The Learning Curve, Essential Knowledge for Investors

How the learning curve impact

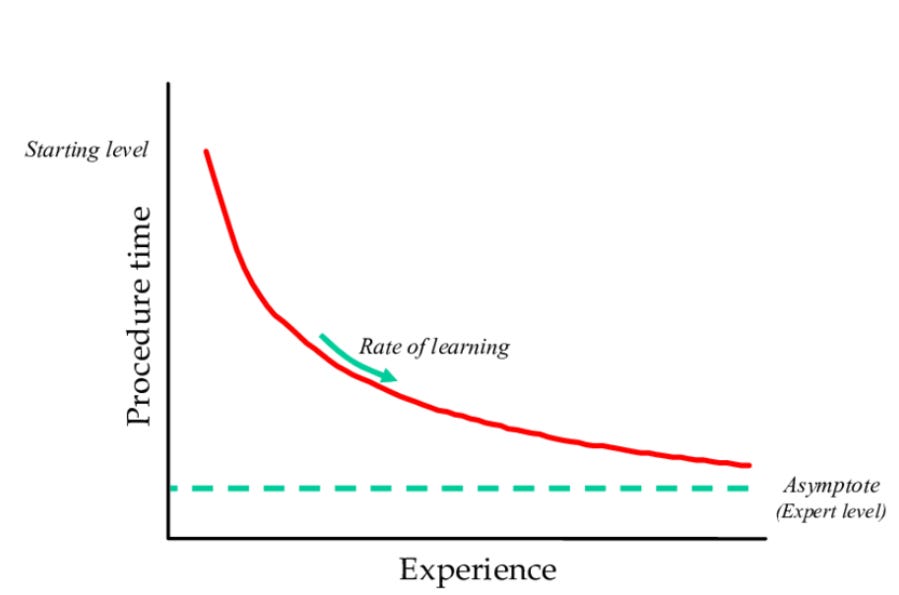

The learning curve is a concept that describes how individuals or organizations improve efficiency and reduce costs as they gain more experience with a specific task or process. The learning curve suggests that as the cumulative volume of production increases, the time and effort required to produce each additional unit decreases. This relationship between experience and efficiency is often represented graphically as a downward-sloping curve.

The learning curve significantly influences costs, particularly in the early stages of a market when cumulative experience has the most pronounced effect. As businesses and workers improve their efficiency with each iteration, costs decrease. For investors, understanding how the learning curve impacts a company’s cost structure and long-term profitability is essential.

This article aims to explain the learning curve’s role in shaping business performance and how investors can leverage this knowledge to make informed decisions.

Key principles of the learning curve

The fundamental principle behind the learning curve is that repetition leads to improved proficiency. For example, as workers repeatedly perform the same task, they become faster, make fewer mistakes, and identify more efficient ways of completing the task. This enhanced proficiency is due to both individual learning (people gaining more experience) and organizational learning (the company streamlining processes, improving workflows, and investing in better equipment).

The rate of the learning curve refers to how quickly efficiency improves and costs decrease as experience accumulates. It is typically expressed as a percentage that shows the reduction in production costs for every doubling of cumulative output. For example, a X% learning curve indicates that with each doubling of production, costs drop to X% of the previous level, resulting in a 1-X% improvement. Learning curve rates can vary significantly across industries. Labor-intensive industries, such as manufacturing, often experience steeper learning curves, where cost reductions happen more quickly. In contrast, industries where automation or capital investments dominate, such as tech or pharmaceuticals, may see slower cost declines due to a less immediate impact of human learning on efficiency.

The impact on costs

The learning curve directly impacts costs by reducing the time, effort, and resources required to produce each unit over time. As workers and companies improve their efficiency, labor costs decline because fewer hours are needed to produce the same amount of output. Material costs can also decrease if production improvements reduce waste or lead to better use of resources. Buyers can enhance their purchasing costs by refining their sourcing strategies or benefiting from the suppliers' learning curve.

This reduction in costs over time gives companies a competitive advantage. By understanding and anticipating the learning curve effect, businesses can lower their prices while still maintaining profitability, undercutting competitors and gaining market share. Additionally, companies that move down the learning curve faster can reinvest the savings into new innovations, further driving cost reductions and creating a virtuous cycle of improvement.

Who gains the most from the learning curve?

The learning curve predominantly benefits two types of companies:

Market Leaders. These companies can quickly double their production capacity, capturing the majority of the market volume. As they increase their output, they move more swiftly through the learning curve, which leads to reduced production costs. This cost reduction enables them to achieve higher profit margins and provides the flexibility to lower prices further, allowing them to gain additional market share. This cycle of growth not only reinforces their competitive position but also amplifies their advantages over rivals, making it increasingly difficult for others to catch up.

