Top Analysts' Major Predictions for 2025

I have compiled major banks' insights so you don't have to!

If you have been following me for a while, you know that I pay close attention to what analysts are saying: price targets, stock recommendations, and predictions. I don’t do this to blindly follow their advice, as I am well aware that most of their insights are not actionable, and their stock picks are rarely contrarian. However, it is a valuable way to gauge the prevailing sentiment and understand what major players are anticipating.

If you are not a fan of analyst opinions, feel free to stop reading here. But if you are curious, I have compiled all the key insights and predictions for 2025 in this article so you don’t have to! Save yourself hours of research with this comprehensive overview!

S&P 500 performance forecast in 2025

Major banks participate in the exercise of forecasting the S&P 500’s year-end level. Here are their predictions for 2025:

Goldman Sachs: 6,500

Morgan Stanley: 6,500

Citi: 6,500

Evercore ISI: 6,600

Barclays: 6,600

Bank of America: 6,666

HSBC: 6,700

BMO Capital Markets: 6,700

Deutsche Bank: 7,000

Yardeni Research: 7,000

Wells Fargo: 7,007

Oppenheimer: 7,100

For context, last year’s average forecast was 4,860, yet the index ended the year above 6,000. (And I don’t mean that the market will go even higher or lower, just that this kind of forecast is very difficult to make)

Macquarie

Global growth

“The global economy has held up remarkably well in recent years despite being buffeted by some large external shocks. With the ripple effects of these shocks now petering out, this bodes well for 2025, and we expect trend-like global growth next year. The developed-world consumer is in excellent shape and should be a key pillar of growth. The policy environment is likely to be volatile, but tariffs are unlikely to have a major impact on growth in 2025, with most of the impact in 2026. China remains challenged by a weak housing market and limited policy flexibility, and growth is likely to disappoint again next year.”

