Updated Evolution AB Stock Analysis

An update to my previous publication incorporating the latest insights from the Q4 2024 report

Almost a year ago, I published my first research article about Evolution (available just here). In this article, I focused on:

The business model and the value chain - how the company makes money

The different brands inside the company (live casino and RNG)

The geographical breakdown

The strategy of the company to grow

A market sizing by 2030

The metrics of the company

A SWOT analysis to highlight the risks and opportunities

A fair price analysis

Using the Q4 2024 report, I will update this research article and add elements to focus on the new challenges the company faces.

Growth and key metrics

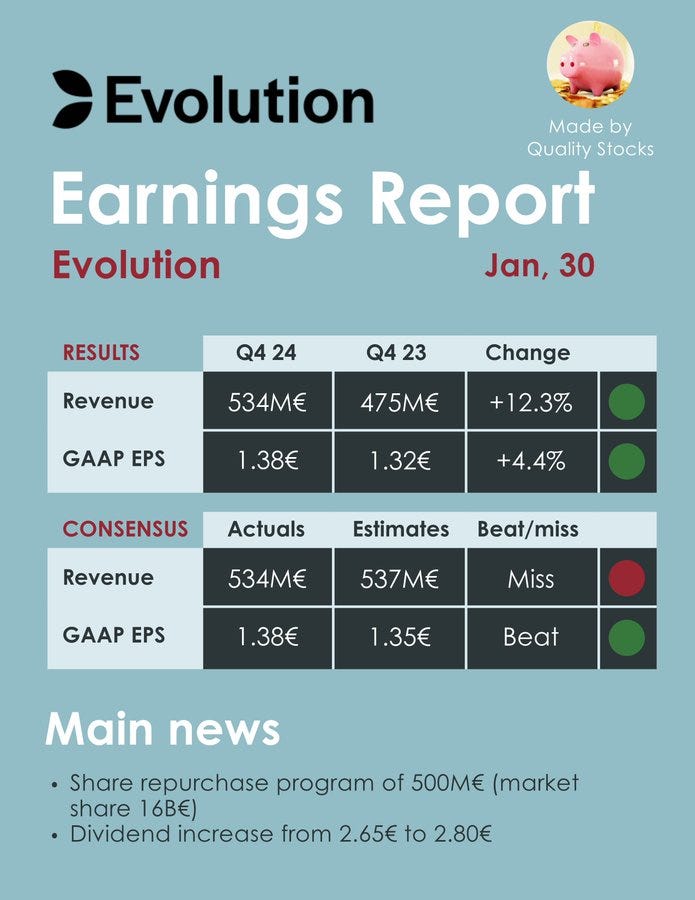

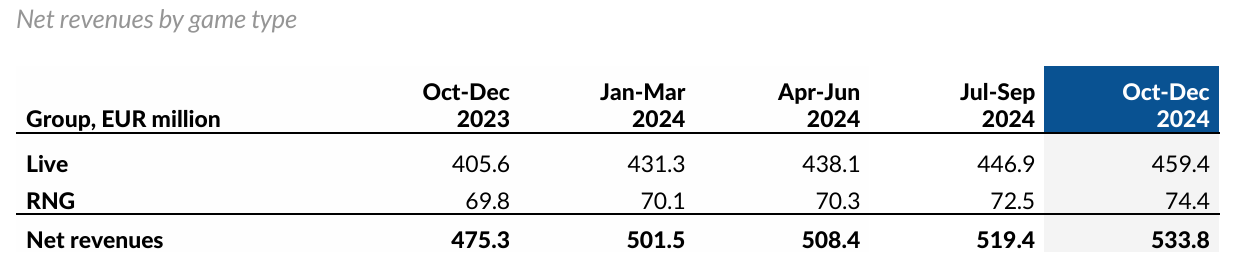

The company reported a 12% year-over-year growth. While some investors highlight that growth is slowing, which is true, I am not surprised. In my market sizing analysis, I estimated the online gambling market's growth potential to be between 11% and 12% annually for the next six years.

Live casino may be slightly more dynamic than the broader online gambling market (as discussed in my dedicated article on online gambling), but given Evolution’s dominant market share, a gradual normalization of growth is expected.

