Stock of the Week: Oracle, the New Hyperscaler

From legacy giant to cloud contender

Here is the 31st edition of “Stock of the Week”. You can find all the previous analyses and my articles on my main page (for an easier search, use a computer, mobile version is harder to navigate).

Here is the link to the previous “Stocks of the Week” as well

Following its earnings, the stock has surged this week. Let’s explore why.

While free subscribers already benefit from a wealth of valuable content, upgrading to a paid subscription unlocks exclusive research, in-depth insights, real-time portfolio tracking, advanced stock screeners, and more giving you an edge to stay ahead of the market. Don’t miss out: subscribe now and supercharge your investing journey!

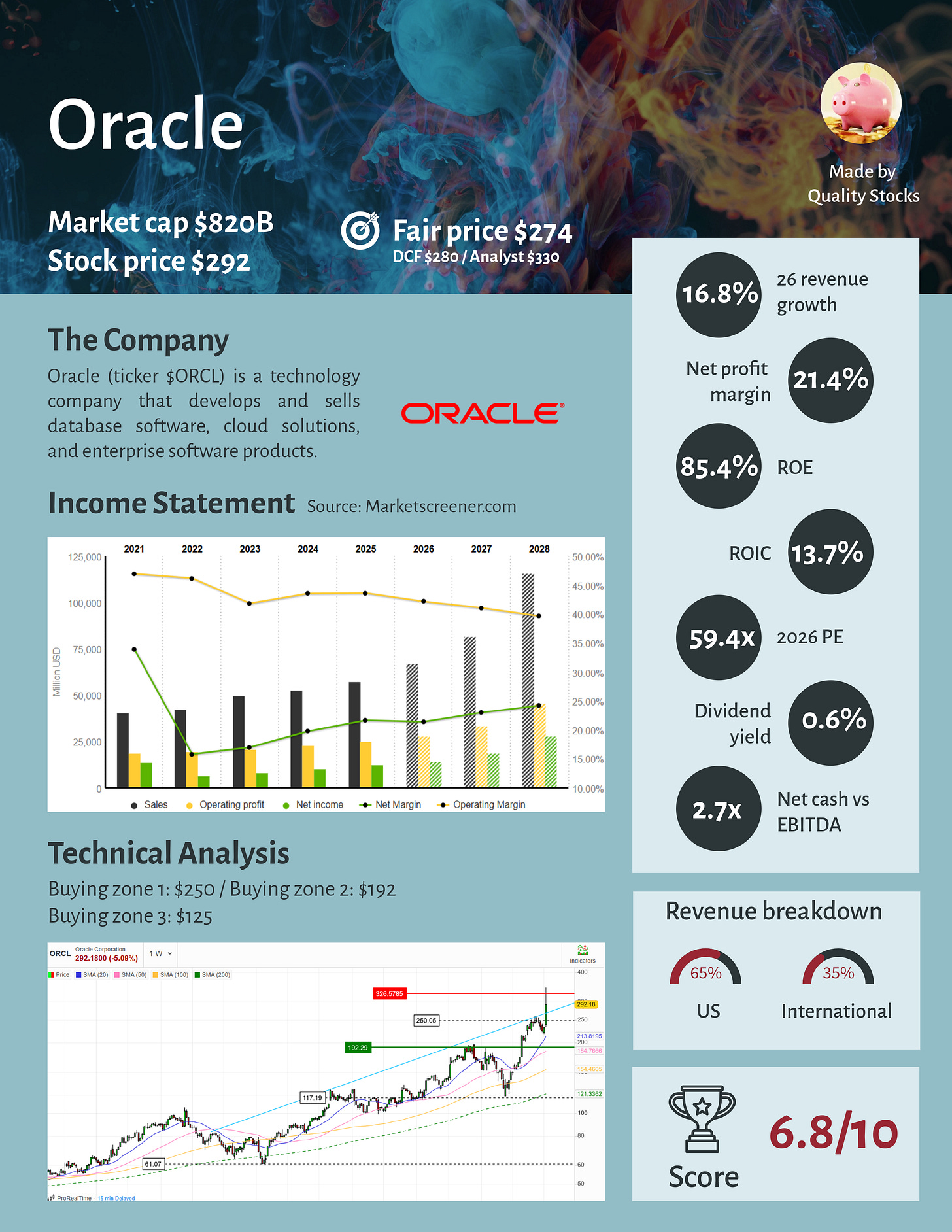

One Pager

The stock at a glance

Recent news

Oracle is currently shifting its main business from entreprise software to AI and cloud

Strategic partnerships with Microsoft to integrate Azure AI with Oracle Cloud Infrastructure

Oracle committed $1B to AI startups, aiming to bolster cloud ecosystem for AI workloads