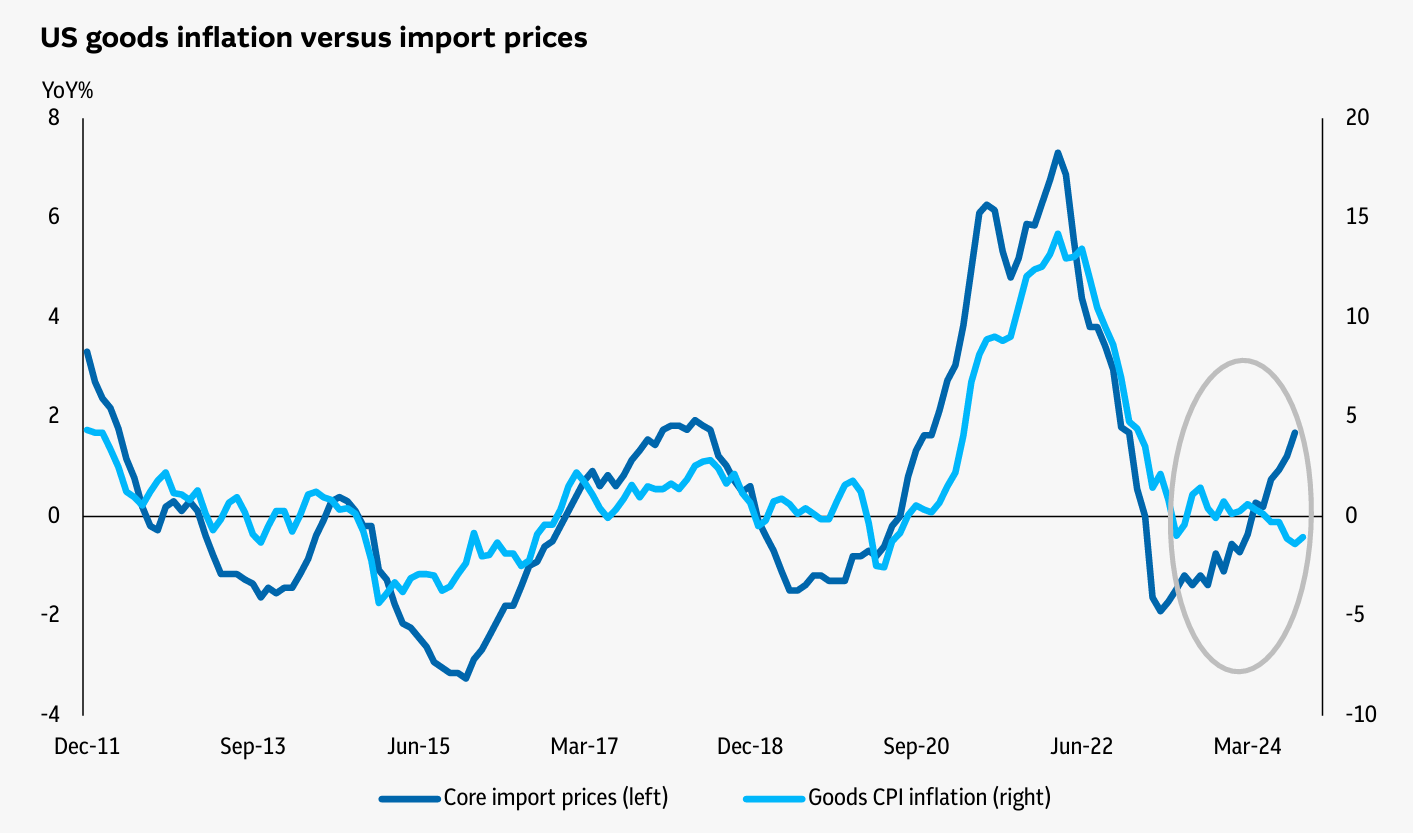

Inflation

“Inflation – both headline and core – has fallen a long way. For most of the developed world it is either back to 2% or headed there rapidly. Much of the disinflation has come through falling goods prices, however, with services inflation remaining remarkably sticky. Looking ahead, goods prices could turnaround, particularly if 2025 is a year of increasing tariffs. This would complicate the outlook for monetary policy, potentially slowing the pace of easing from many of the world’s major central banks.”

Interest rate expectations

“Central banks (with the exception of the Bank of Japan) have been reducing interest rates for some time now, with the aim of returning monetary policy to a more neutral setting. Markets are pricing in significant further cuts, although expectations for how far the US Federal Reserve will ease have been wound back recently. But if goods inflation does return, and global growth remains strong, central banks may pause their easing cycles earlier than the market and many analysts expect.”

Investment implications

In 2025, real estate is expected to benefit from falling interest rates and healthy global growth, particularly in sectors like residential, living, and logistics, where supply-demand dynamics are favorable. Infrastructure should see higher multiples due to lower interest rates and strong growth, with private infrastructure likely delivering returns of 11-12%, above its long-term average. Listed equities face valuation challenges, but there are pockets of value, especially in small-caps and real assets, with attractive opportunities outside the US in financials, utilities, and consumer staples. While debt and credit markets may face pressure from overestimated rate cuts, yields remain attractive, particularly in Australian and European sovereign debt, and private credit continues to offer strong risk-adjusted returns, benefiting from a shift away from bank lending and increased private equity deal flow.

You can find the full report just here.

Morgan Stanley

Morgan Stanley identified 5 major themes for 2025

How to invest in a fully-valued market

“Investors rarely agree on any one point; after all, there is a buyer and a seller at every price. But as we enter 2025 most investors do agree on one thing: Market valuations seem to be full and not many think assets are cheap. This is true across both fixed income and equities, the most widely traded asset classes. The question we then ask about 2025 is: How do you invest in a fully-valued market? The simple answer is to optimize asset and investment selection in portfolios, because their return attributions may make a bigger difference than has been the case over the last several years. Said differently, we must prioritize alpha over beta.”

