Hims & Hers just released its earnings results, and despite stellar growth, the market’s reaction has been extremely negative after hours. I find this fascinating because it is a classic case, an excellent opportunity to learn and refine one’s investment strategy.

That is the core purpose of this newsletter: to empower you with insights and tools to enhance your performance and deepen your understanding of the stock market!

So, why is the stock crashing? What lessons can we learn? Let’s dive in!

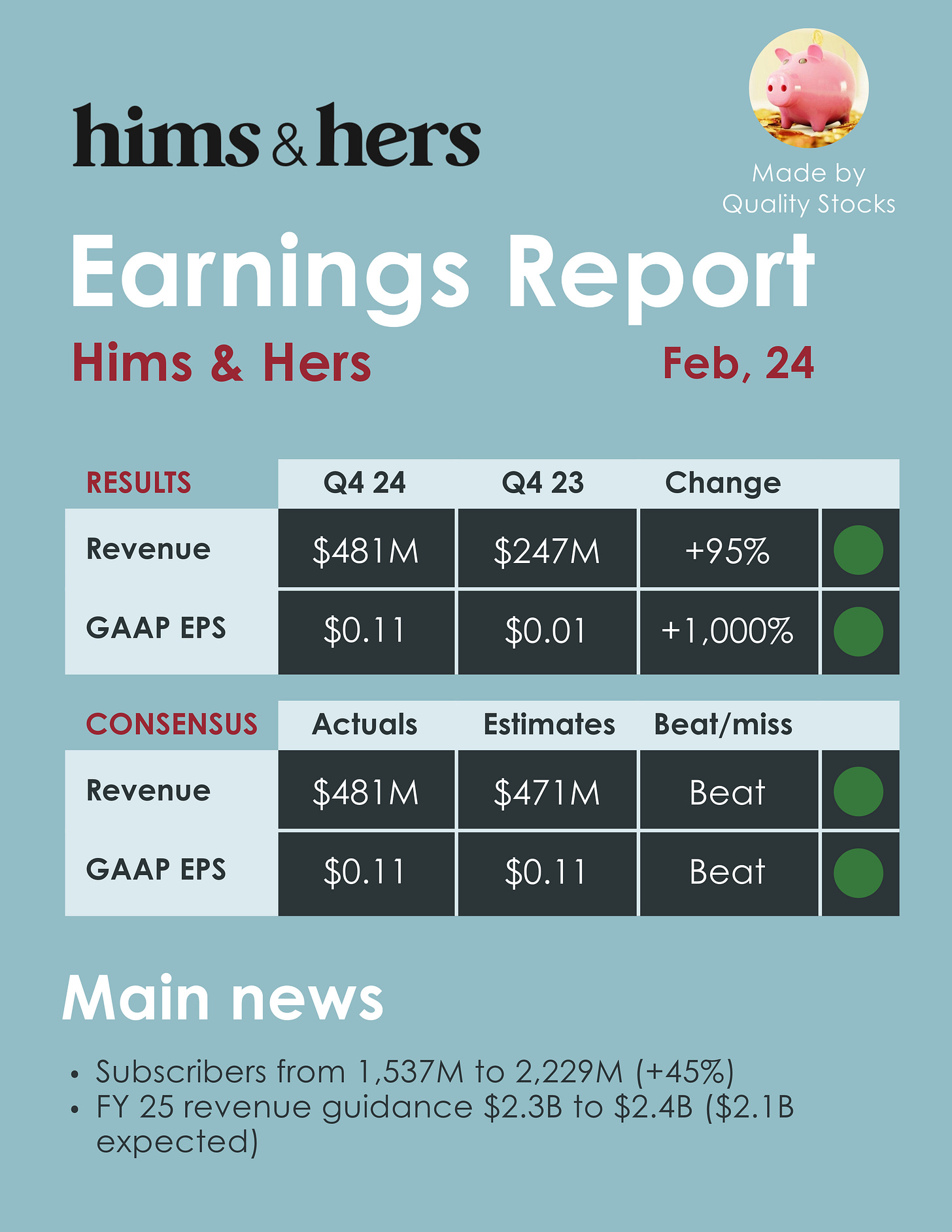

The earnings report

The earnings were impressive, with nearly 100% YoY growth. The company is now profitable, making EPS growth truly stellar.

