Why are Share Buybacks a good thing?

On the stock market, a cannibal gets bigger and bigger

Some companies are particularly known for buying back their own shares in large quantities. They are often referred to as cannibals.

These cannibals are among my favorite stocks. On one hand, it is a way of generating returns for the shareholder with little or no tax. On the other hand, when it is done well, it is often a sign of quality for the company.

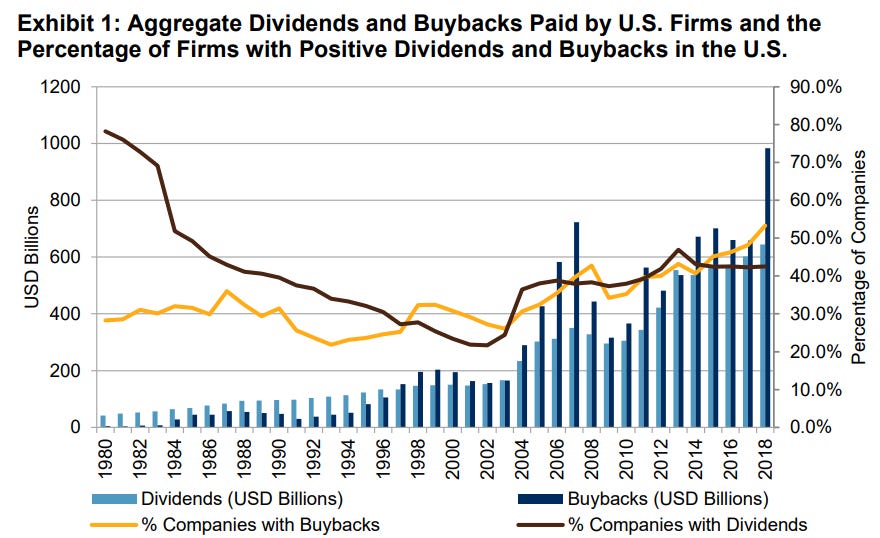

Since 1997, share repurchases have surpassed cash dividends in the US. This is a sign of the growth of this form of shareholder return.

So why is it good to have cannibalistic actions? Well, because the returns are greater over time.

On the S&P 500, over the last 10 years, the average performance of the S&P 500 buybacks index has been 15.5% per year, compared with 13.6% for the S&P 500 and 13.5% for the S&P 500 equal weight.

These elements can be found over other time periods:

Over 15 years, the average annual return is 11.2% for the S&P buyback index, compared with 9.0% for the S&P 500.

Over 20 years, we have 11.5% vs 6.1%

The buybacks strategy is even more effective than other strategies, such as the dividend strategy. In fact, the source of the return is made up largely of dividends.

Whether it is because it is a promising long-term strategy, or just a sign that the company is doing well, share buybacks are an element to watch when choosing which stocks to invest in.