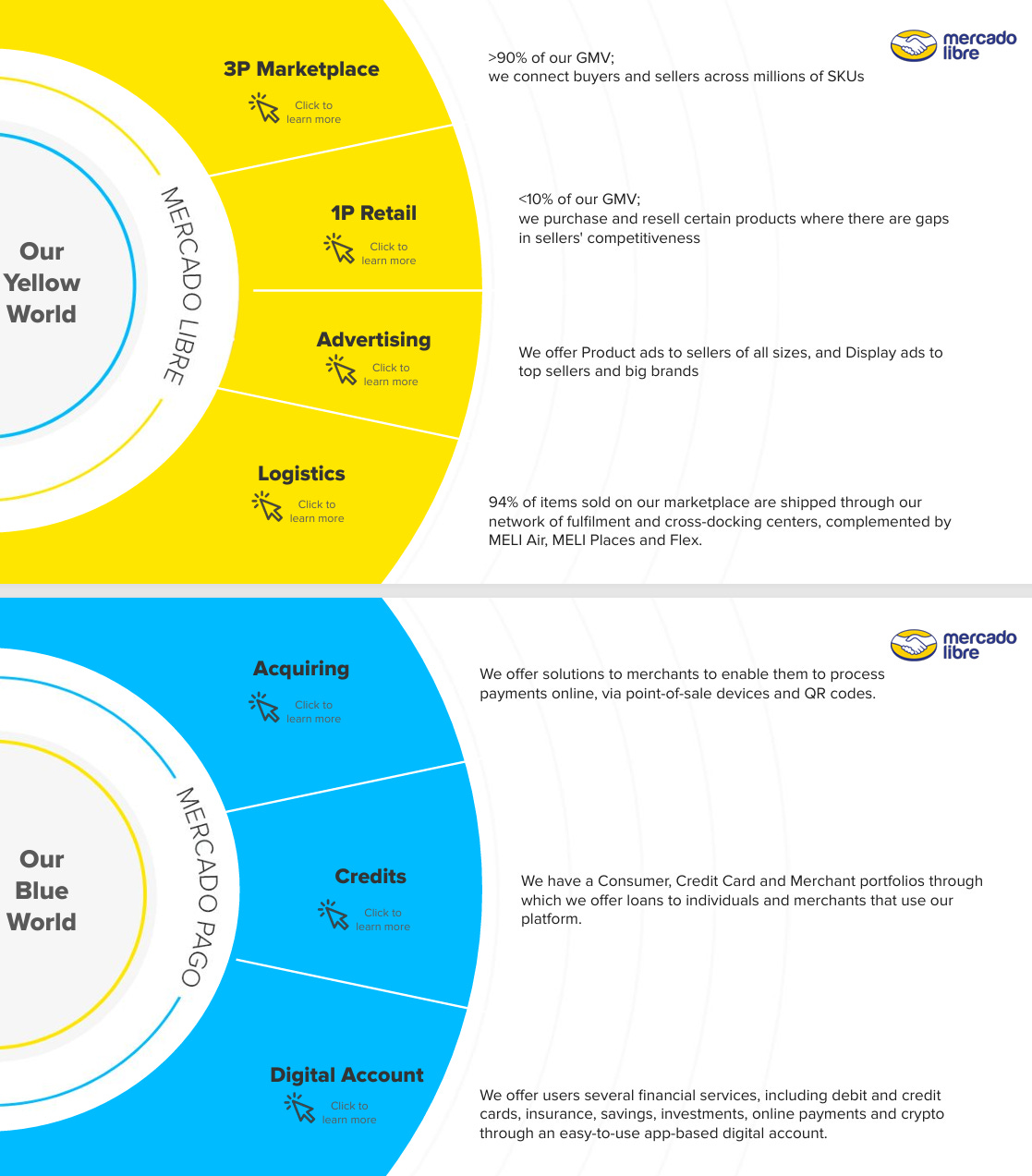

The company is divided into 2 different parts:

The “yellow world”. This part of the company focuses on logistics and delivery operations. It is designed to ensure efficient supply chain management and fast, reliable delivery services. Key features of the Yellow World include a transportation, warehouses, and logistics.

The “blue world”. This part of the company centers around payment solutions, credits/loans, and financial services.