Subscriber count has surged 45% YoY, rising from 1.5M to 2.2M. Meanwhile, the monthly online revenue per subscriber is also up 38% YoY.

The company is rapidly expanding its market share.

The FY 2025 revenue guidance stands between $2.3B and $2.4B, well above the expected $2.1B. Weight loss revenue should represent $725M so roughly 1/3 of the total sales.

3 reasons the stock is crashing

So, why is the stock crashing? Given the strong earnings report and above-expectations guidance, it may seem surprising.

1. The stock is expensive

Given the company's growth phase and relatively low margins, this is perhaps the least convincing explanation for the stock's decline. However, as of February 24th, the FCF yield was approximately 2.4%, with a PE ratio of 90x.

2. Bad newsflow

The initial drop from over $68 was triggered by the US FDA announcing that the shortage of semaglutide-based weight loss drugs, such as Ozempic and Wegovy, had officially ended. This decision directly impacts Hims & Hers, as the company had been capitalizing on the shortage by offering compounded versions of these medications through its telehealth platform.

Compounded drugs (custom-made alternatives) were allowed only during the shortage, enabling Hims & Hers to fill a gap left by major pharmaceutical companies like Novo Nordisk and Eli Lilly. With supply now stabilized, the FDA is expected to restrict or halt the sale of these compounded versions in the coming months. Since weight loss treatments have been a key growth driver for the company, losing this segment poses a potential challenge.

However, management clarified that the $725M outlook for weight-loss drugs accounts for the revenue impact of the shortage ending.

3. A clear pattern

More importantly, the stock has become overcrowded. The strong growth has attracted speculation, resulting in parabolic charts and exponential returns.

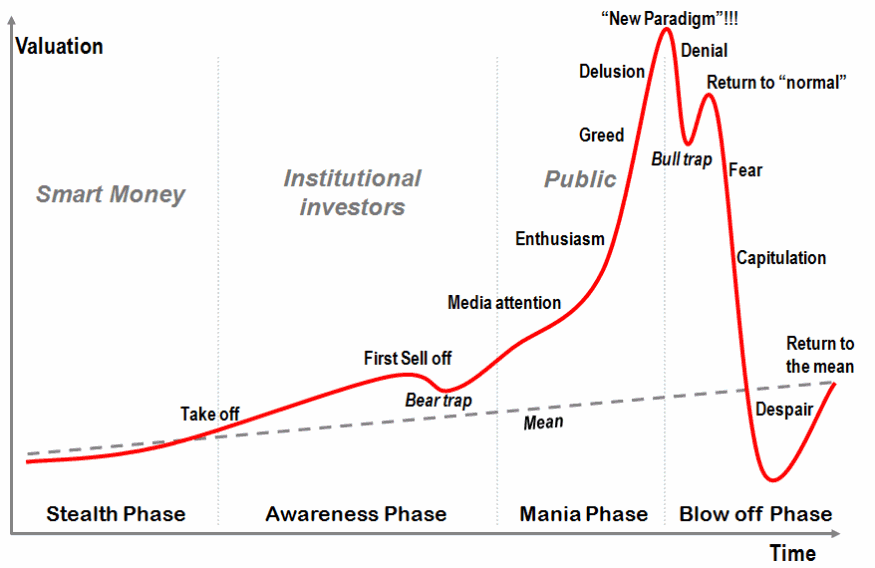

This is a pattern we have clearly identified and analyzed in this article.

In this article, we clearly explain the patterns a stock exhibits during bubble phases (or at least periods of overheating).

Even if the long-term investment thesis remains intact (and it may have changed in this case), it is normal to experience a bearish pullback after a bullish surge, or at the very least, a strong return to normal following a parabolic expansion.

In this case, we can clearly identify the “bear trap” (around January 10th), “the media attention” phase, then the acceleration of the “enthusiasm” phase.

What to do right now?

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.