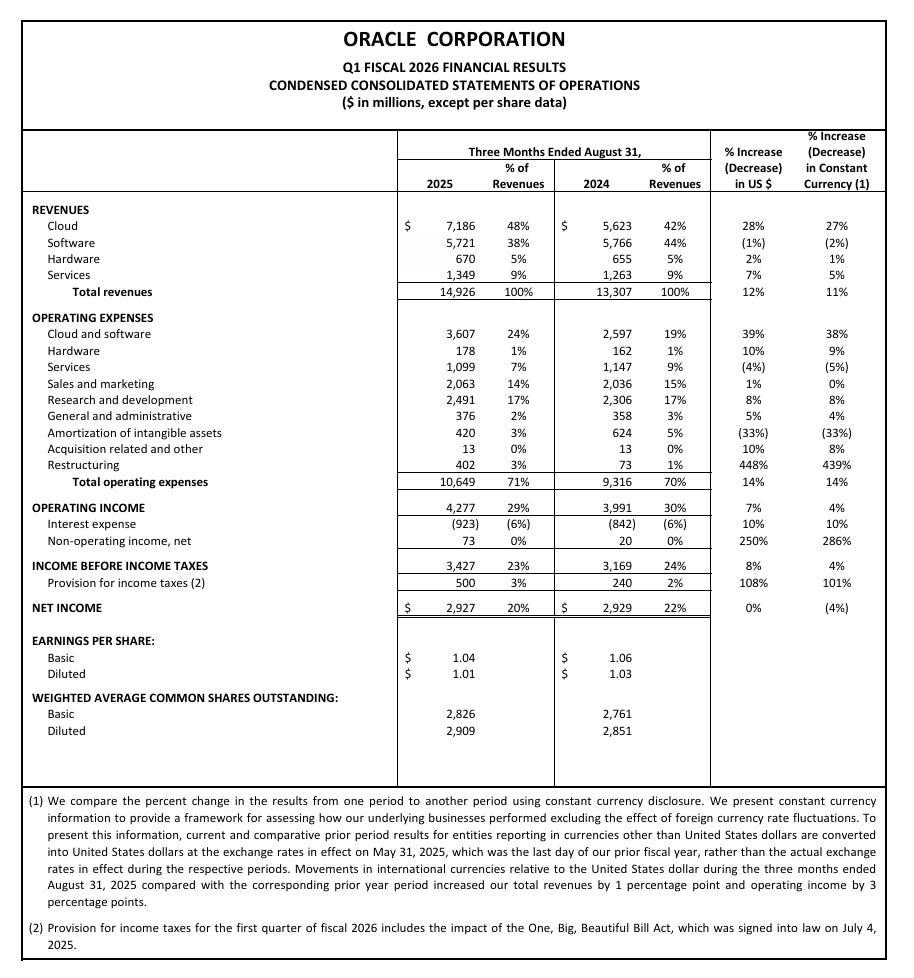

Last earnings report

In the last quarter, Oracle’s cloud revenue surged 27%, while software revenue slipped 2%, a clear sign that its business model shift is paying off at the right time.

The real standout, however, was its remaining performance obligations (RPO), essentially its order backlog, which soared 359% to $455B, representing roughly 7 years of future revenue. This massive jump was driven largely by a landmark deal with OpenAI.

This deal alone is worth $300B over 5 years. To put that into perspective, AWS generates around $100B in revenue per year, highlighting the sheer scale of Oracle’s agreement.

Analysts’ recommendations

Sept, 11. Argus. Buy. $270 —> $384

Sept, 10. BNP Paribas. Buy. $272 —> $377

Sept, 10. TD Cowen. Buy. $325 —> $375

Sept, 10. Bank of America. Neutral —> Buy. $368

Sept, 10. DA Davidson. Neutral. $220 —> $300

Sept, 10. Jefferies. Buy. $270 —> $360

My analysis

This massive influx of orders raises several questions. First, can OpenAI truly scale at this pace? Its current revenue is around $13B, yet projections aim for $300B by 2030. What happens if growth slows, or if competitors capture significant market share? On top of that, the sheer size of this deal introduces substantial execution risks

Still, it undeniably underscores that Oracle has emerged as a new hyperscaler, joining the ranks of Microsoft, Amazon, and Alphabet

The market seems to have already recognized this new status: the stock is up 75% YTD

However, with a valuation around 60× earnings, much of this optimism may already be priced in. A more prudent approach might be to wait for a potential cooldown before entering

Technical analysis

I have defined three buying zones that I find interesting for long-term investments during pullbacks. While these zones may not be reached, I am prepared for a market (or stock) consolidation to seize long-term opportunities. For me, this approach offers a better risk/reward ratio.

Of course, this is just my opinion, and I am sharing it with you, but each investor should decide on their own investment style. With that said, here are my three buying zones for Oracle.

Buying zone 1. $250

Buying zone 2. $192

Buying zone 3. $125

If you enjoyed this article and like Quality Stocks, please give it a like and spread the word!

Used source: Marketscreener.com. Affiliate link just here

I agree, the direction is defined but tha path is long, even nvidialost 40% before all time highs.So best strategy is to wait the right moment.