The bull market matures on optimism

“On September 30, 2022 the S&P 500® hit a -25% bear market correction from earlier in the year. But historically, -25% corrections have generated excellent buying opportunities. As it turned out, the 12-month return for the S&P 500® at the end of September 2023 was +20% and 2024 has been equally consistent as the second year of this bull market. We are now entering what we believe is the “optimism phase” of the bull market, where we expect investors to be even more optimistic than they have been in the past two years. The final leg of a bull market, before the next bear market, is the “euphoric stage” - and that’s the danger zone. But that comes later. Expect to enjoy 2025.”

In fixed income, securitized credit might be the sweet spot

“Our central view heading into 2025 is that we believe monetary policy will outpace current market expectations, driven by moderate growth and a bumpy, yet persistent, disinflationary trend. While the base case remains economic data-dependent, the post U.S. election environment has made it increasingly policy-dependent as well. If fiscal dovishness materializes amid higher tariffs, we anticipate further upward pressure on yields, steeper yield curves and rising risk premiums, ultimately pushing terminal rates higher. However, we believe markets are currently priced on the hawkish side of our base case. On the other hand, a moderating monetary policy, coupled with a strong consumer, robust corporate balance sheets and healthy investor demand for risk should bode well broadly for fixed income spread sectors. Overall, we believe the best opportunities will be in securitized credit, particularly U.S. MBS.”

Stimulus fatigue: China can’t band-aid its way to recovery

“Since September 2024, Chinese policymakers have focused on delivering a series of stimulus packages to inject new life into their struggling economy and boost share prices. However, high debt levels, overinvestment, an unresolved property bubble, underwhelming domestic consumption and international trade pressures all contribute to the structural weaknesses in China’s economy that stimulus packages alone cannot resolve. Lessons from other debt laden economies suggest the path to stability requires cleaning up bad debt through either write-offs or restructuring, followed by bank recapitalization. This approach is undeniably painful, but without such drastic measures, stimulus packages will continue to provide fleeting relief. Deeper transformation must occur in China for lasting economic health”

The potential impact of Gen AI on private markets

“The potential impact of generative Artificial Intelligence (AI) on private market performance is expected to be a key theme in 2025. While private equity is expected to participate through both investing in “AI-natives” and companies that attempt to expand revenue and profitably through AI applications, we recognize that some of the earliest opportunities are identifiable in private infrastructure. Two key infrastructure-related themes driving this have been the digitization of society and economies, and the global energy transition. These two mega themes meet where data requirements lead to power demand, and this is leading to extensive investment opportunities.”

You can find the full report just here.

JP Morgan

JP Morgan for 2025 presented a range of ideas “top 25 for ‘25”. Here is a summary

Easing global policy

1. Normalizing policy rates. “The global easing cycle will likely support economic growth and risk assets such as stocks and high-yield bonds, but we don’t think it will spark a surge in borrowing that pushes growth and inflation to an above-trend rate.”

2. US & Japan over emerging markets & China. “More broadly, even when EM companies do deliver strong revenue and profits, shareholder dilution means that GDP growth does not always translate into earnings per share growth or market returns. Volatility in earnings and currency valuations also disrupts compounding.”

3. Continued US housing shortage

4. Productivity gains. “If AI-driven productivity gains are sustained, it could propel GDP growth without stoking inflation (and helpfully offset pressure from aging populations).”

5. Increased dealmaking

Accelerating capital investment

6. AI: boom or bust? “AI could potentially impact all services activity in the economy”

7. Healthcare disruption. AI and GLP-1 will continue to be healthcare market drivers

8. Automation & robotics

9. Building power infrastructure. “Investors looking to capitalize on the growing demand for power can focus on broad infrastructure funds, power generation and utility companies.”

10. Redefining security

Understanding election impacts

11. Defining Trump 2.0

12. Sunsetting tax policy

13. Managing rate volatility. “Markets could view any type of expansionary fiscal policy and increased government spending as a reason to demand higher yields for holding long-duration sovereign debt.”

14. Anti-trust risks. “As governments are increasingly viewing data and technology as strategic assets, some large technology firms have effectively functioned as tolerated monopolies. This may not change even if overall anti-trust activity picks up.”

