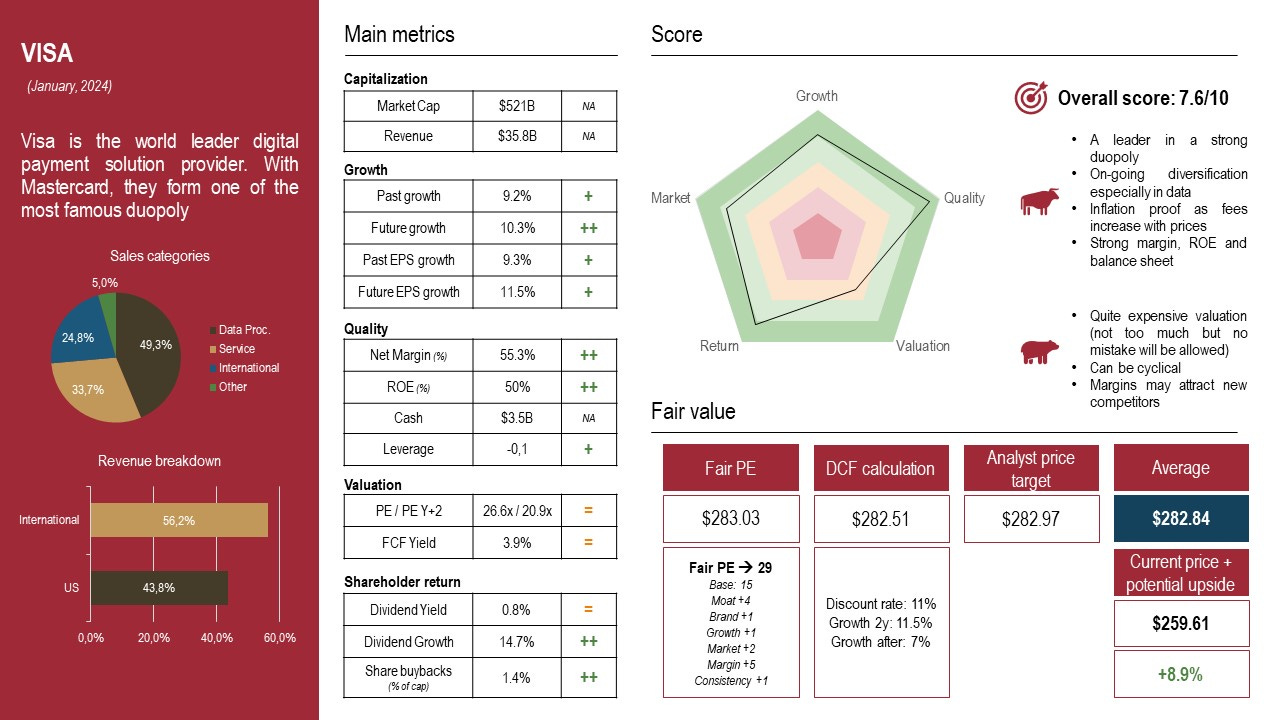

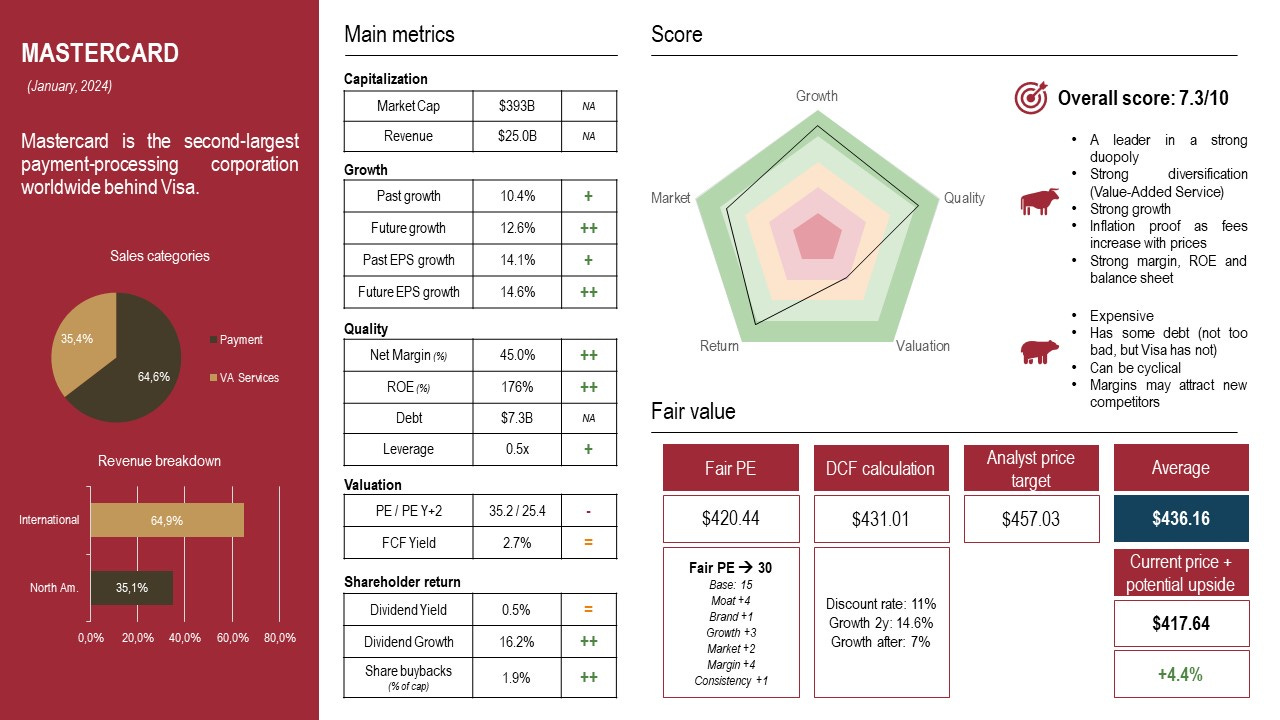

Certain companies consistently command attention due to their extraordinary metrics. Two such entities, Visa and Mastercard, stand as titans in the payments industry. This article aims to help understand and compare the most famous duopoly in the world. By provinding 2 one-pager analysis, you can explore, understand and compare Visa and Mastercard at a glance.

In terms of metrics, the huge differences are:

Mastercard is growing faster at around 14% vs 10% for Visa

But Mastercard is more expensive with a PE above 35x vs less than 27x for Visa

Mastercard also has debt and Visa as not, but the leverage of the debt remains reasonable at around 0.5x EBITDA

Neither of them seems overvalued but the current price is really close to fair value. So no upside shall be expected due to low valuation.

Both are ultra high quality, so the choice between Visa and Mastercard is mainly a style choice: growth or GARP.