GlobalData, a Potential Still Waiting to be Unlocked?

Can management prove the analysts wrong and significantly surpass their expectations?

At the close of H1 2024, during its earnings call, GlobalData’s management reaffirmed its ambitious 3-year strategic goal of reaching £500M in revenue by the end of 2026, driven by both organic growth and M&A activity. In contrast, analysts predict more conservative revenue of £333M, accounting only for organic growth. However, factoring in management's M&A expectations, revenue could reach approximately £390M organically - a 15% increase over analyst projections.

But is management's outlook realistic? Can this small-cap company carve out its place among industry giants? And will AI be a disruptive threat or a powerful growth catalyst in this journey? Let’s find out in this article.

If you are interested in the sector, check out this article on RELX, a major industry leader.

Company overview

GlobalData is a data and analytics company that provides comprehensive insights across various industries. It offers a wide range of services such as market intelligence, competitor analysis, or risk assessment to help businesses make informed decisions. They are B2B focused.

Leveraging a robust platform of proprietary data, expert analysis, and innovative tools, GlobalData helps clients identify growth opportunities, optimize strategies, and stay ahead of market trends.

The platform is organized by industry, covering sectors such as consumer goods, retail, food service, medical devices, pharmaceuticals, technology, retail banking & payments, insurance, oil & gas, power, construction, mining, travel & tourism, aerospace & defense, packaging, and automotive.

For each industry, GlobalData collects and curates a wide range of data, including macroeconomic indicators, company intelligence, patents, thematic research, deals, consumer insights, expert panels, and company filings. To ensure data quality and produce exclusive content, GlobalData leverages the expertise of 800 industry specialists, 1,200 researchers, 250 data scientists, and 100 editorial and data journalists.

Let’s use the Oil & Gas sector as an example of what B2B customers can access on the platform.

Competitor intelligence. Data on 53,000 companies, with expert assessments on 900 key players.

Disruption insights. Identification of potential disruptive themes to help executives mitigate risks.

Economic analysis. Detailed data on field production, regulatory frameworks, valuation tools, and planning.

Market data & insights. In-depth analysis of fields, exploration blocks, plants, refineries, and ongoing projects.

Real-time intelligence. Up-to-date information on news, deals, M&A activity.

Analyst access. Expert consultation available as needed.

This example clearly demonstrates that the curated and enhanced data GlobalData offers is not easily discoverable elsewhere, providing significant value across industries.

AI, disruption or opportunity?

As demonstrated in the Oil & Gas example, the data available on the platform is not easily discoverable, requires careful curation, and cannot be generated by AI. This holds true across other industries as well, making a full disruption by AI unlikely in this area.

Instead, AI could enhance the business in two key ways:

Data sorting and organization. AI can streamline the curation process, improving efficiency for GlobalData while enhancing the quality of its database.

User navigation. AI can assist customers in navigating vast amounts of data, making it more accessible and user-friendly.

Moreover, it is widely recognized that AI models require curated and reliable data to function effectively. As such, rather than being disrupted by AI, sources like GlobalData are likely to become indispensable for training and supporting AI models.

Growth targets and key drivers for achieving them

The company aims for an annual growth rate of 20%, with 10% coming from organic growth and the other 10% from acquisitions.

To achieve the 10% organic growth, the company employs several key strategies:

Price increases. This must be done carefully, balancing between leveraging pricing power and offering additional value on the platform. Overly aggressive price hikes without added value could push customers to seek alternative data sources.

Expansion within existing clients. Increasing the number of users (or "seats") within current customers.

Broaden customer offerings. Selling additional products or services to the same customer, such as expanding into more industries or offering broader data scopes.

New customer acquisition. The company currently serves 5,000 customers but estimates the total addressable market at 125,000, representing only 4% market penetration. The U.S. market, in particular, shows significant untapped potential and is a major growth opportunity.

To drive this organic growth, the company invests heavily in sales, marketing, customer success, and enhancing both the platform and its data offerings.

On the acquisition front, the company has invested £300M since 2017, including £145M over the past 16 months. Its M&A strategy focuses on acquiring smaller companies to simplify the integration process and limit the risks.

Customer churn, a weakness in the model

One of the key metrics to monitor in a subscription-based and recurring revenue business model is customer churn, or renewal rate.

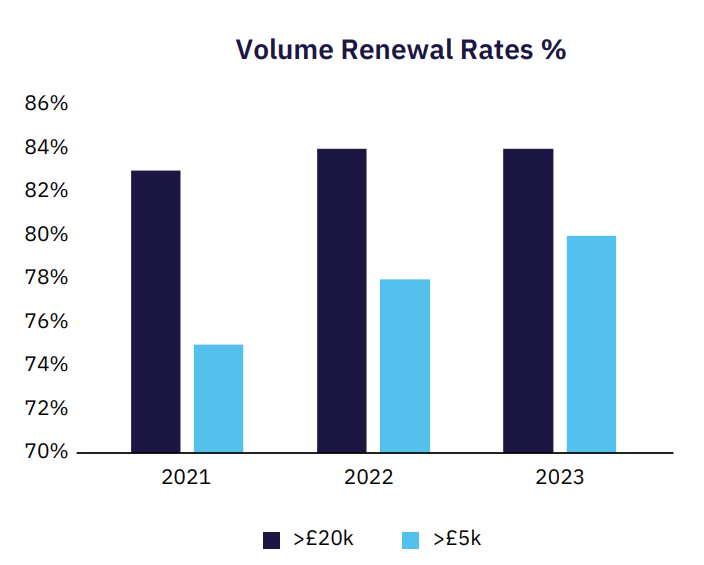

Currently, the renewal rate for major accounts (those generating over £20k in revenue) stands at approximately 84%. This rate is even lower when considering all accounts generating above £5k in revenue, though it is showing some improvement.

Management has set a target renewal rate of around 90%, with industry leaders achieving rates of about 95%.

High churn rates not only slow growth but also indicate that the value provided may not be sufficient for some customers. This suggests that these customers may prefer alternative options or opt out of subscriptions entirely.

Outlook

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.