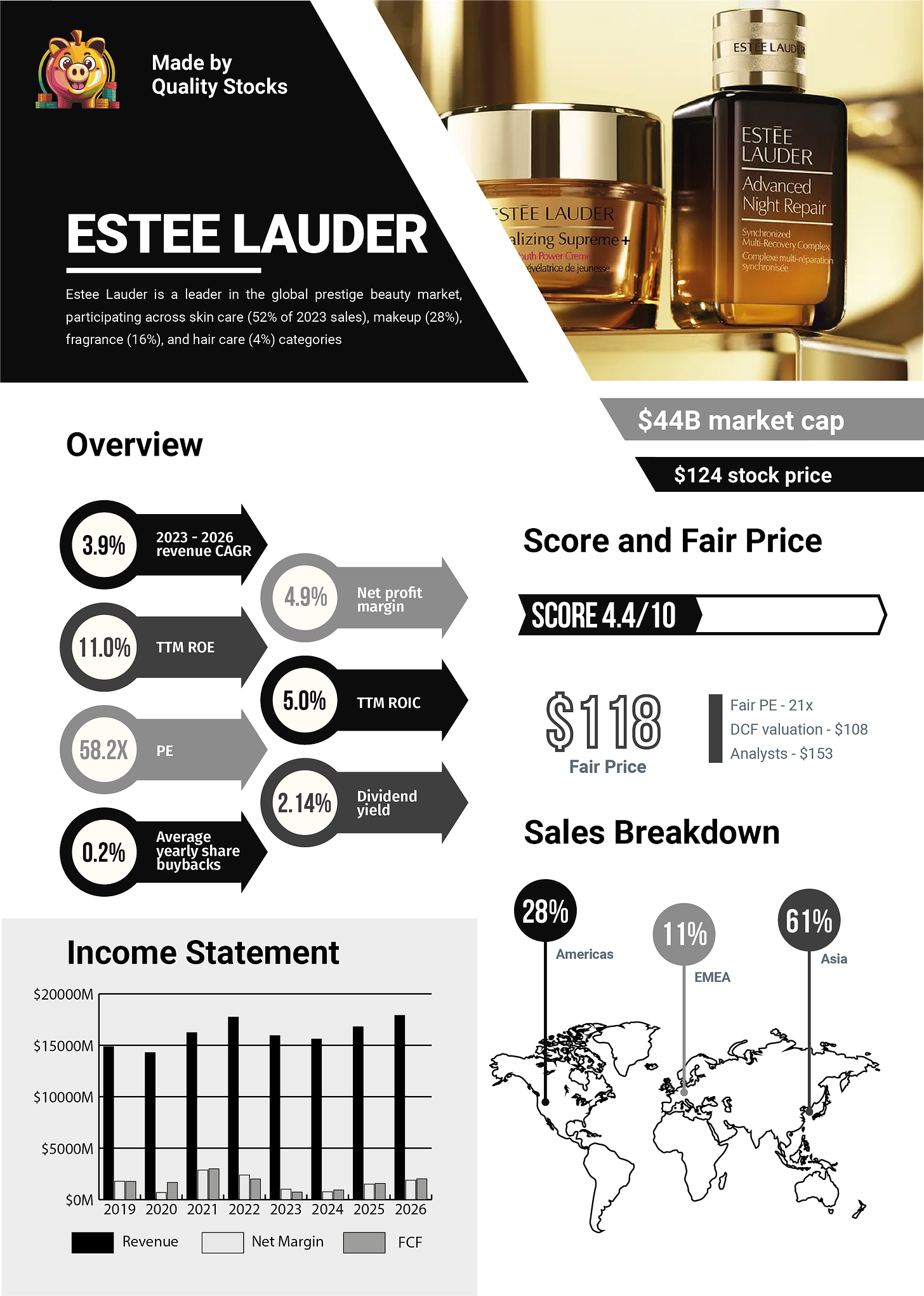

The recent drop in Estée Lauder's stock price, falling from $360 to $125, could be seen as an opportunity. But is it really the case?

