Success in Stock Picking: It Is Not About Always Being Right

Even the best investors get it wrong! Conviction, capital allocation and patience

In investing, the popular image of a successful stock picker is often that of someone who always gets it right, predicts market moves, spots the next Amazon early and exits positions just before a downturn. But this idea is not only misleading, it is dangerously counterproductive. It can lead to blindly following gurus and in reality, you do not need to be right all the time to build significant long-term wealth.

What matters more than constant correctness is conviction, patience, process, and the ability to stay rational in the face of uncertainty. Mistakes are inevitable. Even the best investors make them repeatedly. What differentiates them is how they size their bets, how they react to new information, and how they learn from the inevitable missteps.

Even the best investors are not always right

Let’s start with some cold hard truth: no investor has a perfect track record: not Warren Buffett, not Peter Lynch, not George Soros. 2 examples:

Warren Buffett. Often considered the GOAT (Greatest Of All Time) of investing, Buffet has made some mistakes along the way. Dexter Shoe, a $400M investment in the 90’s, eventually became worthless. Despite this mistake, Berkshire’s long-term speaks for itself

Peter Lynch. He average a 29% annual return be admitted that the was wrong 1/3 of the time. However he was able to let his big winners run and cut his losers when necessary. “In this business if you're good, you're right 6 times out of 10. You're never going to be right nine times out of ten. This is not like pure science where you go”

Being slightly more right than wrong

If perfection is not the goal, what is? You just need to win more than you lose, and have your winners outperform your losers. Many great investors maintain hit rates in the 55% – 60% range. The math works in your favor if your winners are big and your losers are contained.

But to make this work in practice, you need more than just good stock selection, you need smart capital allocation.

A common mistake among investors is taking profits too early and holding onto losers for too long, hoping they will bounce back. This is emotionally comforting but mathematically damaging. Successful investors do the opposite

Letting winners run allows compounding to do its job. When you are holding a great company that continues to outperform, staying invested, even as it climbs, can produce life-changing gains

Cutting losers early prevents small mistakes from turning into portfolio-dragging disasters. It is about capital preservation and discipline

This requires an objective framework for evaluating positions over time and the humility to accept when a thesis is no longer valid.

Stacking the odds in your favor

To maximize your edge, build your portfolio with businesses that exhibit these characteristics:

Quality stocks: Strong balance sheets, sustainable margins, capable leadership. And if you read this newsletter, you know I like Quality Stocks!

Durable moat. Competitive advantages that protect profits (network effects, patents, switching costs. Here is an article about moat and another one about expanding moats

Decent valuations. Not just growth at any pric, —reasonable multiples based on earnings and cash flow

Secular trends. Exposure to long-term tailwinds like AI, decarbonization, digitization, or demographic shifts. Here are some examples

Market share gainers. Companies steadily outpacing peers in capturing demand

Strong financial metrics. High ROIC, healthy free cash flow, revenue consistency and margin expansion

Each of these factors individually increases the probabilities in your favor. Together, they create a repeatable framework for making “slightly more right than wrong” decisions.

