Waters, A Strong Business Model in the Analytical Instruments Market

Mixing defensive growth and recurring revenue

Waters has long been recognized as a leader in the analytical instruments market, driven by its strong and resilient business model. It specializes in innovative technologies for liquid chromatography, mass spectrometry, and thermal analysis. Central to the company’s success is its focus on high-quality, precision instruments and recurring revenue streams through service contracts and consumables.

This article explores Waters' business model, strengths and weaknesses and will also estimate its outlook and fair price.

Company overview

Waters specializes in 2 core technologies:

Liquid Chromatography: A technique used to separate and analyze different components in a liquid mixture by passing it through a column with a specialized material.

Mass Spectrometry: A method that identifies and quantifies molecules in a sample by converting them into charged particles and analyzing their mass.

These technologies are crucial for analyzing and identifying molecules across various industries. Waters serves four primary markets: Pharmaceuticals, Clinical Diagnostics, Food/Environmental Testing, and Materials Science.

Waters’ business model begins with the sale of precision instruments, with over 150,000 installed globally. Once installed, recurring revenue is generated through three main sources:

Consumables. Essential for maintaining the instruments, with the column, where the chemical reaction occurs, being the most critical component. As proprietary products, Waters remains the primary supplier of these consumables.

Software. Necessary for instrument operation, monitoring, and analyzing results, ensuring optimal performance of the systems.

Services. Offering training, support, and maintenance to keep instruments functioning efficiently.

At the end of an instrument’s lifecycle, typically around 5 to 7 years, customers are prompted to replace or upgrade, continuing the revenue cycle. Additionally, new applications for Waters’ technologies may emerge, further driving growth.

Revenue breakdown

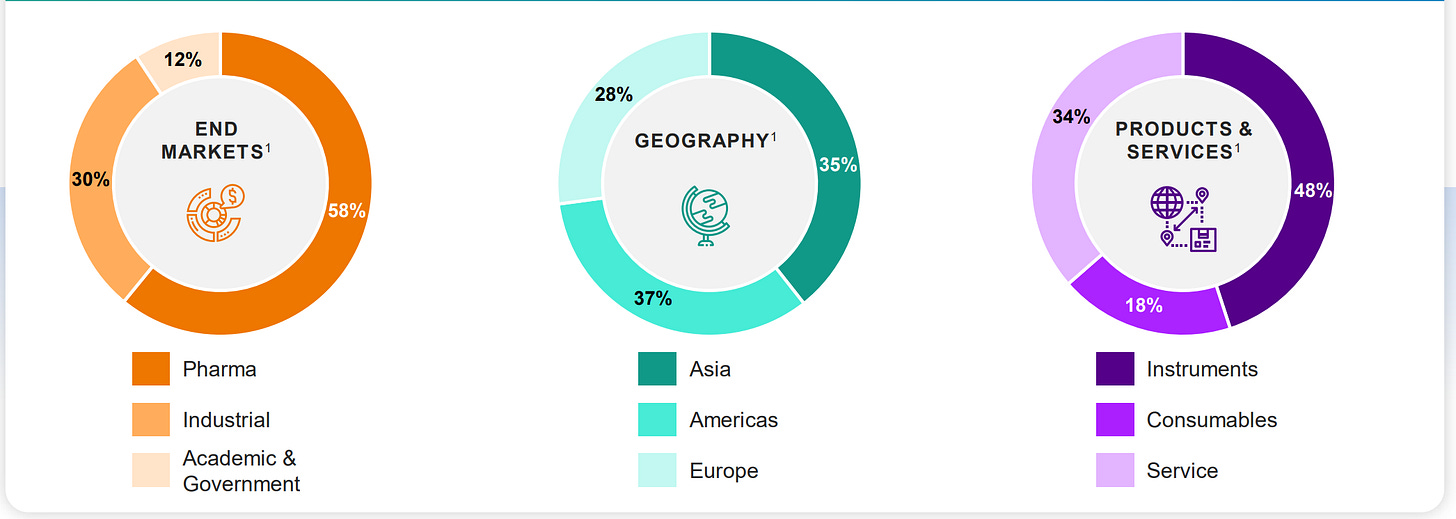

The pharmaceutical sector accounts for over 50% of Waters' total sales, making it the largest contributor. The industrial sector follows, with the food industry being a key component within this category.

Geographically, the company's revenue is well-balanced, with approximately one-third of sales coming from Europe, the Americas, and Asia, respectively.

An important strength of Waters’ business model is that only 48% of sales are from instrument sales. The remaining 52% comes from consumables and services, both of which generate recurring revenue streams. This strong reliance on recurring revenue is one of the company's major advantages.

Innovation is the main growth driver

Growth opportunities for Waters can come from several avenues, including price increases, expanding service offerings, or gaining market share. However, the most significant driver of growth is likely new applications, as they expand the company’s total addressable market (TAM).

These new applications are fueled by Waters’ strong commitment to R&D, which represents over 5% of total revenue and nearly 10% of instrument revenue.

Waters also leverages innovations to maintain and grow its market share by delivering greater value to customers, such as faster testing, reduced human error, and enhanced detection of specific molecules.

The current estimated TAM for Waters is $12 billion, with potential for an additional $7 billion through emerging markets like battery testing, sustainable polymers, and bioanalytical characterization, which are seeing rapid growth.

Outlook

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.