Innovators. Companies that drive innovation can either enhance the rate of the learning curve or pioneer new markets and products. By being the first to introduce a new offering, they can expedite their journey through the learning curve, gaining a significant advantage over competitors who follow. This allows them to establish themselves as leaders in emerging markets, optimizing both their production processes and market strategies to maximize profitability.

This underscores the critical importance of focusing on market share and the advantages enjoyed by the leading company. A firm with a 10% market share is in a stronger position when the second-largest competitor holds only 5%, compared to having a 15% market share while the top competitor holds 30%.

Moreover, when investing in small-cap companies, it is important to consider their position within niche markets. If a small-cap company is a leader in its specific niche, its smaller size may not be a disadvantage. Instead, its leadership can translate into significant growth opportunities and resilience against larger competitors. This allows such companies to leverage the learning curve effectively, driving down costs and improving profitability as they capture a larger share of their specialized market.

An example: lithium-ion batteries

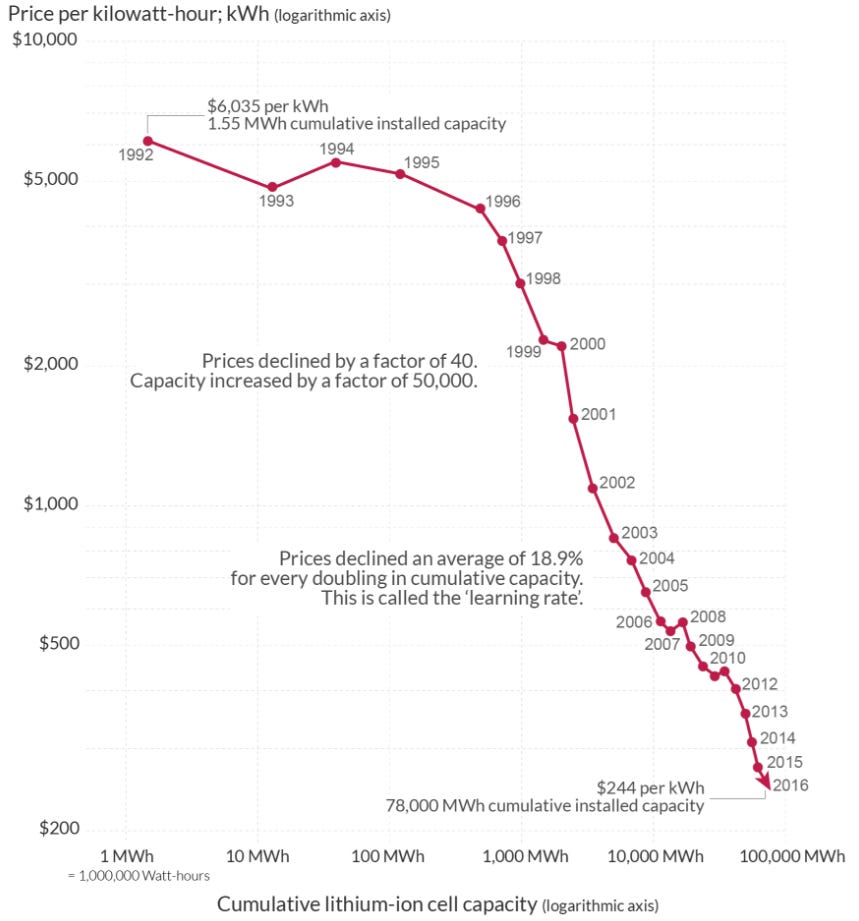

Here is an example of the price per kilowatt-hour (kWh) of lithium-ion cells, which highlights another aspect: the future pricing trends appear predictable.

As the cost of lithium-ion technology continues to decline due to advancements in production and economies of scale, it is likely that prices will also decrease, particularly in a competitive market. This dynamic means that as manufacturers achieve lower production costs, they may pass these savings on to consumers, further stimulating demand but reducing their potential revenues.

The primary risk associated with decreasing costs is that market leaders may significantly lower their prices, making it extremely challenging for competitors to remain viable and profitable. This situation can be exacerbated in cases of overcapacity, where supply exceeds demand, further driving down prices. For investors, it’s crucial to identify such market dynamics, as they can have a substantial impact on returns.

Conclusion

Understanding the learning curve is essential for stock market investors, as it provides insights into a company's cost structure, competitive positioning, and long-term profitability. Investors should be mindful of how these dynamics play out in different industries. Companies in labor-intensive sectors may experience steeper learning curves, while those in technology or pharmaceuticals may see slower progress. Additionally, awareness of pricing strategies in competitive markets is crucial, as aggressive pricing by market leaders can impact smaller competitors' viability.

Ultimately, investors who can identify companies poised to leverage the learning curve effectively will be better positioned to make informed investment decisions. By focusing on firms that demonstrate strong learning potential and market leadership, investors can tap into significant growth opportunities and enhance their overall portfolio performance. Understanding these nuances will help investors navigate the complexities of the stock market, ultimately leading to more informed and strategic investment choices.