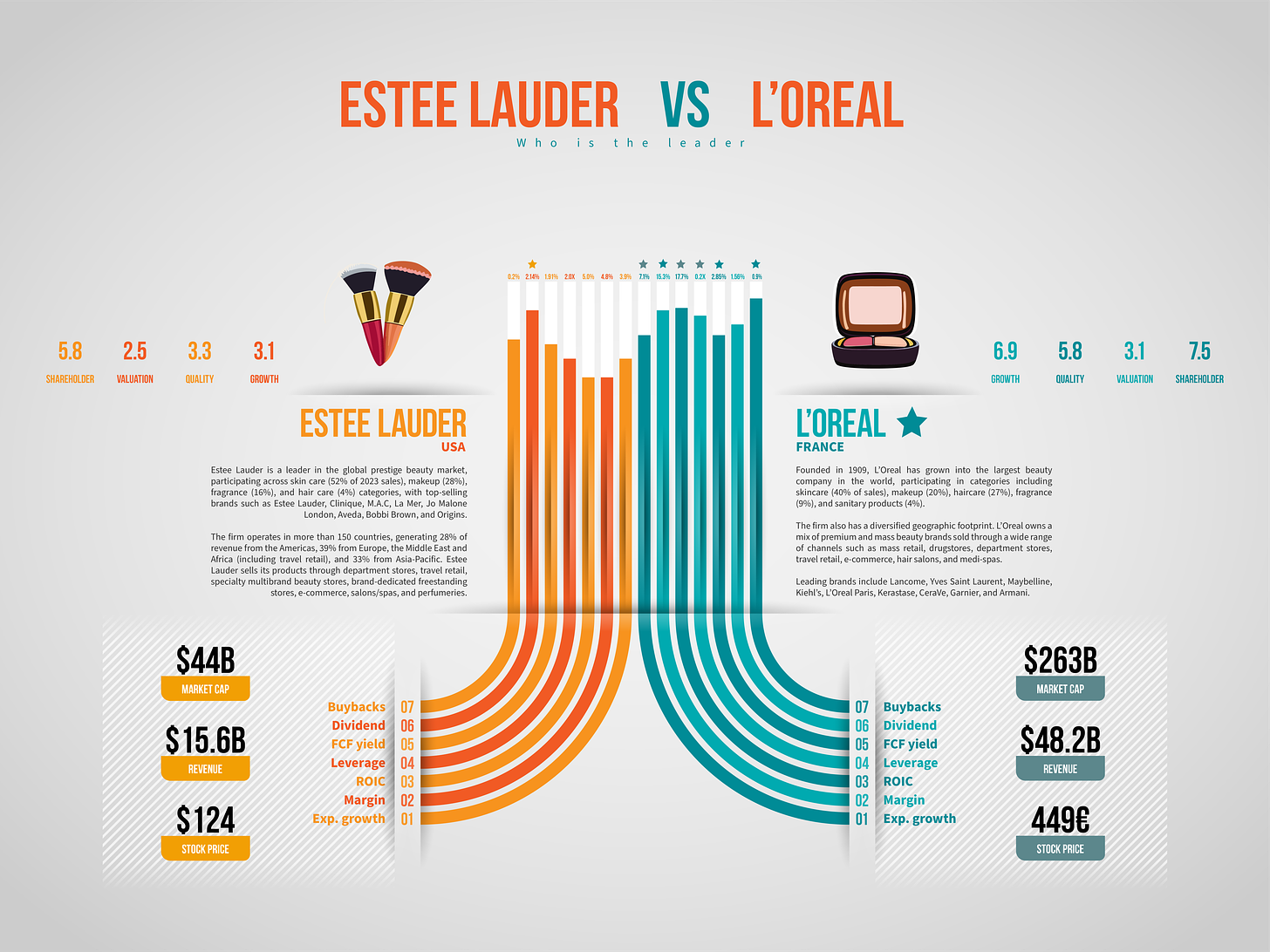

On nearly all compared metrics, Estée Lauder is behind L'Oréal, the clear winner of this duel. Even in terms of valuation. However, it is worth noting that the expected margin improvement in the coming years should enable Estée Lauder to return to valuation levels lower than its rival.