The example of my small-cap portfolio

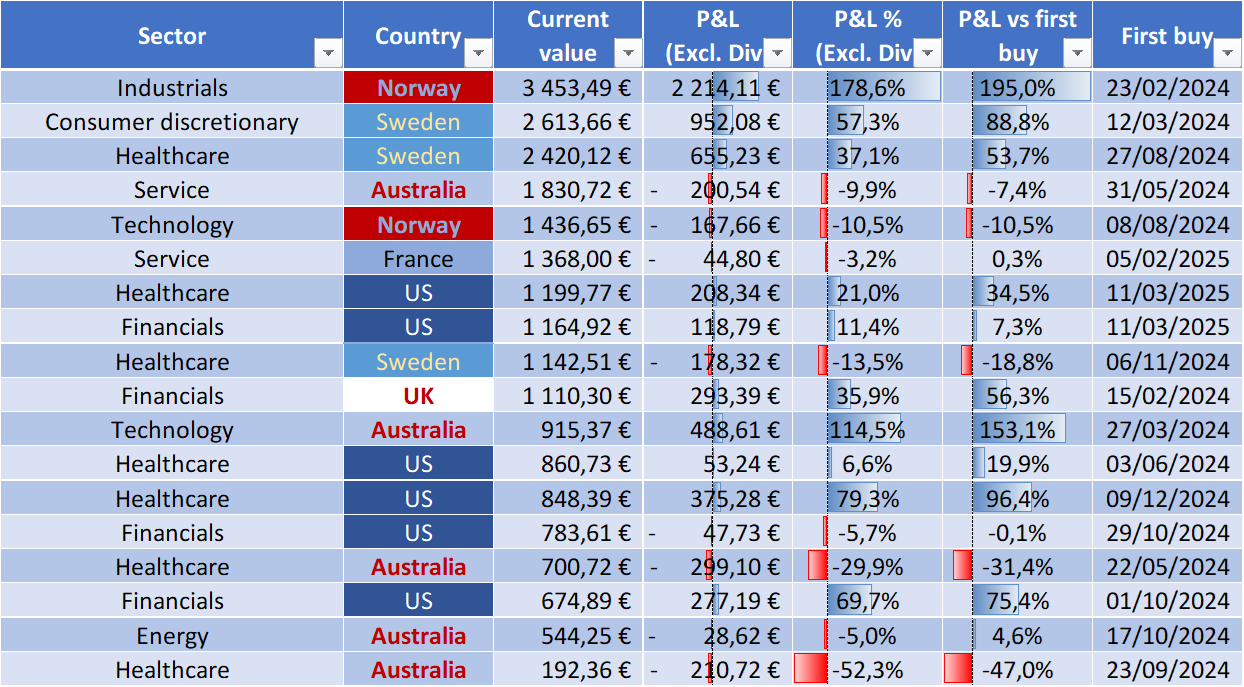

This small-cap portfolio has begun in February 2024. You can find all the details of my portfolio just here. The table provides key information about each stock in my portfolio

Sector and country

Current portfolio value (in €)

Performance vs. average cost (excluding dividends)

Performance vs. first buy

Key insights:

6 out of 18 picks are in the red

Winners attract reinforcements. The strongest performers tend to rise to the top. I actively reinforce these positions, which is why the P&L vs. First Buy is often higher than the P&L vs. Average Cost.

The stock with the weakest performance sits at the bottom and I will not consider reinforcing it until there is strong evidence of financial and technical recovery

My reinforcement plan follows a clear priority order:

4 high-growth small positions. I target the 4 smallest holdings that have shown rapid, substantial gains. I will wait for a strong pullback though

3 top performers on pullbacks. I look to add to the top 3 stocks whenever they show temporary weakness

Others at attractive levels. I consider the remaining stocks when they enter compelling buy zones, provided that their valuation metrics and fundamentals are improving

Although over 1/3 of the positions are currently in the red, the portfolio has delivered a 50% return since inception 16 months ago, outperforming the S&P 500 by more than 28%.

Winning without perfection

The goal of this newsletter is simple: to help you become a better investor. I share actionable investment knowledge, market insights, stock analyses, and regularly spotlight stocks I find compelling. All with the aim of deepening your understanding of the stock market.

Let’s be clear: the myth of the flawless investor is not only unrealistic, it is counterproductive. Chasing perfection distracts from what truly drives long-term success: a robust process, strong discipline, and a mindset open to continuous learning. Even the greatest investors make mistakes. What sets them apart is how they respond, sizing positions wisely, letting winners run, and cutting losers with conviction.

My small-cap portfolio is a real-world example of this approach. Despite over 1/3 of the positions currently in the red, the portfolio has outperformed the S&P 500 by more than 23 percentage points in 16 months. This performance is not built on flawless stock picking. It stems from a clear, repeatable strategy rooted in fundamentals, smart capital allocation, and adaptability.

I do not hide from mistakes, I embrace transparency, sharing both wins and losses to help you learn from my experience. Because in the end, investing success is not about being right all the time. It is about being right enough, and having the right process.