The second key metric is margin. Adjusted EBITDA margin increased by only 8%, and with the higher Swedish tax, EPS rose just 4%.

In 2024, the EBITDA margin stood at around 68%, with expectations for 2025 ranging between 66% and 68%. While I don't see this as a long-term concern, it will slightly impact my DCF model and, consequently, my fair price estimate.

Live Casino represents more than 80% of the revenue and as it is growing faster than RNG, this will continue.

Asia's growth remained flat quarter-over-quarter, while the U.S. was the fastest-growing region, underscoring the strong potential of the North American market for Evolution, and the rationale behind the company's significant investments in this region.

Many challenges… but even more opportunities

The stock is under pressure due to a series of negative developments, including:

Slowing growth

Strikes and operational disruptions in Georgia

Cyberattack-related disruptions in Asia

Legal challenges, including a class action lawsuit in the U.S. and an investigation by the UK Gambling Commission

Increasing regulatory scrutiny

A higher tax rate in Sweden and stronger costs, leading to lower margins

It would be unwise to downplay these factors. However, what stands out to me is that while they may cause short-term turbulence, they do not fundamentally alter the company's long-term outlook. Let’s explore why!

Slowing growth

I have already explained why I believe a 10% to 12% organic growth rate is reasonable for the company, its market is expanding at a similar pace.

However, the company is also leveraging its cash reserves and the low valuations of competitors to drive additional growth through acquisitions, such as its recent purchase of Galaxy Gaming. These acquisitions not only provide a slight boost to growth but also create commercial and operational synergies.

In the live casino segment, the number of tables has increased to 1,700, 100 more than at the end of 2023. Management remains optimistic about growth and continues to invest accordingly.

“To respond to the continued strong demand for Live Casino we will continue to invest for growth during 2025. We have ongoing projects for new studios in Brazil and the Philippines and I expect in total to open 3-4 new studios during the year. For 2025 we estimate capex of about 140 MEUR in line with 2024.”

Improvements made to the RNG platform helped increase growth even if it only reached 7% YoY.

Regulation is an opportunity

In my different writtings, I always stated that regulation was a short-term disruption and a long-term opportunity. Why? Because in the short-term the company may face revenue reductions. But in the long-term regulation benefits to the biggest players.

Evolution’s management seems to agree with this statement and declared in the last report:

“An increasing number of countries introduce a national regulation for online casino. We view this development positively and consider it a long-term driver of growth for the industry as it over time attracts new end-users and clarifies how B2C operators can address the market”

The net revenue in regulated markets is growing faster than the revenue in unregulated markets (16% YoY). The share of regulated market (currently at 41%) will also continue to grow as regulations develop in major countries.

“We have a very exciting year ahead in Latin America, where the Brazil market introduced local regulation starting in January 2025, our upcoming local studio will be important to supply the demand in the country.”

Decreasing margin

While increased tax-rate is a long-term issue, it doesn’t change the growth outlook of the company. The forecasted decrease in EBITDA margin is due to higher costs (especially to enter new markets) and a will to develop in regulated markets.

This should represent a long-term opportunity. Management is even more optimistic, stating that margins are expected to improve over time.

“We estimate the EBITDA margin for full-year 2025 to be in the range of 66-68 percent. We have scalability in our business model and in the longer term there is good opportunity for higher margins.”

Other opportunities

The very low valuation gives the opportunity to the company to buyback shares at a very small price. This will probably partially compensate the margin reduction.

The company recently announced a 500M€ new share buyback program (above 3% of the market cap). The company currently owns 2.5% of its own share. In comparison the market cap is currently around 15B€.

Customer concentration

The top 5 customers are becoming increasingly important. While this isn’t a major concern at the moment, it’s something to monitor to see if Evolution can maintain a balanced share across its top 5 customers.

In the following sections, I will update my fair price estimate, identify potential buy zones for the stock, and calculate the total shareholder return an investor could expect from investing in Evolution.

Access to this section is available to paid subscribers. Subscribe now to unlock a wealth of content, exclusive research, analyses, screeners, and to track my portfolio!