So, the two stocks are for two different types of investors:

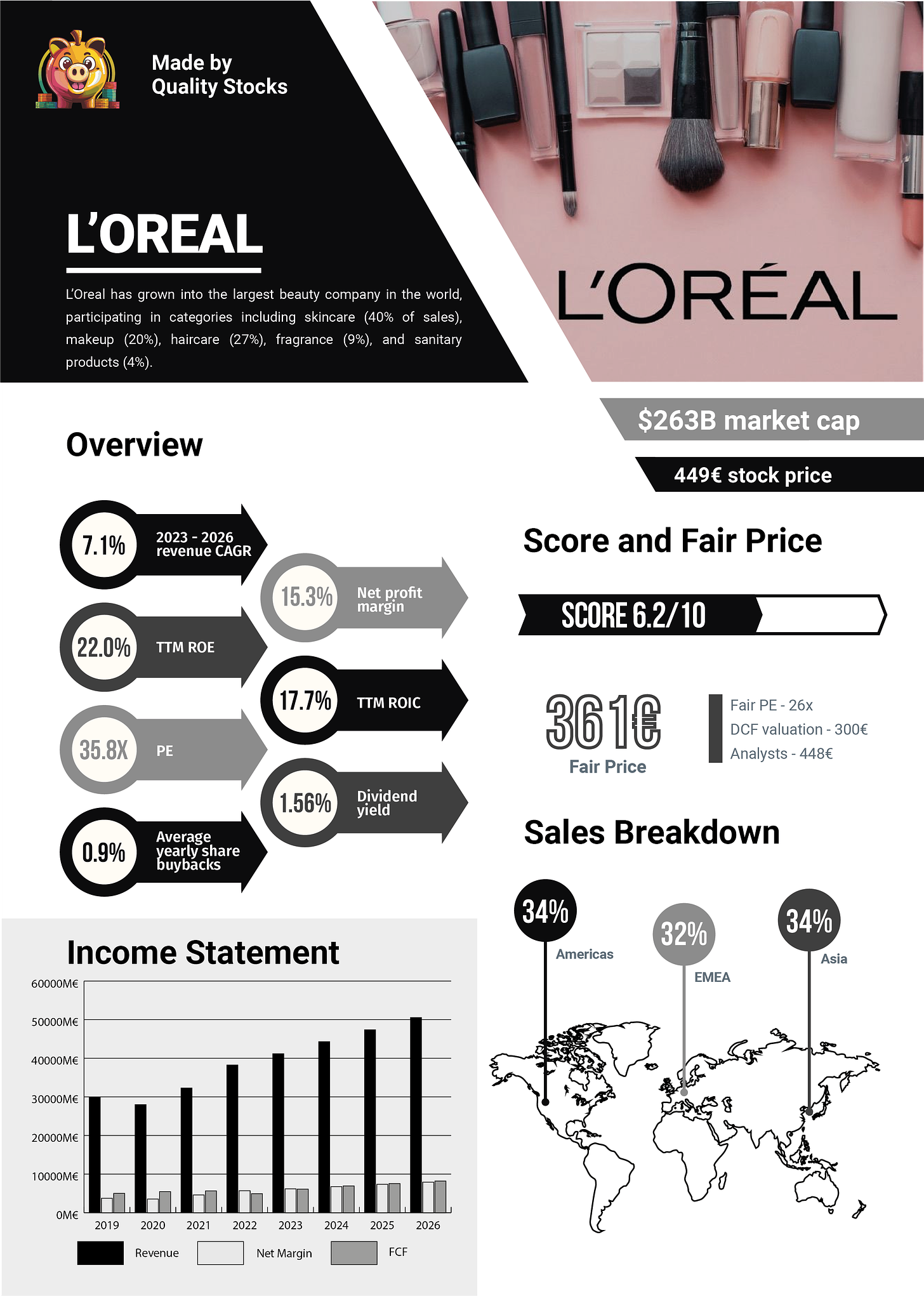

L'Oréal is a blue chip, a bit expensive, showing significant dynamism and dominance in its market. The main risk could come from increased competition and shifts in trends that could challenge metrics and drastically reduce its valuation

Estée Lauder is a fallen giant with the potential and capacity to rebound. This could be a gamble or prove to be longer than expected (as with Kering or PayPal, for example), but the potential is greater. The risk-to-reward ratio is therefore higher - it is worth noting that this is not at all my investment style.

Without further ado, here is an infographic and two one-pagers to understand the situation of each company.

If you like stock duels, you can find here the previous ones:

What are your thoughts on InterParfums? See how it has outperformed both in its May 2024 Investor Deck here, page 11: https://www.interparfumsinc.com/investor-presentations