15. Rising anti-establishment movements. In the US but also in Europe, Japan and India.

Renewing portfolio resilience

16. The wealth check. “Our research has found that nearly half of all publicly traded companies at some point suffer a catastrophic loss in value, and nearly two-thirds underperform the index”, a word to reduce the risk of the portfolios

17. Finding value in income. “One way to increase portfolio resilience is to increase the share of total return that is driven by income. Many investors will be looking for new sources of income as cash and Treasury bill yields decline.”

18. Defending agains inflation

19. Reconfigured returns. “Consider using tools such as options to change the risk and return profile of underlying assets”

20. The gold rush. “Gold ETF inflows were nonexistent in 2024, but new demand from retail investors, who face declining risk-free interest rates in 2025, could push prices higher.”

Evolving investment landscapes

21. Evergreen alternatives

22. Sports & streaming. “Sporting events are one of the few media experiences that reliably attract significant viewership”

23. The 21st century space race. “The U.S. Department of Defense’s budget requests for space-based systems have increased from roughly USD 9 billion in 2019 to more than USD 25 billion in 2025”

24. Liability management. “As the market begins to anticipate future policy rate cuts, borrowers can lock in lower rates regardless of whether the rate cuts materialize”

25. Reimagined cities

You can find the full report just here

Bank of America

Here are the 10 key macro calls for the markets in 2025:

S&P 500 upside potential. Savita Subramanian forecasts over 10% growth for the S&P 500 in 2025, supported by a 13% acceleration in earnings growth.

US economic growth. Aditya Bhave projects US GDP to grow by 2.4% in 2025 and 2.1% in 2026, driven by improved productivity and supportive fiscal policies that may benefit the US more than other global economies.

Federal Reserve policy. The Fed is expected to cut rates by 25 basis points in both March and June before pausing, with the 10-year Treasury yield remaining in a tight range of 4-4.5%.

Commodities outlook. Weaker demand for raw materials in 2025 may result in oversupplied oil and grain markets, while metals remain balanced. Gold is expected to peak at $3,000 per ounce after early-year headwinds.

US Dollar performance. The USD is anticipated to remain strong through the first half of 2025, with growth concerns and policy uncertainty likely leading to depreciation in the second half.

Emerging markets opportunities. Uncertainty surrounding US policy could pressure emerging markets in the short term. However, a peak in the USD and clarity on trade policies may create attractive buying opportunities.

Cyclical sector outperformance. Cyclical stocks are poised for strong performance in 2025, driven by factors such as productivity gains, increased manufacturing investment, and favorable political shifts.

Strong credit demand. Developed market credit is expected to deliver strong total returns for the third consecutive year, supported by robust demand and favorable market conditions.

Chinese growth outlook. China's GDP growth is projected to slow to 4.5% in 2025. However, domestic demand stimulus is likely to offset tariff-related impacts over time.

European equities recovery. European equities may face a 7% decline in the Stoxx 600 by mid-2025, followed by a recovery to levels near current valuations.

Conclusion

In conclusion, 2025 is shaping up to be a pivotal year for global markets, offering both challenges and opportunities across asset classes and regions. From bullish forecasts for the S&P 500 and US economic resilience to a cautious outlook for Chinese growth and emerging markets, the landscape will demand strategic focus and adaptability.

Major banks plan shifting monetary policies, evolving inflation dynamics, and sector-specific trends, such as AI-driven productivity gains and cyclical sector outperformance. They recommend investors to stay informed and prioritize thoughtful asset allocation, to capitalize on the opportunities that lie ahead.

What are your predictions for 2025? Share that in the comments!

If you liked this article and enjoy Quality Stocks, spread the word!

Merci pour ton analyse. En effet, les perspectives pour 2025 sont intéressantes, avec un S&P 500 en hausse et des opportunités dans des secteurs comme l'IA et les petites capitalisations. On va suivre ça de près ! //******//Thanks for your analysis. Indeed, the prospects for 2025 are promising, with the S&P 500 on the rise and opportunities in sectors like AI and small caps. We'll keep an eye on that!

On GB,Türky,Italia,Zypern ,Swiss,Portugal,Malta,Nederland is more!