As the Chinese market slows, many luxury companies face difficulties. Among them, two emerge as leaders: LVMH and Hermès.

These two companies have distinct profiles:

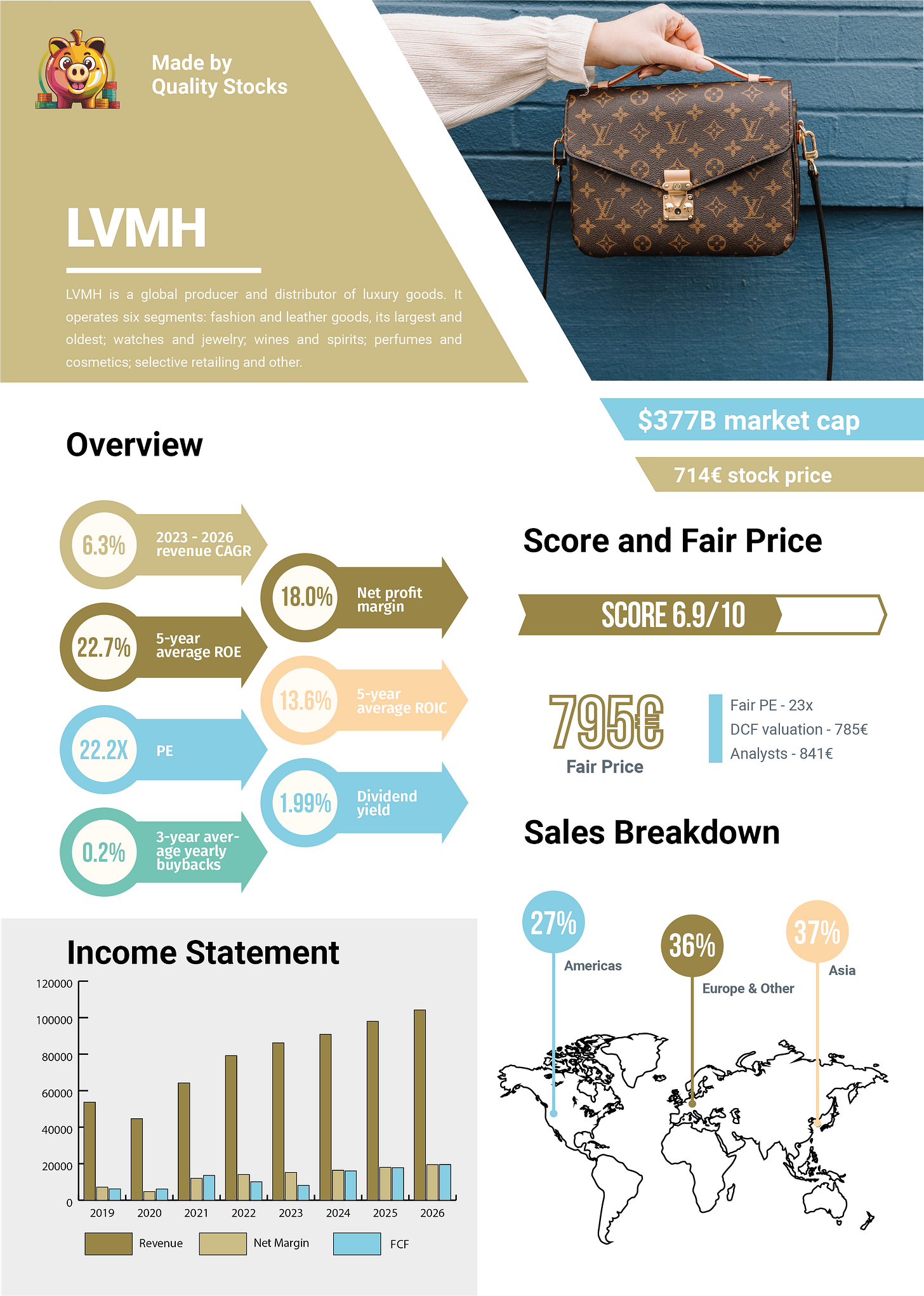

LVMH: More diversified, larger, and with wider distribution channels, LVMH is the leader in luxury and is particularly strong in acquisitions. Recently, the company has been building a new division specializing in travel and hospitality.

Hermès: The epitome of quality, most of Hermès' revenue comes from a single brand, and its distribution channels are highly selective. The company's metrics are outstanding, with incredible net profit margins, ROE, and ROIC. However, its stock is known to be extremely expensive.

While Hermès is the winner of this duel, the scores are close. Choosing between the two depends on investment style: LVMH is essentially a luxury ETF at a reasonable price, while Hermès represents high quality at a premium.

If you're interested in learning more, you can find my articles about Hermès [here] and LVMH [here].

If you like stock duels, you can find here the previous ones:

Why not both?