It is interesting to note that the company heavily focuses on tech. The core of the “yellow world” is a marketplace that connects sellers and buyers. In only 10% of the cases, the seller is Mercadolibre itself. However more than 90% of the logistics is operated by Mercadolibre. To select the 10%, the company uses the massive amount of data to find the most profitable / interesting products to sell to maximize sales and margin.

Of course advertising is a great development stream like we can see currently for Amazon. By the way, my article on Amazon is available just here.

This gives Mercadolibre a strong competitive advantage while reducing the financial risk of directly owning the inventory.

The “blue world” synergies with the “yellow world” by integrating financial services such as payments, credits, and insurance into the e-commerce and logistics ecosystem, enabling seamless transactions, fostering trust, and enhancing customer convenience throughout the entire shopping and delivery experience.

Revenue breakdown

The revenue breakdown by segment is as follows

There are 4 main parts:

Commercial services growing 45% YoY is the marketplace, advertising and logistics revenue. They represent almost 50% of the sales of the company

Commerce product sales represent 10% of the revenue and are growing 62% YoY. They are the products bought and sold directly by Mercadolibre

Financial services (23% of the revenue) are growing 12% YoY

Credit revenues are growing 35% YoY

Growth rate by country is as follows:

Brazil +41% YoY

Mexico +44% YoY

Argentina +14% YoY

Others +39% YoY

If you enjoy this article, share it and help spread the word!

Strength of the model

Mercadolibre owns a fast and extensive delivery network. By adding more and more customers and merchants, the network effect increases its moat every month.

The company is dominant on its market. This is clearly visible in the following chart.

This can be explained by several reasons: understanding of local markets and their specificities, adaptation to payment preferences, comprehensive platform and strong logistics infrastructure.

Outlooks

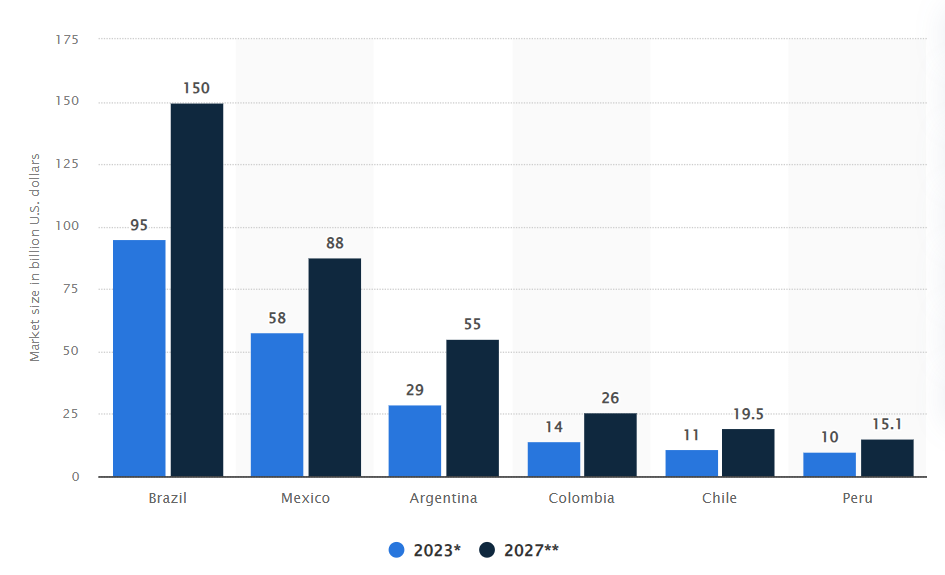

Mercadolibre can rely on 2 strong tailwinds. The first one is the fact that Latin America’s ecommerce market is far from mature. This leaves a significant growth potential.

According to different studies, the Latin America e-commerce market should grow above 15% a year CAGR from 2024 to 2030.

The financial division growth is helped by the strong ecosystem revolving around its platform and logistics. Success in Latin America e-commerce market relies on tailoring payment strategies to local cultural and economic preferences. Offering diverse options (bank transfers, digital wallets, mobile payments, …) boosts customer trust, enhances user experience, and drives conversions.

The following sections of this article will dive into key metrics, risks & opportunities, fair value, expected shareholder returns, and technical analysis. These insights are available exclusively to our paid subscribers. To access premium content, unlock valuable stock ideas, and gain in-depth analysis, subscribe to Quality Stocks today!

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.