Teleperformance, Opportunity or AI’s Next Casualty?

The fallen angel of the French stock market faces a defining moment

Teleperformance was once the French market’s rising star. Between 2012 and 2022, its share price soared from $16 to $410, delivering 25-bagger returns, plus dividends. Back then, the narrative was simple: a market leader in a booming sector, relentlessly consolidating a fragmented industry. And then… it all came crashing down.

In this stock deep dive, I will unpack the causes of Teleperformance’s collapse, outline its new AI-driven narrative, and assess the stock’s upside potential. As with all the analyses, I will walk through key metrics, risks and opportunities, fair-value estimates, and suggested buy zones for interested investors. Let’s dive in!

The business

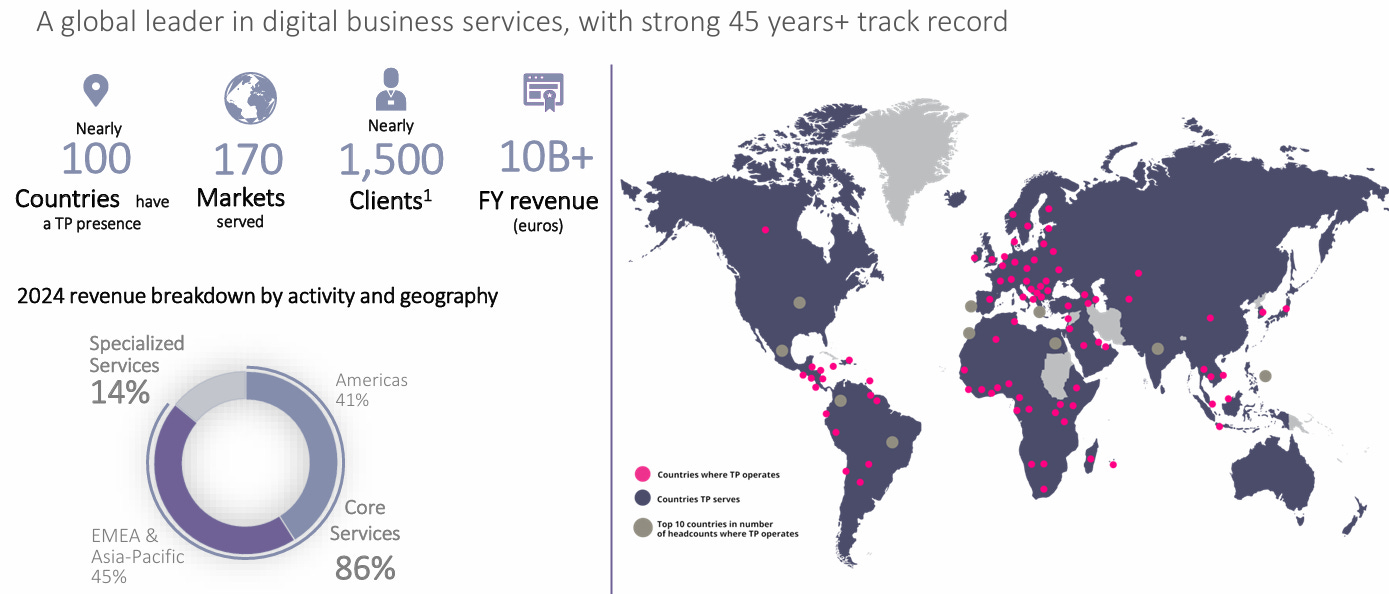

Teleperformance is a global leader in outsourced customer experience management and business process outsourcing (BPO), supporting clients across sectors including technology, healthcare, finance, and retail. The company delivers seamless omnichannel customer care, technical support, back-office operations, and analytics to enhance customer engagement and operational efficiency.

Teleperformance operates in 170 markets with a presence in 100 countries, reflecting its global reach. Approximately 40% of its revenue comes from the Americas, while 45% is generated across the EMEA and APAC regions.

