Zoetis, Leader in Animal Health

Discover what justifies the high price of the stock

Zoetis is a global leader in animal health, dedicated to supporting the well-being of animals and the livelihoods of their owners. With a rich heritage in veterinary medicine, Zoetis specializes in developing and delivering innovative products and solutions for the prevention, treatment, and management of diseases in livestock and companion animals alike.

Spun off from Pfizer in 2013, the stock is well-known from quality investors. But what justifies the company's significant valuation?

In this article we will describe the business, metrics, strategy and opportunities of the company. We will also identify its fair valuation and a SWOT analysis will allow to identify the bull and the bear cases.

Company overview

The company has 2 major different segments:

Companion animals. 2/3 of the revenue. Dogs and cats represent most of the revenue, horses a small part (less than 5%)

Livestock. 1/3 of the revenue. 4 animal groups: cattle (half of the lifestock revenue), swine, poultry and other (fish, sheep, …)

Zoetis has more than 300 products lines, with 2,000 new products and lifecycle innovation introduced in the last 10 years. The company covers different therapeutic areas:

Parasiticides. 22.8% of the revenue. They prevent or eliminate external or internal parasites.

Vaccines. 20.7% of the revenue. They prevent diseases (respiratory, gastrointestinal, …)

Dermatology. 16.7% of the revenue. Diagnosis, prevention and treatment of conditions related to the skin, hair and nails.

Other pharmaceuticals. 15.0% of the revenue. This is the fastest growing segment with 22.7% growth in 2023. It includes pain or oncology.

Anti-infectives. 12.4% of the revenue. They prevent or kill bacteria and fungi.

Animal Health Diagnostics. 4.4% of the revenue. Testing and analyzing blood and urine for diagnostics.

Medicated feed additives. 4.1% of the revenue. Additives for livestock to prevent or treat different conditions.

Other (non-pharmaceuticals, human health). 3.9% of the revenue

Geographically, most of the revenue is made in the US (53%). Other main markets are Brazil, Australia, China, UK and Canada (each between 3% and 4% of the revenue). Other countries each represent less than 2% of the revenue.

Zoetis owns around 30 production sites, using also a wide CMO network.

One of the most interesting thing with animal health, vers human health, is that the patent cliff (period when pharmaceutical patents expire, leading to a sudden decline in revenue due to increased competition from generic alternatives) is less violent. It takes several years to lose half of the revenue instead of some quarters to lose 75% in human health. More information on patent cliff impact for human health just here.

Competitive landscape

Main Zoetis competitors are (as a comparison Zoetis revenues is $8.5B)

Merck&Co. $5.6B revenue for the petcare division

Elanco. $4.5B revenue

Idexx Laboratories. $3.7B revenue

Virbac. $1.3B revenue

Dechra. $0.8B revenue

Vetoquinol. $0.6B revenue

Among the other competitors are Mars (pet food) and Boehringer Ingelheim

Zoetis is therefore the leader of its market and is consistently gaining market share. Since its IPO Zoetis has grown more than its industry every single year.

Zoetis domination can be seen in the following figure, showing the market position of the company in its different markets.

Growth driver and strategy

The key market drivers for the next years are: increasing medicalization, growing human-animal bond, innovation for new treatments, expanding global population and advancing sustainable agriculture.

There is a strong trend for petcare. Owners are younger and wealthier, have a stronger bond with their pets. Innovation allows to increase pet medicalization and develop new technologies.

Among new technologies, Osteoarthritis Pain (OA) should be a huge growth driver with 2 key products able to reach $1B+ sales.

Lifestock growth benefits from fundamental growth drivers like global population growth (and meat consumption). Aquaculture and poultry should also develop quickly due to ecological concerns.

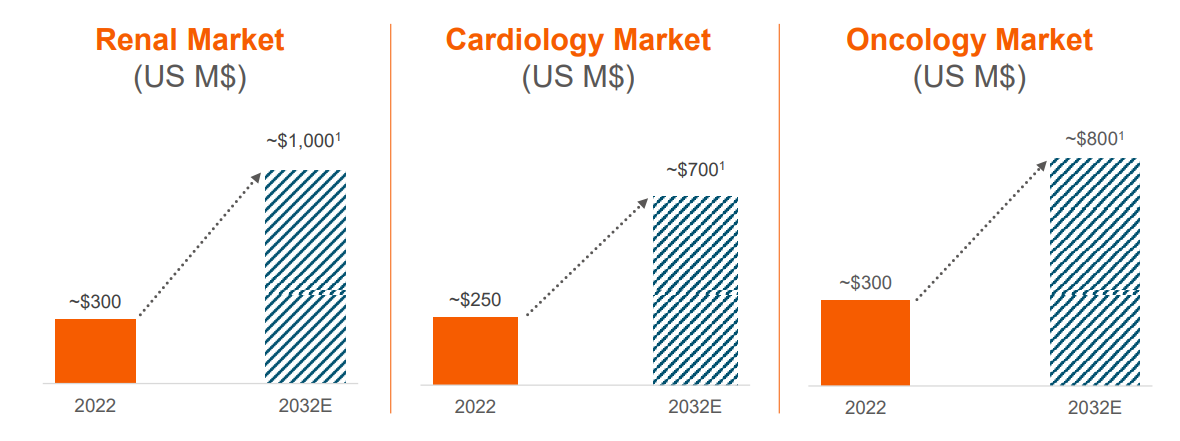

Renal, cardiology and oncology are also very promising markets

The strategy revolves around 4 pillars:

A growth revenue faster than the market. To do that, Zoetis will develop their best sellers, innovate, develop new markets, accelerate commercial excellence to take share.

Invest in innovation and growth capabilities. The goal will be to improve ROIC through investment and R&D prioritization, improve supply chain.

Increase net income faster than revenue. Zoetis will use its scale to leverage its costs and improve its product mix to develop higher margin product categories.

Return excess captial to shareholders through dividend, share buybacks and reinvestment in the business. Zoetis aims to maintain balance between investments and ROIC.

In the short term, there are 5 growth drivers: companion animal parasitides, dermatology portfolio, OA pain, global diagnosis and emerging markets.

Market outlooks

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.