Understanding the difference between ASML, Applied Materials, KLA Corporation and LAM Research

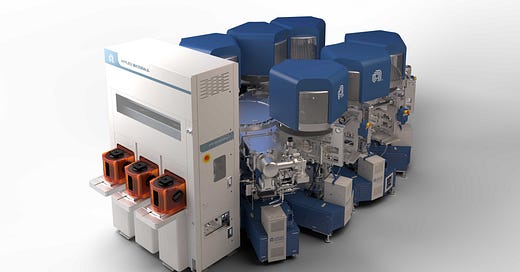

4 semiconductor equipment giants

The semiconductor market is at the center of modern technological innovation, powering advancements in fields such as artificial intelligence, 5G, and electric vehicles. Semiconductors are increasingly present in cars, phones, computers, robots, and countless other devices.

Given this context, it is unsurprising that various segments of the semiconductor value chain, including equipments, raw materials, and software, are experiencing significant growth. Equipment manufacturers, in particular, are a pick-and-shovel play in this sector, providing the critical tools needed to fabricate semiconductors.

However, it can be challenging to understand the differences between each equipment manufacturer. In this article, we will define the basic elements of the semiconductor manufacturing process and compare four of the top five manufacturers: KLA Corporation, Lam Research, Applied Materials, and ASML.

The Top 5 players

The equipment manufacturing market is dominated by 5 main players. The Top 5 players have the following revenue:

ASML (Netherlands) $33B

Applied Materials (US) $29B

LAM Research (US) $17B

Tokyo Electron (Japan) $15B

KLA Corporation (US) $11.6B

Other players are much smaller and include ASM International, Teradyne or Nikon. In this article, we will focus on 4 of the Top 5 players.

The different equipments

The main way to distinguish companies is to identify the kind of equipment they produce. Each equipment type at a specific test of the production line / or depends on the used technology. Here are some major types:

Litography equipment transfers circuit patterns onto silicon wafers using light or other energy sources. Wafers are coated with a photosensitive material (photoresist), exposed to light through a mask, and developed to create patterns

Track equipement applies and develops photoresist on wafers before and after lithography

Clean equipment removes contaminants, particles, and residues from wafers to ensure high yield and precision

Chemical Vapor Deposition (CVD) equipment deposits thin films of material on wafers by chemical reactions in a vapor phase

Physical Vapor Deposition (PVD) equipment deposits thin metal or dielectric films through physical methods like sputtering or evaporation

Epitaxy (EPI) equipment grows a high-quality crystalline layer on a silicon wafer substrate

Etching equipement removes specific areas of material from wafers to create patterns

Chemical Mechanical Planarization (CMP) equipement polishes and planarizes wafer surfaces to ensure flatness for subsequent layers

Thermal processing equipment alters material properties through controlled heating

Implant equipment introduces dopants into the wafer to modify electrical properties

Process Diagnostics and Control (PDC) monitors, analyzes, and controls manufacturing processes to ensure high quality and yield

Electrochemical Deposition (ECD) deposits metal films, particularly copper, through electroplating

What does each company do?

This chart is very interesting as it shows the market share (and size) of each of the 5 major companies in each type of equipment.

We clearly identify the dominance of ASML in litography and of KLA Corporation in control equipments. Applied Materials has the broader product range, reflecting its strategy to be a one-stop-shop.

Comparison

Revenue comparison

As we saw earlier, here is the revenue for each company:

ASML (Netherlands) $33B

Applied Materials (US) $29B

LAM Research (US) $17B

KLA Corporation (US) $11.6B

Growth

In the past decade, ASML has been the fastest grower. This dynamic should continue in the next years.

KLA Corporation expected EPS growth in 2025 is due to weak financial performance in 2024 (as well as Lam Research).

Applied Materials is the slowest growing company but it remains the more diversified.

Net and gross margin

KLA Corporation presents the highest gross margin with 61%. ASML is next with 51%. Applied Materials and Lam Research are very close with 47% and 48% respectively.

For the net margin, we have the same order:

KLA Corporation 33.6%

ASML 28.8%

Lam Research 26.4%

Applied Materials 26.0%

Valuation

In this category, it is only logical to see that the actors with a dominance in their niche (KLA Corporation but mostly ASML) and the highest growth and margins have a richer valuation.

Service

Service plays a fascinating and critical role in the semiconductor equipment industry. It encompasses a diverse range of activities, including spare parts, equipment relocation, repairs, consumables, upgrades, and software solutions. This segment is particularly compelling for several reasons:

Recurring revenue. Service generates consistent, reliable income streams

High gross margins. The profitability of this segment is strong

Rapid growth. Service revenues are outpacing the overall revenue growth for all four major companies

In terms of revenue contribution, service accounts for 23% of total revenue for ASML, Applied Materials, and KLA Corporation, an interesting uniformity across these industry leaders. Lam Research, however, stands apart with a more service-focused strategy, driving service to represent 43% of its total revenue.

Balance sheet

KLA Corporation is the only company having debt (representing 0.4x EBITDA). The net cash position of the 3 other players is between 0.2x and 0.4x EBITDA.

Other elements

Applied Materials has a “display activity”. This activity focuses on providing equipment, services, and technologies for manufacturing advanced display panels used in TVs, smartphones, monitors, and other devices, with an emphasis on innovations like OLED and flexible displays. It represents a small proportion of the revenue for now (around 3.5%).

KLA Corporation has the highest ROE but all 4 companies have an ROE above 30%.

A stock for each style

Each stock aligns with different investor expectations:

ASML. Ideal for investors seeking dominance, ASML operates almost as a monopoly in the lithography space. Its strong financial metrics and the growing importance of lithography in semiconductor manufacturing make it a compelling choice

KLA Corporation. Similar to ASML, KLA thrives on niche dominance, with robust margins and favorable market tailwinds as demand for control equipment grows faster than the broader market. However, it offers a more attractive valuation (and is slighlty less dominant)

Lam Research. Perfect for those valuing recurring revenue, Lam Research boasts 43% of its revenue from services, growing over 20% annually. While it may lack the edge of niche specialists or broader offerings, its focus on recurring income makes it an intriguing investment

Applied Materials. A quintessential GARP (Growth At a Reasonable Price) play, Applied Materials balances slower growth with stability. Unlike KLA and Lam Research, it avoided a revenue decline in 2024. Its lower valuation reduces expectations, while aggressive share buybacks bolster EPS growth.

Conclusion

It is unlikely that these companies manage to reproduce their previous performance in the future. However, reasonably valued and with a promising market, they offer interesting investments if you aim between 10% and 14% return a year.

Let me know what you think of this comparison and these stocks in the comments!

If you liked this post, give it a like and spread the word!

Used source: Marketscreener.com. Affiliate link just here

Great read. I have a long position in each of the 4 stocks you focused on!

You hit the nail right on its head. Each company has their own focus and there is an upside from gaining exposure to all.

Excellent, thank you very much.

Do you have an analyse about MPWR?