Drivers of the Share-Price Decline

Following a post-COVID surge, propelled by one-off contracts, Teleperformance’s shares have tumbled from around 400€ to below 100€. This is a stark reversal for a company once viewed as a rising star. Key events since 2022 include:

10 November 2022. Shares plunged after Colombia’s Ministry of Labour launched an investigation into traumatic working conditions in the Tik Tok content-moderation unit, sparking an ESG-driven sell-off by major institutional investors

18 November 2022. Under intense ESG scrutiny, Teleperformance announced it would stop signing or renewing contracts for moderating the most graphic user-generated content

Early 2023. Analysts flagged a structural downtrend as investors grew concerned that rapid AI-driven automation could displace large portions of the workforce and compress service volumes

28 February 2024. Shares tumbled 30% to a 7-year low following Swedish fintech Klarna’s launch of an AI assistant, stoking fears that advanced AI tools could erode Teleperformance’s core BPO business

March 2024. The stock hit its weakest level since December 2016 before a modest rebound, underscoring persistent investor anxiety over AI disruption

3 June 2024. Management guided to just 2% – 4% organic growth for FY 2024 (well below historical norms) after missing earlier targets, further undermining confidence in its ability to sustain growth and margins. Growth has not recovered since

Is Teleperformance beyond recovery?

Despite recent challenges, several factors underpin a bullish outlook.

Ongoing acquisitions

Teleperformance continues to expand its capabilities and market share through strategic deals. For example, the Majorel acquisition, largely equity-financed at attractive prices amid the share-price slump, added roughly 20% to 2024 revenue without diluting key financial metrics.

Smaller tuck-ins such as Capita Translation & Interpreting (in 2023) and ZP (in 2025) have further diversified the service portfolio. With sector valuations at multi-year lows, these acquisitions represent compelling bargains that strengthen Teleperformance’s positioning as the market recovers.

A strategic turn toward AI

Teleperformance has embraced AI not only as a service driver but as a core element of its messaging. This is most visible in two flagship initiatives:

The “Centaur Strategy” is a hybrid model in which human experts work alongside AI “co-pilots” to boost efficiency and decision-quality, with some routine tasks fully entrusted to agentic AI

The TP.ai Initiative is structured around 3 complementary pillars:

TP.ai dataservices. It delivers end-to-end operational support for AI projects to ensure high-quality training inputs

TPinfinity. It leverages Teleperformance’s transformation expertise in technology, analytics, consulting and design to accelerate clients’ digital roadmaps

TP.ai solutions. It partners with leading AI vendors and customers to develop and deploy co-pilot and autopilot solutions that optimize outcomes across the human–co-pilot–autopilot continuum

Together, these elements signal a clear shift. Teleperformance is no longer just a BPO provider, but a full-stack AI-enabled partner.

Enhanced communication

Teleperformance is enhancing the transparency of its communications to help shift market perception. For instance, it received top honors at the 2024 Globee Golden Bridge Awards for an AI-driven digital solution that streamlines back-office operations.

AI, a real threat or an opportunity?

2 key factors temper the risk of full disruption by AI. First, clients typically seek end-to-end solutions when outsourcing customer service. While AI in autopilot mode can handle roughly half to two-thirds of interactions, human involvement remains essential for complex or sensitive cases.

As a result, companies that can combine skilled human agents, rich datasets and robust AI tools will be best positioned to deliver the service customers expect.

Second, AI represents a powerful lever to improve service quality and operational efficiency. Although revenue growth may come under pressure due to increased competition or new AI-native entrants, the resulting productivity gains are likely to support (or even expand)profit margins.

What could drive future EPS growth?

As Teleperformance rapidly pivots toward AI, its survival seems increasingly likely. The more pressing question, however, is whether it can defend its market share and improve margins.

Based on current evidence, there is reason for cautious optimism. While a return to double-digit revenue growth appears unlikely, the company still has several levers to drive continued EPS growth:

Operational efficiency gains through AI adoption

Ongoing acquisitions, supported by a deleveraging balance sheet

Share buybacks, capitalizing on the currently low valuation (PE is around 9x)

Expansion into new markets and service offerings. For instance, the LLM (Large Language Model) training market (20% CAGR) represents a promising end market for Teleperformance to monetize its data services

This multi-pronged approach could allow Teleperformance to maintain profitability and shareholder returns, even in a slower growth environment. It is worth noting that this is a high-risk contrarian bet.

In the following sections, you will find detailed insights into key metrics, fair price estimation, a comprehensive SWOT analysis (strengths, weaknesses, opportunities, and risks), and precise buy zone identification. Subscribe now to unlock full access to this newsletter, including exclusive analyses, portfolio tracking, screeners and curated stock picks

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.